SAP User Associations—The Moment of Reckoning

The results of the survey reveal the worst: public cloud is not an accepted operating model, as the vast majority of SAP users prefer on-prem or hybrid models. The DSAG (German-speaking SAP User Group) survey has confirmed the coexistence of on-prem and cloud solutions, which have been predicted for some time. Many companies rely on hybrid scenarios or are planning to do so, and this will remain the case for the time being, says DSAG CEO Jens Hungershausen.

The end of 2025 has been a difficult time for SAP CEO Christian Klein: SAP system landscapes are predominantly hybrid, and only a third of those surveyed by the user association DSAG are familiar with the new Business Suite. SAP's communication has failed, and public cloud is a marginal phenomenon.

The result of the DSAG, ASUG, UKISUG, and JSUG survey: hybrid scenarios dominate the picture. According to this joint survey of SAP user groups in North America, Germany, Austria and Switzerland as well as the UK and Japan, more than two thirds of all respondents use cloud solutions for enterprise applications, workloads, or data storage. However, the SAP system landscapes used are predominantly hybrid, i.e. they consist of on-prem and cloud solutions.

ㅤ

ㅤ

"SAP needs to show attractive paths toward a modular clean-core landscape in the direction of the cloud."

Jens Hungershausen,

Chairman of the Board,

DSAG

Not all clouds are the same: the SAP community seems to be taking a differentiated approach to the cloud. Hyperscalers seem to be on the right track with their storage and AI offerings and are seizing the moment. SAP, on the other hand, is struggling to justify the advantages of a vendor lock-in through the public cloud and a dominant end-to-end system, such as the new SAP Business Suite.

Cloud yes, SAP no

The results of the DSAG 2025 survey are a bitter pill for SAP CEO Christian Klein to swallow: SAP has most likely given the impetus for widespread cloud computing among its customers, but the ERP company itself is hardly benefiting from it. As reported by the user association DSAG, cloud solutions are highly prevalent in the SAP community. However, this also includes applications from Microsoft, IBM, Workday, Oracle, Salesforce, Google, and AWS.

76 percent of DSAG members surveyed currently use cloud solutions for business applications, workloads, or data storage. "In an international comparison, we see that cloud usage is also steadily increasing among our members—albeit with a different dynamic than in the US, for example. The DACH region is characterized by mature on-premises landscapes, high data protection requirements, and a strong awareness of investment security. This explains the more cautious but sustainable approach many companies are taking to cloud transformation,“ says Jens Hungershausen in view of the unflattering figures for SAP.

SAP cannot benefit from the relocation of workloads or the storage of data in the hyperscalers' cloud systems. SAP's customers who move to the cloud with their own ERP licenses are lost to SAP. Only by signing a RISE-with-SAP contract can users achieve the desired vendor lock-in and SAP itself a probable three- to four-fold increase in revenue, as SAP CEO Christian Klein explained at the 2025 Annual General Meeting in response to a shareholder's question. For SAP, RISE is a lottery jackpot. For an SAP customer, it is a journey of no return and without a cloud exit.

For many customers, the path to the cloud, particularly via the commercial vehicle RISE with SAP, is like a strategic one-way street, at the end of which cloud exit looms as an unresolved risk. The core problem lies in the contractual metamorphosis of the customer from license owner to mere tenant. In the course of the transformation and the application of the full-use equivalent (FUE) model, companies often give up their permanent on-prem usage rights and swap them for temporary cloud subscriptions. This loss of autonomy weighs heavily, as SAP does not actually have a native exit strategy that enables a return to the on-prem world, or a smooth switch to another provider, while retaining the functional logic.

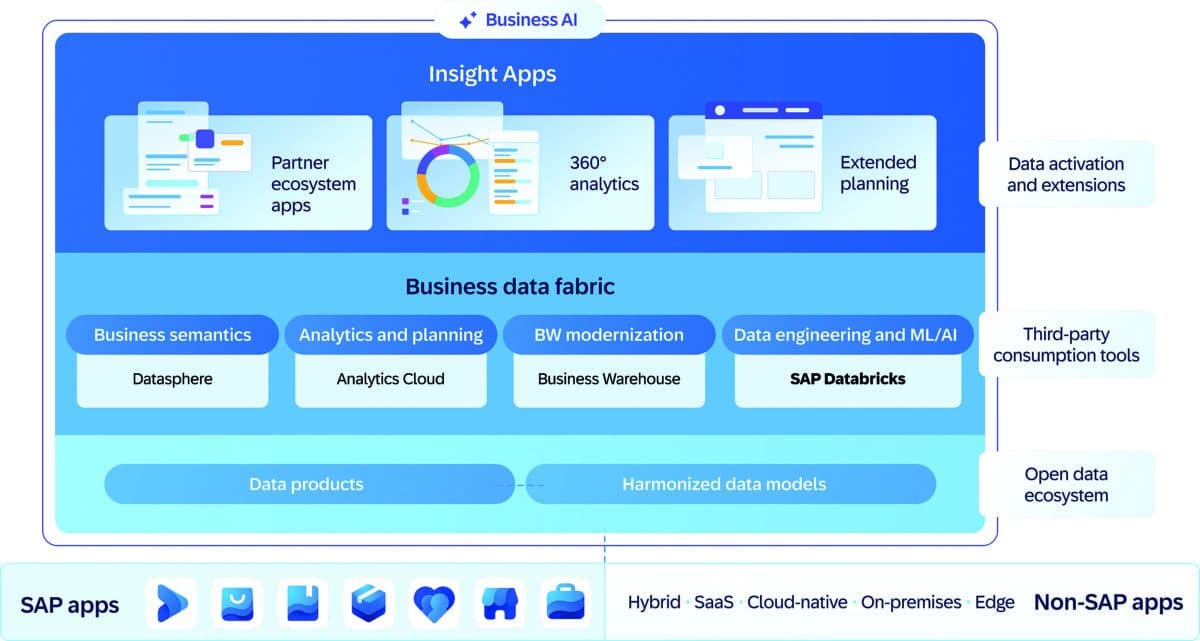

Functional overview of the SAP Business Data Cloud with Datasphere, Analytics Cloud, Data Warehouse, and SAP Databricks.

Cloud exit strategy

Experts from the SAP community point out that simply downloading the database at the end of the contract is worthless, as the business logic and interpretability of the data is lost without the proprietary SAP software license. Data without algorithms has no value. This is where the DSAG user association comes in and has long been calling for binding exit scenarios. The user representatives emphasize that RISE must not be a dead end and that transparent processes for the step from the purchase license to the subscription—and back if necessary—must be contractually fixed. The concern is well-founded: if the cloud transformation fails or the costs become unbearable, the customer is left without old licenses and is at the mercy of price dictates for contract extensions.

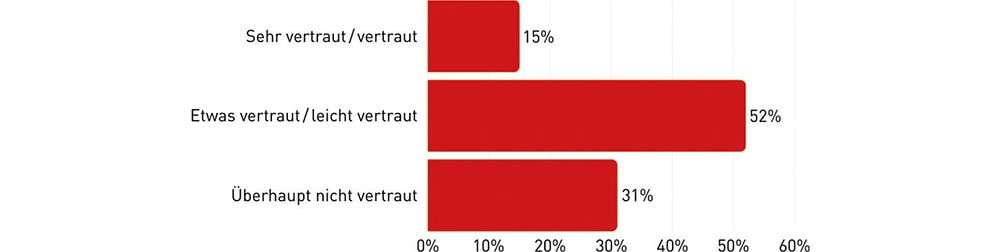

How familiar are you with the SAP Business Data Cloud based on the diagram at the top of the page? 15 percent are very familiar, 52 percent somwhat familiar, and 31 percent not at all familiar. n=274. Source: DSAG

The EU Data Act fills this vacuum as a regulatory corrective. The regulation aims to break the "vendor lock-in" by legally obliging providers of data processing services to remove all commercial, technical, and organizational barriers to switching providers. Of legal relevance is the obligation to gradually abolish switching charges so that they are completely inadmissible from January 2027. In addition, providers must guarantee functional equivalence for IaaS and interoperability for SaaS through open interfaces in order to ensure data portability.

Although the Data Act thus establishes a legal right to a cloud exit, the technical reality in the SAP context remains complex. The legal obligation to hand over data does not yet solve the license problem of the missing application logic after the end of the contract. Although SAP will be forced by regulation to include exit clauses in its general terms and conditions, the risk remains for customers that the data will be operationally useless in a pure export format. A valid exit strategy therefore often requires the receipt of "emergency licenses" or the use of specialized data retention solutions that archive data separately from the SAP system in a legally compliant manner.

Only 10 percent of DSAG members (ASUG: 21 percent, UKISUG: 15 percent, JSUG: 24 percent) believe that the RISE and GROW journeys will fundamentally improve (see Cloud Exit) or accelerate their move to the cloud. This appears to be a wish for a future release change, in line with the motto: hope springs eternal. A structured cloud offering should support SAP customers in gradually modernizing their landscapes.

Even if isolated SAP announcements are already creating small incentives on the path to the cloud, the DSAG user association believes that more initiatives are needed to accelerate the real path to the cloud. Many companies still operate highly individualized systems with S/4 on-prem. "To encourage more customers to actively move toward the cloud, SAP must show these customers attractive ways to achieve a modular clean-core landscape,“ explains Head of DSAG Jens Hungershausen.

System landscapes

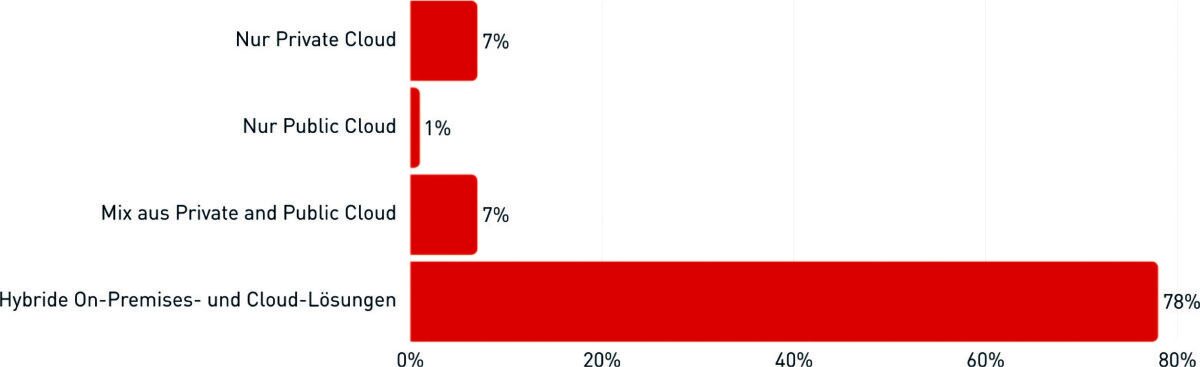

When asked about the SAP system landscapes currently in use, 78 percent of DSAG members are using hybrid on-prem and cloud solutions (ASUG: 49 percent, UKISUG: 56 percent, JSUG: 55 percent). Only 7 percent of DSAG members rely on the private cloud (ASUG: 23 percent, UKISUG: 14 percent, JSUG: 10 percent). The public cloud is the favorite of only 1 percent of DSAG members, but not operationally (ASUG/JSUG: 4 percent, UKISUG: 8 percent). This means that the commitment to future public cloud use falls below the statistical fluctuation range.

Which of the following environments best describes your current system landscape? 7 percent use only private cloud, 1 percent use only public cloud, 7 percent use a mixture of private and public clouds, and 78 percent use a hybrid on-prem and cloud solution.

n=274 Source: DSAG

The conclusion is that public cloud will be de facto non-existent in the SAP community! According to the DSAG study, only 7 percent prefer a mix of private and public cloud (ASUG: 24 percent, UKISUG: 17 percent, JSUG: 27 percent). "Companies‘ reluctance to adopt the public cloud is due, among other things to the complexity of customer landscapes, fears of losing system adaptations and well-established functions, and, last but not least, the economic conditions, which cause some to doubt the return on investment. Finally, potential dependence on a single provider also plays an important role in their considerations," summarizes Jens Hungershausen.

Half of DSAG members (ASUG: 21 percent, UKISUG: 33 percent, JSUG: 29 percent) are concerned about potentially being dependent on a single provider such as SAP. In addition, 27 percent of DSAG members (ASUG: 18 percent, UKISUG: 22 percent, JSUG: 27 percent) have concerns about a lack of internal expertise or cloud readiness.

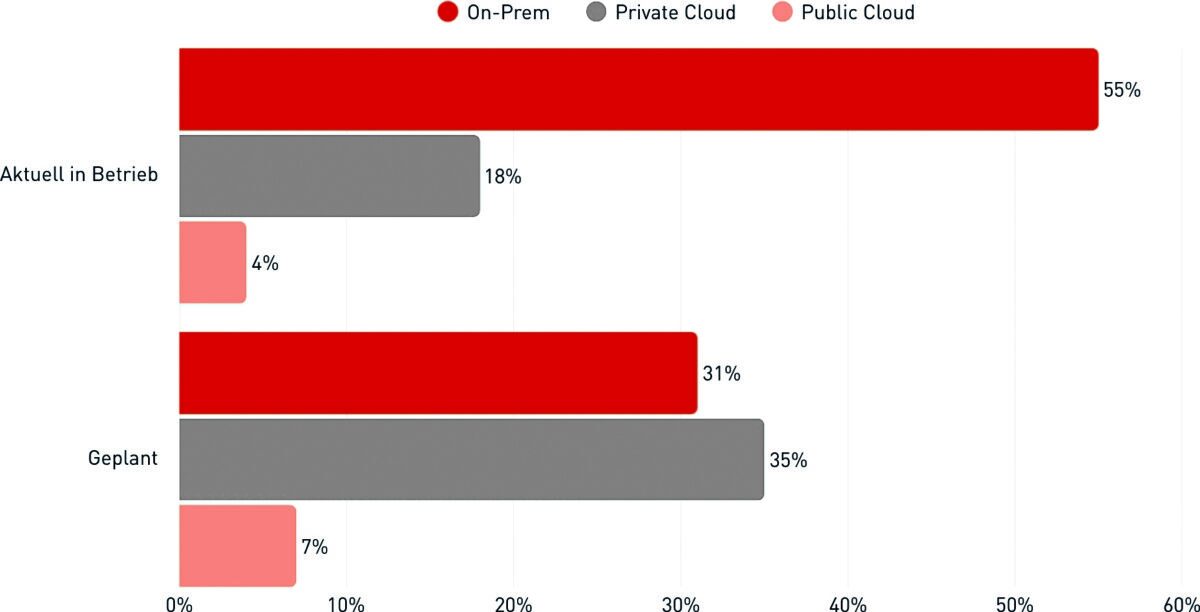

SAP's failure to invest in a CCoE (Customer Center of Expertise) structure and a cloud exit structure is now beginning to emerge as a serious mistake. It therefore seems logical that S/4 on-prem is used by 55 percent of DSAG members (ASUG: 28 percent, UKISUG: 23 percent, JSUG: 18 percent). On-premise is also ahead in future planning for S/4 Hana deployment, at 31 percent (ASUG: 15 percent, UKISUG: 10 percent, JSUG: 6 percent).

Only 18 percent of the SAP customers surveyed currently use S/4 Hana as a private cloud edition (ASUG: 33 percent, UKISUG: 18 percent, JSUG: 44 percent). The current operational S/4 public cloud use is comparatively low, with only 4 percent of the DSAG members surveyed here using this option to date (ASUG: 10 percent, UKISUG: 10 percent, JSUG: 13 percent)—in the future, even fewer users will use SAP's general public cloud offering, see above.

Where do you use or plan to use SAP S/4 Hana (multiple selection possible)?

55 percent are currently running S/4 Hana on-prem, 18 percent are running on private cloud, and 4 percent are currently running on public cloud. 31 percent are planning to run S/4 Hana on-prem, 35 percent plan to on private cloud, and 7 percent plan to on public cloud.

n=274 Source: DSAG

The private cloud use of S/4 Hana is planned by 35 percent (ASUG: 50 percent, UKISUG: 35 percent, JSUG: 28 percent). Seven percent of DSAG members are planning to use the S/4 public cloud (ASUG: 11 percent, UKISUG: 10 percent, JSUG: 16 percent). According to the DSAG user association, the reluctance of DACH companies when it comes to the cloud is more of a cultural and structural nature than a technical one.

Data protection and security

The pronounced need for data protection in the DACH region and the associated concerns about possible access, e.g. to data stored by US hyperscalers, play a role in the considerations. According to the survey, the figures are as follows: 45 percent of DSAG members (ASUG: 52 percent, UKISUG: 47 percent, JSUG: 31 percent) have security and data protection concerns when operating central SAP workloads and applications in the public cloud.

A loss of system adaptations and functions is feared by 63 percent in the DACH region (ASUG: 36 percent, UKISUG: 58 percent, JSUG: 49 percent). Despite SAP BTP (Business Technology Platform), DSAG members believe that the chance of modifications in the public cloud is too small. The DSAG survey showed that 43 percent of members would like more flexibility in the choice of deployment models, i.e. private cloud, public cloud, or on-prem (ASUG: 32 percent, UKISUG: 36 percent, JSUG: 37 percent).

This result reflects the DSAG user association's demand for an open, standardized and flexible deployment model for the public and private cloud. "Customers need real freedom of choice and must be able to decide for themselves whether they want to run their systems on-premises, in the private cloud, or in the public cloud. SAP must create the conditions for this with transparent and scalable licensing and cost models as well as clear migration paths," says Jens Hungershausen, repeating a key DSAG demand from the 2025 Annual Congress in Bremen.

SAP licenses and PKL

From the perspective of customers, communication efforts are needed with regard to the Business Suite license and pricing models. In recent months, SAP communications and marketing have been absent. Observers in the SAP community largely agree that SAP is neglecting the marketing slogan "Good work deserves visibility". SAP remains silent and 70 percent of DSAG members criticize knowledge gaps in the area of suite roadmap and maintenance (ASUG: 39 percent, UKISUG: 61 percent, JSUG: 68 percent). "Even though the ‘new Business Suite’ has only been on the market for a relatively short time, this is a high figure for the DACH region. As DSAG, we need to work with SAP to do a much better job of educating people," demands and hopes Jens Hungershausen.

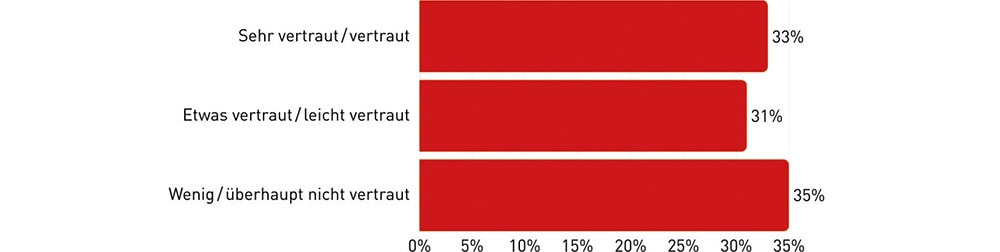

Specifically, half of DSAG members lack information on the long-term roadmap and support timelines (ASUG: 40 percent, UKISUG: 54 percent, JSUG: 35 percent). Only a third of the participants in the user survey are familiar with the redesigned Business Suite (ASUG: 22 percent, UKISUG: 27 percent, JSUG: 18 percent). 31 percent of DSAG members are somewhat familiar (ASUG: 28 percent, UKISUG: 37 percent, JSUG: 29 percent). A total of 35 percent of DSAG respondents are not very familiar or not familiar at all (ASUG: 51 percent, UKISUG: 36 percent, JSUG: 53 percent).

Marketing and communication have also failed with younger SAP products: when asked about their knowledge of the Business Data Cloud (BDC), only 15 percent said they were familiar with it (ASUG: 17 percent, UKISUG: 19 percent, JSUG: 11 percent). Only half of the survey participants in German-speaking countries are somewhat familiar with it (ASUG: 61 percent, UKISUG: 53 percent, JSUG: 66 percent). Not at all familiar with BDC are 31 percent (ASUG: 22 percent, UKISUG: 30 percent, JSUG: 22 percent). In terms of knowledge gaps about the Business Data Cloud, the top three places are occupied by integration capability, licensing and pricing models and the differences to previous SAP data solutions. Many companies still have too little orientation when it comes to the Business Data Cloud.

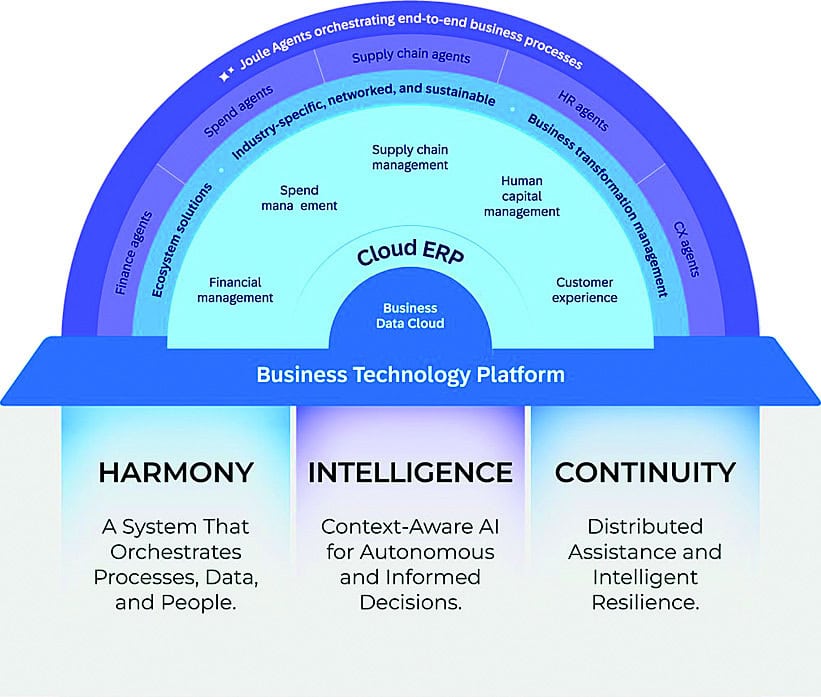

The SAP Business Suite and the digital workplace form a harmonized, intelligent, and continuously integrated environment.

BDC and BTP with many questions

For SAP marketing and the communications departments, this means that the Business Data Cloud must be comprehensible, accessible and open so that all SAP customers, both in the cloud and on-prem, can benefit from it. There must be no dependency on individual commercial constructs and there needs to be clearer communication and more information from SAP about the requirements and the specific benefits of the solution. "Only then can the Business Data Cloud become a real added value for the entire SAP customer base," summarizes Hungershausen.

Based on the diagram on this page (above), how familiar are you with the redesigned SAP Business Suite? 33 percent are very familiar, 31 percent are somwhat familiar, and 35 percent are not familiar with the redesigned SAP Business Suite. n=274. Source: DSAG

Cloud solutions in general (Microsoft, Workday, IBM, Oracle, Salesforce, etc.) continue to gain ground. The user survey also confirmed the coexistence of on-prem and cloud solutions, which has been predicted for some time. The survey of SAP user groups from the DACH region, the USA, the UK, and Japan shows: SAP's cloud strategy has been driven to the wall by CEO Christian Klein, and SAP's marketing and communications departments have failed. Hardly any SAP customers know about Business Data Cloud and the new SAP Business Suite, as well as future support and operating models.

Apparently, financial analysts see SAP's precarious situation in a similar way to the DSAG user association: the SAP share price was below 200 EUR at the start of 2026, following an all-time high of around 275 EUR last year. The survey was conducted in July and August 2025 among SAP user groups from DACH, the USA, the UK, Japan and Australia. 274 participants were registered from the DACH region. 80 percent of them are headquartered in Germany. The top 5 industries represented are machinery, equipment, and component manufacturing, followed by utilities and the public sector. Professional services followed in fourth place, ahead of financial services.