DSAG Investment Report 2023

Reaching for SAP's price and conditions list (PKL) to solve another ERP challenge is no longer a given. According to the annual DSAG investment survey, SAP is moving in the right direction, but there are also many areas where DSAG members express clear criticism. The DSAG user association has communicated its expectations to SAP in this regard - namely, a holistic arrangement that benefits all user companies and is not based on across-the-board annual increases. During the DSAG keynote at the fully booked Technology Days last March in Mannheim, the advocacy group called on SAP to refrain from applying the 3.3 percent price increase to cloud services that have been discontinued. "If customers are asked to pay even more for cloud solutions that have already been discontinued or are no longer maintained, this creates a negative impression of the manufacturer - and from DSAG's point of view, this cannot be SAP's goal," said DSAG Chairman Jens Hungershausen.

"If customers are asked to pay for discontinued cloud solutions, this creates a negative impression."

Jens Hungershausen, Chairman of the Board DSAG

In response to the current economic climate, CEOs are looking to cut costs and boost revenue growth. That's according to PwC's 26th annual Global CEO Survey, which polled 4410 CEOs in 105 countries last October and November. Fifty-two percent of CEOs say they are cutting operating costs, while 51 percent are raising prices and 48 percent are diversifying their product and service offerings. However, more than half say they have no plans to reduce their workforce in the next 12 months.

Bob Moritz, Global Chairman of PwC, says: "A volatile economy, the highest inflation in a decade and geopolitical conflicts have contributed to CEO pessimism being at its highest in over a decade. CEOs around the world are re-evaluating their operating models and cutting costs, but despite these pressures, they continue to put their employees first when it comes to retaining skilled workers in the wake of the Great Resignation. The world is changing inexorably and the risks to organizations, people and the planet will continue to increase. If companies want to not only thrive, but survive for years to come, they must carefully balance the dual imperative of minimizing short-term risks and operational demands with long-term outcomes - because companies that don't transform won't be viable."

Business Suite 7 vs. S/4 Hana

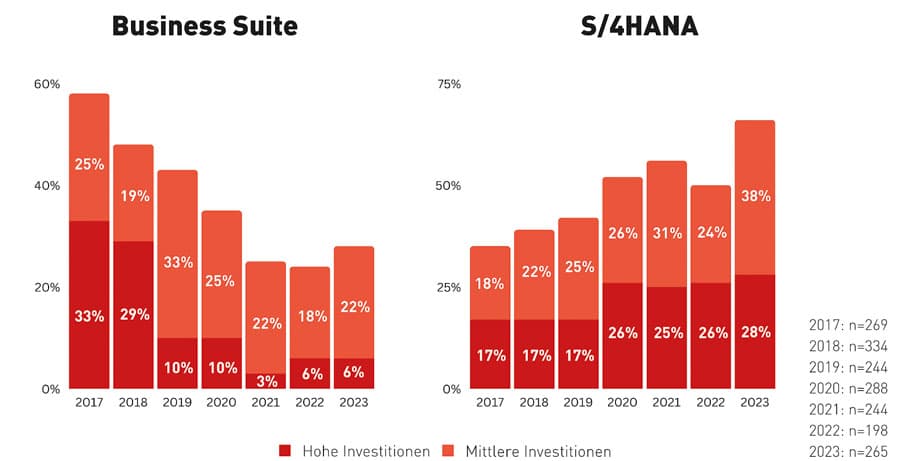

Nevertheless, Business Suite is relevant for SAP investments this year, with six percent for high investments and 22 percent for medium investments. In S/4, 28 percent plan high and 38 percent medium investments. Despite PwC's findings to reduce operating costs, the willingness of DSAG member companies to invest is not surprising, because by 2027 and 2030 at the latest, companies will have to switch from their old ERP system to S/4 Hana. Then older systems will fall out of maintenance!

"For S/4 Hana projects in particular and transformation projects in general, the following applies: Depending on their complexity, migration projects can take several years. A real transformation requires that new technologies are evaluated and introduced, and processes are rethought," says Jens Hungershausen. In addition, migration projects often involve replacing old code or existing processes and cleaning up master data. The industry association believes that SAP has a duty here to give its partners greater ability to provide adequate support for migration projects.

"2027 still sounds a long way off. Nevertheless, the effort involved in such a migration should not be underestimated. Here, companies need strong partners with sufficient resources at their side," judges Jens Hungershausen. The necessary availability of partners for the short time span until 2027 becomes an additional external challenge for the success of the project. Companies are therefore called upon to act.

Cloud environment and prices

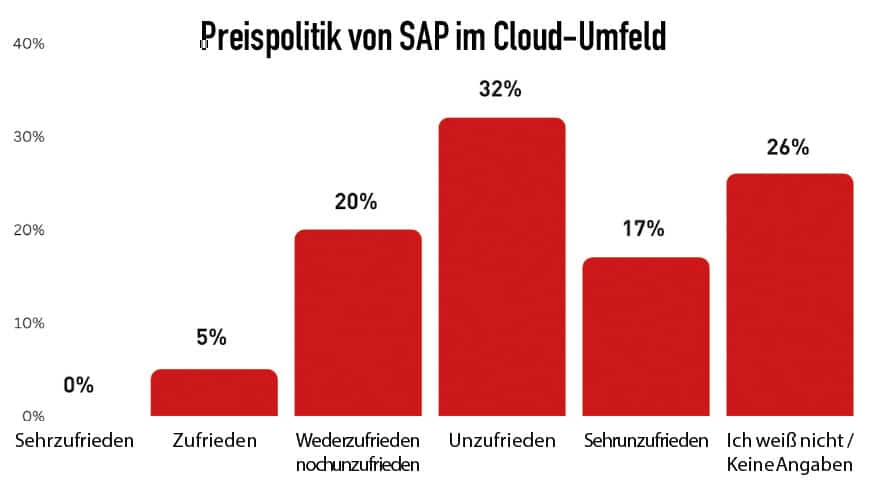

This investment report also asked for the first time for an assessment of SAP's pricing policy in the cloud environment. Only five percent describe themselves as satisfied. Twenty percent rate their status as neither satisfied nor dissatisfied, and 26 percent of respondents did not give any information. "Of course, this result does not hide the fact that almost half of the respondents do not like SAP's pricing policy. But I see this as a fundamental problem that customer companies have with all cloud solution providers," says Jens Hungershausen, summing up the results. And he adds: "The planned annual price increase for SAP cloud services has caused a lot of criticism among DSAG members. We are convinced that reliable mechanisms for price development are needed. This is also why these values are like an echo of a reaction from SAP customers already shown last year. A recurring annual increase in prices makes it more difficult for companies to move to the cloud."

Compared to 2022, the IT budgets of the companies surveyed are increasing at 54 percent, staying the same at 26 percent and decreasing at 15 percent. SAP budgets are increasing at 52 percent, remaining the same at 31 percent and decreasing at 15 percent. "The upward trend in IT budgets and budgets for SAP solutions that was already evident last year is continuing at roughly the same level. This speaks for confidence among companies that crisis situations will be mastered well," summarizes DSAG Chairman Jens Hungershausen. This provides the German-speaking SAP community with a differentiated picture of the global findings from the PwC study.

Another question revolves around digital transformation and the progress made by companies. This question was not asked last year, so the comparison with 2021 must be used. Very far is five percent, while 39 percent describe themselves as far, the identical figure as in 2021. 52 percent see themselves as not very far, an increase of two percentage points compared to the report two years ago. "This indicates that companies set other priorities during the pandemic and perhaps also initially postponed planned digitization projects due to the existing uncertainties," says Jens Hungershausen. When asked about the SAP solutions used, ERP/ECC 6.0 or SAP Business Suite continues to lead the field with 79 percent, ahead of S/4 On-prem with 41 percent.

This is followed by S/4 Private Cloud with eight percent and S/4 Public Cloud with three percent. These figures should be viewed with reservations: As a survey by E-3 Magazine revealed, the terminology used by SAP and in the community is by no means consistent. Increasingly, the private cloud is also defined as an on-prem solution in the company's own data center or at an outsourcer, hoster or hyperscaler. Together with HPE, SAP has even set up its own private cloud-on-prem concept here.

Between January 24 and February 15, 2023, 265 participants in the DACH region took part in the survey. CIOs, CCC managers and contact persons from member companies were surveyed. Only one person per member company was contacted and asked to participate. 188 DSAG members took part from Germany, 35 from Switzerland and 31 from Austria. 11 participants came from other countries.