Minus 40 Percent Loss at SAP

Christian Klein argues like Donald Trump

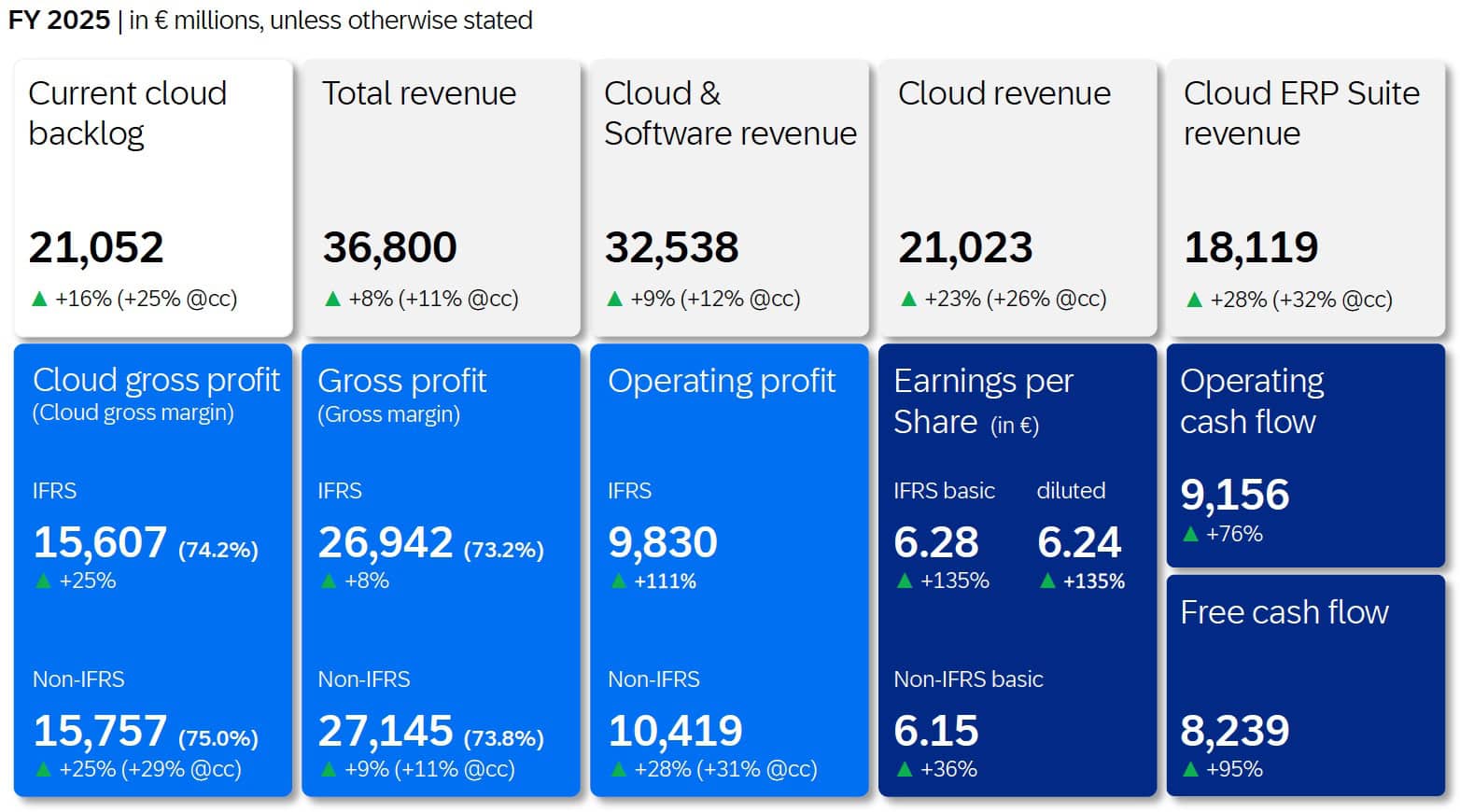

On the day the preliminary 2025 SAP balance sheet figures were published, SAP shares on the Frankfurt Stock Exchange dropped by over 15 percent. This one-day loss shows the shock effect of the SAP figures. However, according to SAP's own presentation, all key figures are positive. The SAP chart for the current balance sheet figures only shows green arrows pointing upwards. See the chart on this page.

CEOs Christian Klein and Dominik Asam argue similarly to US President Donald Trump: What do you care about reality? The spoken word is what matters! Trump said to excuse the weakness of the dollar. Klein speaks positively about the figures presented; however, the stock exchange is where the bill will ultimately be settled, and financial analysts and investors seem to have a completely different opinion.

Graphic with figures from the fourth quarter of 2025. Source: SAP

SAP CEO Christian Klein defiantly said: “Q4 was a strong cloud quarter, with bookings resulting in 30 percent Total Cloud Backlog growth to a record 77 billion EUR. The significant Current Cloud Backlog growth in Q4 has laid a strong foundation for accelerating Total Revenue growth through 2027. SAP Business AI has become a main driver for growth as it was included in two thirds of our Q4 cloud order entry, combined with strong AI adoption across the ERP Suite.” (See also the explanation of "Business AI" at the end of this text.)

His fellow Executive Board member and CFO, Dominik Asam, adds: “We closed 2025 on a high note, delivering strong operating profit and free cash flow ahead of our expectations. This performance reflects focused execution, financial discipline, and the continued trust our customers place in us as the North Star for their digital transformation. As evidenced by continued strong growth well ahead of the market in SaaS and PaaS, and our ability to bring such growth down to the bottom line and Free Cash Flow, we are confident that our strategy and operational discipline will continue to drive long-term value creation.”

Sustainability—SAP is losing touch with the cloud/AI scene

SAP was able to keep up with the cloud hype for years without making its own mark. During the general cloud euphoria, it was easy for the global ERP market leader to benefit from favorable market conditions. However, SAP has been unable to successfully swim along in a growing AI market. Currently, neither cloud computing nor AI can contribute anything positive to SAP's business development, as reflected by the decline in the SAP share price.

Sustainability? The term describes a process whose results produce something new. Managing a forest sustainably means new trees can grow as a result of timber extraction and forest maintenance. The forest remains profitable while continuing to grow, ultimately becoming even more profitable. SAP has clearly failed to achieve this goal.

SAP CEO Christian Klein surfed the cloud wave for a long time and profited from it, with the share price rising to over 280 euros. However, this was not sustainable! Klein tried something similar with AI, but it failed immediately. Handelsblatt.com (a German economy magazine) reported that SAP's AI marketing is far ahead of reality. The preliminary SAP balance sheet figures published today confirm that neither CEO Christian Klein nor CFO Dominik Asam has mastered the cloud or AI. SAP shares lost up to 15 percent at times, trading at 166 euros. Since their high last year, shares have plummeted by a staggering 40 percent.

Cloudy promises—why SAP cloud dreams fail in the face of reality

SAP is not a cloud company but rather an ERP group that is trying to retain technological sovereignty over its customers by adopting a third-party operating model whose core principles it has not mastered. The much-vaunted cloud DNA is completely absent in Walldorf, as the company's roots are deeply anchored in the on-premises world of R/3 and ECC 6.0.

Even the Hana database technology, once hailed as revolutionary, was originally an on-prem project designed to accelerate computing processes, not for infinite scaling in cloud computing. If Hana does not scale as expected in the cloud, it is not a coincidence but rather a systemic failure of the code, which was written for hardware appliances and not virtual elasticity.

SAP recognized early on that its infrastructure expertise alone was insufficient to compete with tech giants such as Amazon, Microsoft, and Google. Partnerships with these hyperscalers are not a sign of strength but an admission that SAP has lost the infrastructure business.

What SAP sells under the “cloud” label is often just a “lift and shift” of outdated architectures to external servers, a Potemkin village that simulates modernity while old mechanisms are often still working in the background. SAP's strategy seems erratic. Sometimes it's "cloud first," then "cloud only," only to end up with hybrid models because customers' needs are different.

SAP's cloud strategy is particularly deceptive when it comes to vendor lock-in. Programs such as "RISE with SAP" primarily serve to deprive customers of their valuable perpetual on-prem licenses and force them into a subscription model. By switching to metrics such as FUE (Full Use Equivalent), customers lose autonomy over their ERP systems. They are degraded from owners to tenants, at the mercy of price dictates.

The biggest risk, however, is the lack of a valid cloud exit strategy. Once licenses are exchanged for cloud contracts, there is no turning back. These contracts stipulate that data may be deleted shortly after the contract ends, which can threaten companies' existence if they don't have backup licenses. Rather than using the cloud as a technological liberator, SAP uses it as a golden cage to maximize revenue.

The AI revelation—why SAP is just a free rider in the age of AI

SAP's AI dilemma is a technological revelation that ruthlessly exposes the failings of an entire decade. While U.S. tech giants are investing billions in developing their own large language models (LLMs), SAP in Walldorf is merely managing its lack of innovation.

There is no "SAP GPT" because the group lacks the courage, resources, and technological vision to compete with the major players. Instead, SAP is resting on its laurels. For example, the well-known Predictive Analysis Library (PAL) in the Hana database is an outdated machine learning tool for regression and classification that has nothing to do with the revolutionary power of generative AI.

SAP's former flagship project, Leonardo, which was meant to combine AI and IoT (Internet of Things), ended up a spectacular flop. It was quietly buried because SAP did not understand the market, and customers did not see its added value.

Today, SAP CEO Christian Klein is trying to fill this strategic void with frantic action and an opaque network of partnerships. SAP employees internally refer to this as a "patchwork quilt" or even "Frankenstein architecture."

SAP's investment in the German AI startup Aleph Alpha appears more like a band-aid than a serious strategy. While SAP is investing a mere single-digit million sum, Microsoft and Google are investing billions in their models. SAP does not understand the rules of the game. It is trying to sell Business AI, but it often only provides a proxy to OpenAI, Google, or Amazon models via the Generative AI Hub of the Business Technology Platform (BTP).

SAP's simultaneous announcement of collaborations with Nvidia, Databricks, Collibra, and DataRobot, without providing clarity on data sovereignty in this "Wild West" of AI agents, adds to the chaos. SAP obtains nearly all its AI knowledge and services from external hyperscalers and start-ups. Its own contribution is limited to embedding this external intelligence in SAP contexts via the Joule assistant.

SAP's attempt to leverage this purchased innovation to force customers into the cloud is particularly underhanded: anyone who doesn't subscribe to RISE with SAP will be cut off from AI innovations. This tactic reveals that SAP views AI more as a sales weapon than as technological progress. Ultimately, SAP remains an AI consumer without sovereignty, dependent on the goodwill of US providers.

1 comment

M

ein Verlust von “Minus 40%” ist ein Gewinn.