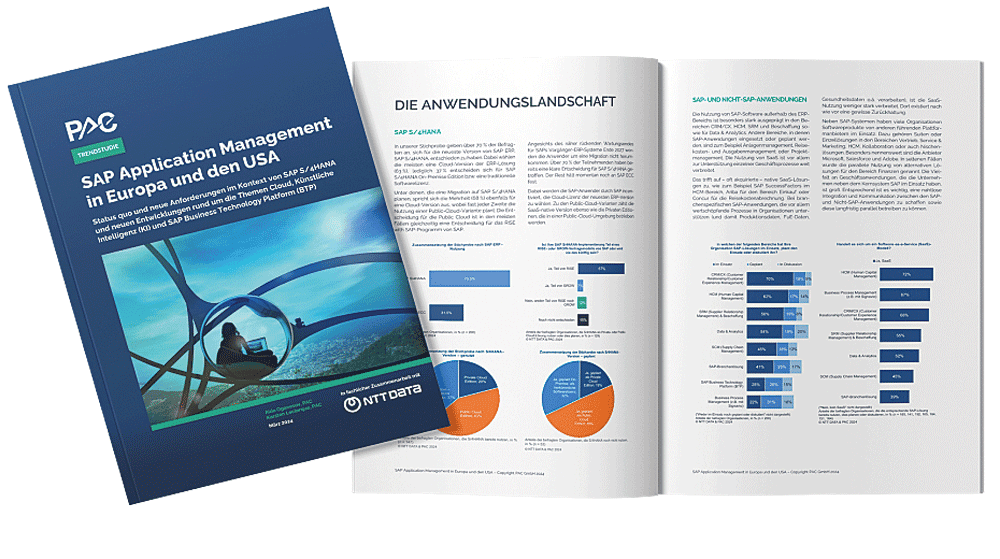

In order to better understand the current status quo and future developments in SAP operations, analyst firm PAC surveyed 200 SAP and IT managers in Europe and the USA on behalf of IT service provider NTT Data. The results of the "SAP Application Management in Europe and the USA" study, which was conducted between January and March 2024, shed light on the effects and opportunities arising from innovative technologies. It provides insights into how companies operate their software applications, the challenges they face in the context of S/4 Hana and the developments they see around cloud, AI and other innovative topics.

Innovation and technology

Innovative technologies such as cloud computing, automation and AI are changing SAP Application Management (AM) by opening up new opportunities to increase efficiency and optimize performance. At the same time, the complexity of the evolving IT landscape is increasing. And new expectations are being placed on IT service providers: they must not only be familiar with the latest technologies, but also be able to integrate and manage them effectively. The Business Technology Platform (SAP BTP) will play a decisive role as a technical basis, as it creates a central platform for the implementation of various technologies and systems.

SNP, a provider of software for digital transformation, automated data migration and data management in the SAP environment, has highlighted the current status of S/4 migration in a meta-study. The study "With confidence into the cloud - Rise with SAP and SAP S/4 Hana" summarizes the results of various studies and user surveys from a technical, operational and strategic perspective. The most important finding: on the one hand, companies are still struggling with challenges, but on the other hand they also recognize opportunities - and are increasingly relying on Rise with SAP when making the switch.

According to SAPinsider magazine, 21% of companies worldwide that use SAP ERP systems are already using S/4, 20% are currently switching and 45% are planning to do so. The study shows that in 2024, almost 60 percent of existing SAP customers will still cite the end of maintenance as the most important factor for a switch. However, opportunities are also recognized: 39% see the migration as an opportunity to redesign processes in order to better adapt them to operational requirements. In another survey by SAPinsider ("Infrastructure and Landscape Trends 2024"), the aspect of having to implement systems to support generative AI and other innovations comes up for the first time this year.

In PAC's international sample, most respondents stated that they would opt for the latest version of SAP, with the majority preferring an S/4 cloud version. The decision in favor of the public cloud goes hand in hand with the choice of Rise with SAP in 67 percent of cases. The use of SAP software outside of Enterprise Resource Planning (ERP) is particularly strong in the areas of Customer Relationship Management and Customer Experience (CRM/CX), Human Capital Management (HCM) and Supplier Relationship Management and Procurement (SRM). With a share of 72%, Software-as-a-Service (SaaS) models are primarily used to support individual business processes, such as SAP SuccessFactors for the optimal management of all aspects of the employee lifecycle in Human Capital Management (HCM).

Alternative ERP software

In addition to SAP systems, many organizations use additional software products from other leading platform providers such as Microsoft, Salesforce and Adobe. However, the variety of business applications that companies use in addition to the core SAP system presents new challenges. "Seamless integration and communication between SAP and non-SAP applications is essential in order to be able to operate both systems in parallel in the long term," explains Ulrich Kreitz, Executive Manager at NTT Data. "This often requires special interfaces, data integration strategies and tools, as well as solutions for managing user identities and access rights. Complex orchestration solutions must be implemented to monitor and control the performance, availability and security of local and cloud-based resources."

According to SNP, the Foundry study identified a prevalence of ERP solutions as a SaaS/cloud variant in the DACH region: 40 percent of respondents prefer this deployment option. 35% pursue a hybrid ERP strategy in which the core ERP system is operated on-prem and extended by SaaS cloud applications. When choosing the cloud, 38% opt for the private edition and 61% for the public edition. At European level, the picture is somewhat different: only nine percent of participants in PAC's CxO survey stated that they choose public cloud provision (IaaS, hyperscaler) for the most important S/4 solutions.

RISE with SAP

With Rise with SAP, the global ERP market leader offers a subscription-based service that bundles customized ERP solutions, transformation services and business analytics. According to the Foundry study, 62 percent of companies using an ERP, cloud ERP or SAP solution believe that this service is the best and most efficient way to implement the S/4 Cloud. One in ten large companies currently use Rise or intend to do so in the future and four percent of small and medium-sized companies opt for it. According to SAPinsider, the proportion of companies that already use S/4 and are considering switching to Rise is increasing year on year: in 2022 it was 23 percent, in 2024 it was already 30 percent.

Collaboration with external partners, particularly in the area of SAP consulting and system integration, plays a decisive role for many companies in the wake of the increasing complexity of the system landscape, especially when it comes to cloud solutions. Those surveyed by PAC place high demands on an SAP partner: 77% of respondents cite expertise in the security of SAP systems and smooth operation as must-have criteria. IT partners such as NTT Data offer expertise and support companies in the implementation, management and optimization of SAP systems in the cloud. "We know the best practices, tools and methods that support, automate and accelerate migration to the cloud.

We also offer our own frameworks with which tasks such as system monitoring, troubleshooting or patch management can be partially or fully automated," continues Ulrich Kreitz. "The IT market has ever shorter innovation cycles. AI will soon become an integral part of SAP's products and the entire portfolio. All the more reason for SAP users to expect their partners to act proactively and inform them about the benefits, opportunities and risks of new technologies, which goes far beyond ensuring smooth, secure operations."

Those surveyed by PAC see enormous potential in automated processes in SAP AM in particular. The study revealed that the degree of automation is highest in the areas of service desk, security and testing. Automation can not only increase efficiency gains, but also reduce susceptibility to errors and detect potential threats more quickly. Manufacturing companies in particular benefit from this, as business interruptions are minimized and production continuity is guaranteed.

The majority of respondents expect further efficiency gains and cost savings of up to 30 percent from the integration of AI into AM, particularly in the areas of monitoring documentation and system administration. The results show that SAP BTP will form the technological basis for all SAP cloud products and for all functional enhancements and innovations of S/4 in the near future. It offers the possibility to complement, extend and integrate solutions from SAP or SAP partners using the same data model. These help to develop innovations faster with traditional tools, no-code/low-code solutions, preconfigured analysis models and self-service analyses.

As companies increasingly switch to the cloud-based S/4 edition, the demand for the Business Technology Platform is also increasing, as customer-specific extensions need to be developed and integrated. NTT Data, together with its subsidiary Natuvion, highlighted the complexity of the digital transformation for companies and the challenges they face in the recently published Transformation Study 2024: In it, 1200 CEOs, CIOs and IT decision-makers from 15 countries shared their experiences with and requirements for the transformation process. Brownfield continues to be the migration approach of choice: as the aforementioned Foundry survey shows, 39% of companies opt for this, with 26% opting for greenfield. A bluefield approach, which combines the advantages of brownfield and greenfield, is chosen by 27% of companies. The advantage of this selective approach is that only the data that is actually required is migrated, while access to existing systems is guaranteed during the upgrade. In particular, larger companies with a turnover of at least ten million euros prefer this approach in addition to brownfield.

Many cooks help a lot

To overcome the typical challenges of time, cost and resources, SAP customers are turning to external support to help them migrate efficiently. Foundry found that nine out of ten of the companies surveyed work with one or more SAP service providers, 55 percent of them for the duration of the migration and 35 percent permanently. PAC's CxO survey confirms that 84 percent of respondents consider the services and templates that a service provider can provide to simplify the migration process to be a decisive factor when choosing a service provider. Tara von Metzen, Vice President of Product Management, SNP: "The clock is ticking! But the end of maintenance for older core releases of SAP ERP in 2027 is not a threat, but a huge opportunity. Growth, innovation and agility are the key benefits that should convince companies to rely on Rise with SAP. With an experienced partner at their side, they can significantly reduce risk, resource and time pressure and move into the future stronger."

To the partner entries: