Financial Engineering

The three musketeers have struck again and opened the money spigot: Co-CEOs Jennifer Morgan and Christian Klein, as well as ingenious CFO Luka Mucic, want to make everyone in the SAP community happy at the same time, and right away. To do this, large amounts of money are shifted - always by legal means, but dubious methods!

How do you make shareholders happy? A high dividend at the annual general meeting silences the critics and makes everyone richer. However, the share price can also be "manipulated" upward in a positive sense.

The simplest recipe for this sounds almost like "simple finance": The company takes out a large loan - in other words, takes on a little debt. With this capital, it launches a share buyback program.

You kind of buy yourself in the form of a back-referenced loop, but that's another story. The fact is that this transfer of money "credit becomes shares in your own company" reduces the number of shares on the stock market.

What now remains to be hoped for: The value of the company remains the same. But because there are now fewer shares on the market, the remaining shares are naturally worth more - the share price should rise and the shareholders are happy.

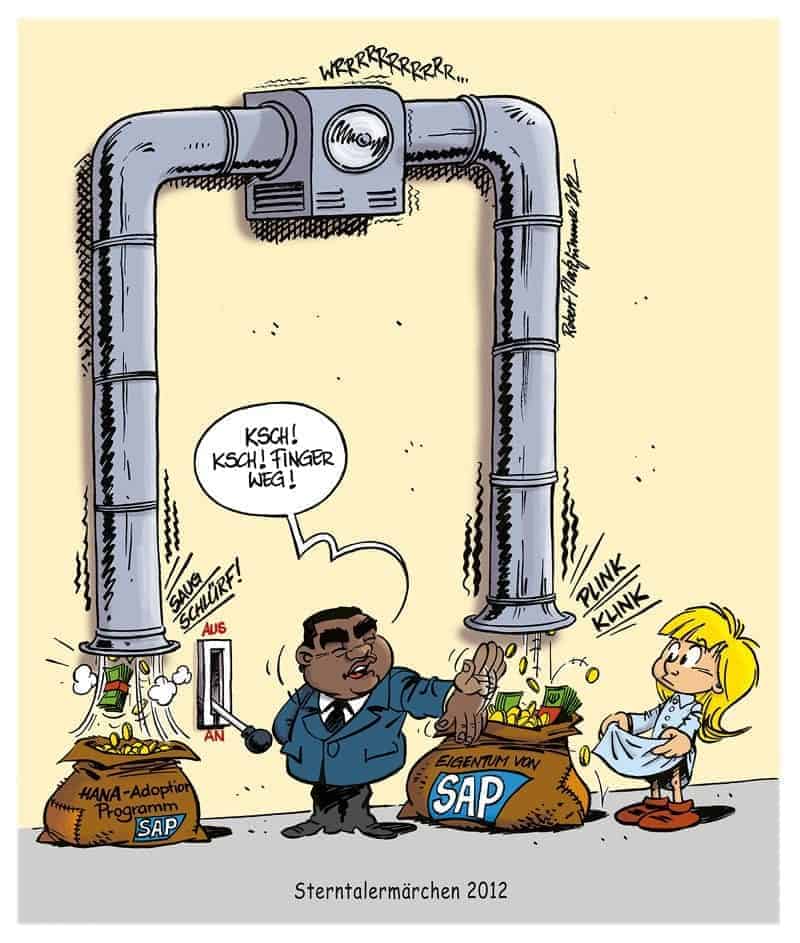

This beautiful and legal transfer of money from corporate debt to a higher stock price has a name: Financial Engineering, see illustration:

Based on technical knowledge and specifications, a machine is constructed that controls money flows. Or, as can be read on Wikipedia:

"Financial engineering is a multidisciplinary field that includes financial theory, engineering methods, tools of mathematics, and the practice of programming."

To outsiders, it may seem like squaring the circle, but CFOs have mastered the art and paradox of turning a debt-ridden company into a more valuable one on the stock market. In the SAP press release, it sounds like this:

"Taking into account the positive financial development and a very solid balance sheet structure, the Supervisory Board of SAP SE has approved an increased capital distribution in 2020 as proposed by the Executive Board.

Under this new program, the company is authorized to carry out share buybacks and/or pay a special dividend totaling €1.5 billion until December 31, 2020."

SAP Chief Financial Officer Luka Mucic said:

"Share buybacks and special dividends - in addition to an attractive regular dividend - are important instruments for increasing the value of the company and enabling our shareholders to share in its success."

He did not mention that the former industrial giant and Siemens competitor General Electric almost slid into bankruptcy due to "financial engineering."

SAP board spokespeople Jennifer Morgan and Christian Klein said:

"SAP's business process optimization program is resulting in a further increase in our financial performance. We are pleased that SAP can now share this success with its shareholders.

Next year's increased capital distribution underscores the great importance SAP places on providing an appropriate return to our shareholders and a disciplined use of our financial resources."