SAP Licensing Practices

For existing SAP customers, the transition to the S/4 world has now become unavoidable. On the one hand, this is due to the announcement that mainstream maintenance for SAP Business Suite 7 (ERP/ECC 6.0) will only be offered until the end of 2027, with optional extended maintenance until the end of 2030 and possibly 2033. On the other hand, however, this technical leap is inextricably linked to a far-reaching realignment in terms of licensing law and business management. SAP's ambition to transform itself from a pure software provider into a cloud company is clear. The Group management, represented by CEO Christian Klein and CFO Dominik Asam, sees the cloud as the decisive strategic measure for achieving the forecast revenue growth and generating a stable, calculable income through subscription models. Revenue from the cloud has now become a substantial revenue stream for SAP. For many long-standing users, cloud migration represents a challenge that is often associated with skepticism and the desire for hybrid landscapes.

Licensing the gospel

A central element of SAP's cloud strategy, particularly in the context of RISE with SAP, is the FUE concept. FUE is the conversion key that determines how existing on-prem licenses are transformed into cloud subscriptions. It is a complex set of rules with detailed instructions on how to make the transition from the traditional on-prem model to the cloud.

The FUE metric aims to simplify license management by converting the previous usage-based user categories into authorization-based equivalents. SAP defines specific conversion factors for different S/4 Cloud usage types: One FUE corresponds to one S/4 for Advanced Use (comparable to Professional User in the on-prem area), one FUE also corresponds to five S/4 for Core Use (comparable to Functional User) and one FUE corresponds to thirty S/4 for Self-Service Use.

The S/4 Cloud Development Access requires approximately two FUEs, which means that one FUE corresponds to half a Developer Access. It is interesting to note that applications such as Key User Extensibility, Side-by-Side Extensibility on SAP BTP, administrative SAP tasks/users and SAP Fiori extensions do not require a separate Development Access license.

The switch to the FUE model can have a significant financial impact on existing customers. Independent licensing experts fear that cloud

licensing can be associated with 20 to 50 percent higher costs compared to existing on-prem installations. This is due to the fact that SAP wants to generate a "secure and predictable income through subscriptions" with FUE. In the SAP Cloud Price List for the third quarter of 2023, the Product Conversion option has been eliminated, which increases the pressure on existing customers. This is prompting many users to accept cloud subscriptions as a permanently profitable source of income for SAP.

At the last SAP Annual General Meeting, CEO Christian Klein also indirectly confirmed an increase in revenue through a cloud subscription model. The additional costs are not only due to more expensive licenses, but also result from an expansion of SAP services in the cloud compared to on-prem maintenance. At the 2025 Annual General Meeting, one shareholder asked about the development of the financial business model in the transition from on-premises to cloud-based solutions. The CEO of SAP, Christian Klein, responded to this question with a short and concise statement: "2 to 3 times." He was referring to a doubling or tripling of existing on-prem license revenue when an existing SAP customer switches to an S/4 subscription model.

The illusion of freedom

With regard to SAP cloud subscription, it should be noted that an exit strategy is not available. A critical aspect of SAP cloud licensing via FUE is the loss of autonomy for the customer. With the conversion of on-prem licenses into cloud subscriptions, ownership of the software is transferred from the customer to the provider. A rental relationship is created. This entails considerable risks, as the consequences of terminating the cloud services are still uncertain and SAP has not provided for a cloud exit.

On behalf of the German-speaking SAP user group (DSAG e. V.), a Munich-based lawyer pointed out that SAP is entitled to delete all data in the cloud one day after the end of the contract term. For cloud users, this means that they must remove and back up their data sufficiently in advance.

The lack of a cloud exit strategy is a recurring theme in the SAP community and is described as "highly dangerous". When it comes to contract renewals, customers are at the mercy of SAP's decisions and have to accept the pricing, which can drive up the cost of cloud subscription. This approach is also referred to in specialist circles as the "mathematical trap-door function", a one-way function that leaves no way back for existing customers after a single use in the cloud. A return to the previously used on-prem world with its own decision-making authority is not planned. The German SAP user group is therefore urgently calling for transparent processes for the transition from purchase licenses to subscriptions and back again if necessary.

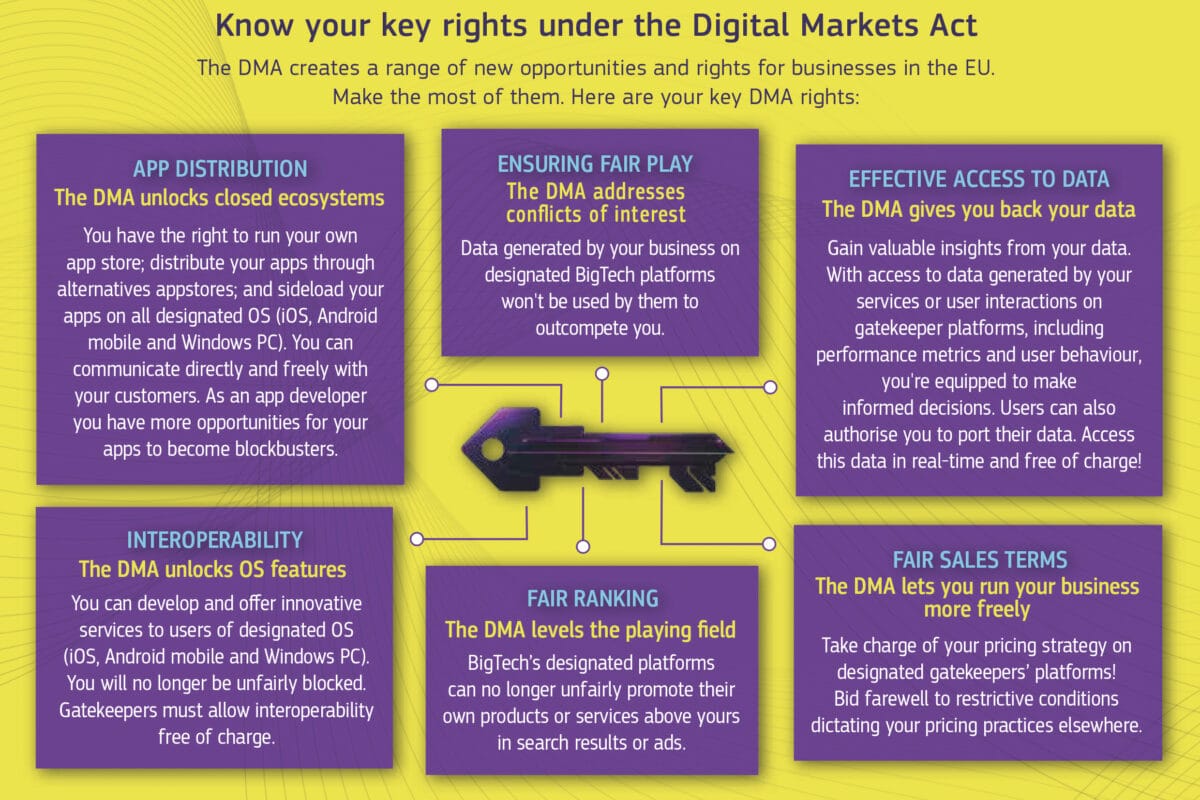

A classic Rise-with-SAP contract is a revelation, especially in view of the ERP world market leadership. After a Rise conversion, the existing SAP customer has almost exclusively obligations and only a few rights. The question arises as to whether the EU Data Act can be useful in this respect. The EU Data Act is a regulation of the European Union that aims to facilitate and promote the exchange and use of data within Europe. The act was published in the Official Journal of the European Union on December 22, 2023. The very detailed document also contains a section on switching cloud providers (hyperscalers) or leaving the cloud. The process mentioned is currently still in the development phase and has not yet been finally defined. Providers, such as SAP, also do not yet have all the necessary documentation at this point. In legal circles, it is assumed that most cloud providers, such as SAP, will wait for the EU model contracts and then incorporate them into their own GTCs, either in the original or adapted form.

In accordance with the applicable EU regulations, it has been possible to change or leave the cloud provider (exit) since January 11, 2024. Providers may also charge a fee for this. EU model cloud exit contracts are to be introduced in the fall of 2025, and from

January 12, 2027, a free switch or exit offer is mandatory. In any case, however, the cloud provider is obliged by the EU Data Act to support and ensure the operational and necessary continued operation of IT operations. According to the current view, cloud providers therefore have a considerable responsibility. In addition to a downstream exit strategy, the so-called Rise contract itself is also relevant when moving to the SAP cloud. Depending on the initial situation, a Rise-with-SAP contract is made up of at least three components that are only marginally related to each other.

The first step is the cloud contract, which regulates the rent in the SAP cloud. The contract is concluded over a longer period and may include an index clause. However, it is crucial that the cloud subscription must always be paid, regardless of whether your own S/4 system has ever been used. In the worst-case scenario, i.e. if the existing SAP customer has to pay for an empty apartment in the cloud for years, this can lead to a real problem.

The provision of the migration service to the cloud (conversion) is associated with separate fee costs, for which a dedicated project team is provided by the SAP company. There are reports in the SAP community that less experienced S/4 conversion teams also exist, which can lead to difficulties when migrating to the cloud. In some cases, SAP is accommodating and cancels the contract, but this ultimately does not solve the problem, as there is a third component of the so-called Rise contract.

The third part of the so-called Rise agreement is an on-prem termination agreement. In simplified form, the situation is as follows: the existing SAP customer transfers its SAP on-premises contracts (R/3 and ECC 6.0) to SAP and in return receives a conditional right of residence in the SAP cloud. What looks harmless on paper can turn out to be problematic in practice. The worst-case scenario would be a failure of the conversion - the existing SAP customer would never arrive in the cloud. The customer is not in a position to withdraw, as they have transferred their on-prem rights to SAP as part of the third part of the Rise contract.

Challenges of license management

Another historically charged issue that has cost a lot of trust in recent years is the licensing of indirect use (digital access). With "Digital Access", SAP has established a model in which license fees are charged for every document that was not created via an SAP dialog. This applies even if the document was created in a third-party system by a user with a valid named user license. The only exceptions are documents that have been transferred from other SAP applications, such as Concur, CRM or Ariba. The problem is that the determination of documents requiring a license is insufficient and contains errors. This makes it difficult to estimate the costs. Licensing experts strongly recommend analyzing the use of third-party applications that interact with SAP in detail, as not every data transfer requires a Digital Access license and an incorrect count can lead to unnecessary costs.

The S/4 transformation is accompanied by significant changes in license management. In the on-prem area, licenses were generally issued on a usage basis, i.e. based on the number of transactions executed. With the SAP cloud and the new S/4 models, on the other hand, licensing is authorization-based. This implies that the license costs per user may in future depend on the scope of the authorization and no longer on actual usage. For companies that work with historically grown authorization concepts, this entails incalculable financial risks. A redesign of the authorization concept is therefore becoming a highly topical CFO issue.

In view of this increasing complexity, proactive license management is essential. Before moving to the cloud, it is essential for companies to consolidate and harmonize their license inventories. This can lead to savings of up to 20 percent on FUE fees. It is crucial to use an independent software asset management (SAM) tool and a detailed analysis of actual usage as well as the existing entitlement concept. It should be noted that tabular conversions or the S/4 Hana Trusted Authorization Review (STAR) service offered by SAP may lead to incorrect results. The STAR service classifies users based on authorization objects and fields. In the case of unclassified users, classification is carried out automatically by SAP, which can lead to expensive relicensing, as the responsibility for license optimization lies with the customer.

SAP strives to continuously improve the precision and scope of the usage survey and can identify deviations from license conditions more efficiently. This means that customers no longer have to rely solely on their own information. The SAP Price and Conditions List (PKL) is highly complex, subject to quarterly changes and includes thousands of software products with various metrics and definitions that differ between on-prem and cloud products.

The new tools "SAP for Me" and "SAP Cloud ALM" were designed to create more transparency in the cloud environment. SAP for Me provides a central overview of usage rights, contracts and system landscapes, while Cloud ALM supports application lifecycle management in the cloud. Nevertheless, monitoring in the cloud is proving to be complex, although it should be more transparent compared to on-prem systems.

The SAP Business Technology Platform (BTP) also plays a central role as the basis for business transformation and for the integration and expansion of SAP solutions in hybrid environments. Licensing takes place via consumption models such as the CPEA (Cloud Platform Enterprise Agreement) or BTPEA (BTP Enterprise Agreement). With these models, customers acquire a credit balance of cloud credits that is reduced through the consumption of services. The remaining volume of unused cloud credits expires at the end of the year, while overuse is billed on the basis of the list price.

The profits of SAP and its customers are the subject of the analysis. SAP's complete realignment, in particular the move to cloud subscriptions and the FUE model, serves the overarching goal of increasing license revenue and establishing a predictable and profitable business model for SAP. Critics refer to this as a "Potemkin cloud", a misleading representation of a more cost-effective future, while the actual relocation costs and increased license fees represent the hidden price increase.

The TCO calculators offered by SAP are not considered representative for generally valid statements, as they cannot comprehensively reflect the complexity of business processes and services. DSAG and a large number of user companies complain about a lack of transparency and the perceived complexity of the licensing models. The argument is that the rental model can be more expensive than S/4 on-prem after a term of four years if the pure license costs are taken into account.

SAP management, led by Christian Klein and Dominik Asam, considers the cloud-first strategy to be indispensable. Klein emphasizes that migration to the cloud is "not an adventure, but a service" that offers a fixed point of contact. There is still considerable skepticism within the community, particularly in the DACH region. Many customers still prefer to operate their SAP systems in-house and therefore rely on on-prem. This results in a problematic relationship between SAP and its existing customers, who often feel "at the mercy" of SAP.

A journey with uncertainties

The development of SAP licenses over the past three years paints a clear picture: SAP is pushing customers into the cloud, driven by the desire for predictable, recurring revenue. The FUE concept is the central mechanism for transferring on-premises licenses to the cloud subscription model. However, this transformation is associated with considerable uncertainty and potential cost increases for customers, as they lose license autonomy and lack a clearly defined cloud exit strategy.

The switch to authorization-based licensing for S/4 Hana in the cloud and the complex regulations for indirect use require highly professional license management. Companies are encouraged to subject their existing authorization concepts to a critical review and, if necessary, to redesign them in order to avoid unnecessary and cost-intensive over-licensing. Precise analysis of actual usage using independent SAM tools is of crucial importance here.

For existing customers, the move to the SAP cloud is a complex and strategic decision that should not be made without careful consideration. For a successful negotiation, it is essential to take an in-depth look at your own needs, the exact license terms and the ability to negotiate these in dialogue with SAP. It is essential that companies do their "homework" and seek advice from independent experts to avoid the pitfalls of the new license models and avoid a financial disaster caused by digital transformation. The SAP community acts as a platform for intensive discussions and the exchange of experiences, as many users work together to find the best way forward in this complex licensing landscape.