Hybrid SAP S/4 Chaos Theory

DSAG, ASUG, UKISUG, and JSUG survey shows hybrid scenarios dominate the picture

A user survey was conducted in July and August 2025 among SAP user groups from the DACH region, the US, the UK, and Japan. A total of 274 participants from the DACH region registered for the survey. 80 percent of them have their headquarters in Germany.

According to this joint survey of SAP user groups in North America, Germany, Austria, Switzerland, the UK, and Japan, more than two-thirds of all respondents use cloud solutions for business applications, workloads, or data storage. However, the SAP system landscapes used are predominantly hybrid, consisting of on-premises and cloud solutions.

The results of the DSAG 2025 survey are a bitter pill for SAP CEO Christian Klein to swallow: SAP has most likely given the impetus for widespread cloud computing among its customers, but the ERP company itself is hardly benefiting from it. As reported by the user association DSAG, cloud solutions are highly prevalent in the SAP community. However, this also includes applications from Microsoft, IBM, Workday, Oracle, Salesforce, Google, and AWS.

76 percent of DSAG members surveyed currently use cloud solutions for business applications, workloads, or data storage (ASUG: 84 percent, UKISUG: 70 percent, JSUG: 72 percent). "In an international comparison, we see that cloud usage is also steadily increasing among our members—albeit with a different dynamic than in the US, for example. The DACH region is characterized by mature on-premises landscapes, high data protection requirements, and a strong awareness of investment security. This explains the more cautious but sustainable approach many companies are taking to cloud transformation," says Jens Hungershausen, DSAG CEO, in view of the less than flattering figures for SAP.

SAP cannot benefit from the transfer of workloads or the storage of data in the cloud systems of hyperscalers. SAP customers who move to the cloud with their own ERP licenses are lost to SAP. Only by signing a RISE with SAP contract can users achieve the desired vendor lock-in and SAP itself a likely three- to fourfold increase in revenue, as SAP CEO Christian Klein explained at the 2025 Annual General Meeting in response to a shareholder's question. For SAP, RISE is a lottery jackpot. For an SAP customer, it is a journey of no return and no cloud exit.

SAP RISE and GROW Journey

Only ten percent of DSAG members (ASUG: 21 percent, UKISUG: 15 percent, JSUG: 24 percent) believe that the RISE and GROW Journeys will fundamentally accelerate their move to the cloud. This seems to be a wish for a future release change, true to the motto: hope springs eternal. A structured cloud offering is intended to help SAP customers gradually modernize their landscapes.

Even though isolated SAP announcements are already creating small incentives for moving to the cloud, the user association DSAG believes that more initiatives are needed to accelerate the actual transition to the cloud. Many companies still operate highly customized systems with S/4 on-premises. "In order for more customers to actively move toward the cloud, SAP must demonstrate attractive paths to a modular clean-core landscape," explains DSAG CEO Jens Hungershausen.

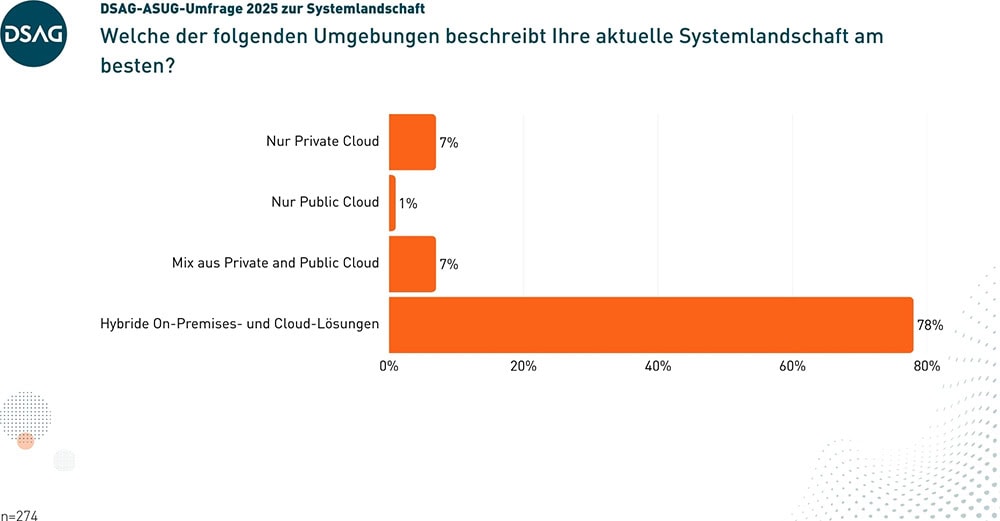

On-premises and hybrid system landscapes are preferred

When asked about the SAP system landscapes currently in use, 78 percent of DSAG members are using hybrid on-premises and cloud solutions (ASUG: 49 percent, UKISUG: 56 percent, JSUG: 55 percent). Only 7 percent of DSAG members rely on the private cloud (ASUG: 23 percent, UKISUG: 14 percent, JSUG: 10 percent). The public cloud is the favorite among only 1 percent of DSAG members, but not operationally (ASUG/JSUG: 4 percent, UKISUG: 8 percent). This means that the commitment to future public cloud use falls within the statistical margin of error. Conclusion: The public cloud will be virtually non-existent in the SAP community!

According to the DSAG study, only 7 percent prefer a mix of private and public clouds (ASUG: 24 percent, UKISUG: 17 percent, JSUG: 27 percent). „The reluctance of companies to adopt the public cloud is due, among other things, to the complexity of existing customer landscapes, the fear of losing system adaptations and well-established functions, and, last but not least, the economic conditions, which cause some to doubt the return on investment. Finally, the potential dependence on a single provider also plays an important role in the considerations,“ summarizes Jens Hungershausen.

SAP vendor lock-in

Half of DSAG members (ASUG: 21 percent, UKISUG: 33 percent, JSUG: 29 percent) are concerned about potentially being dependent on a single provider such as SAP. In addition, 27 percent of DSAG members (ASUG: 18 percent, UKISUG: 22 percent, JSUG: 27 percent) have concerns about a lack of internal expertise or cloud readiness.

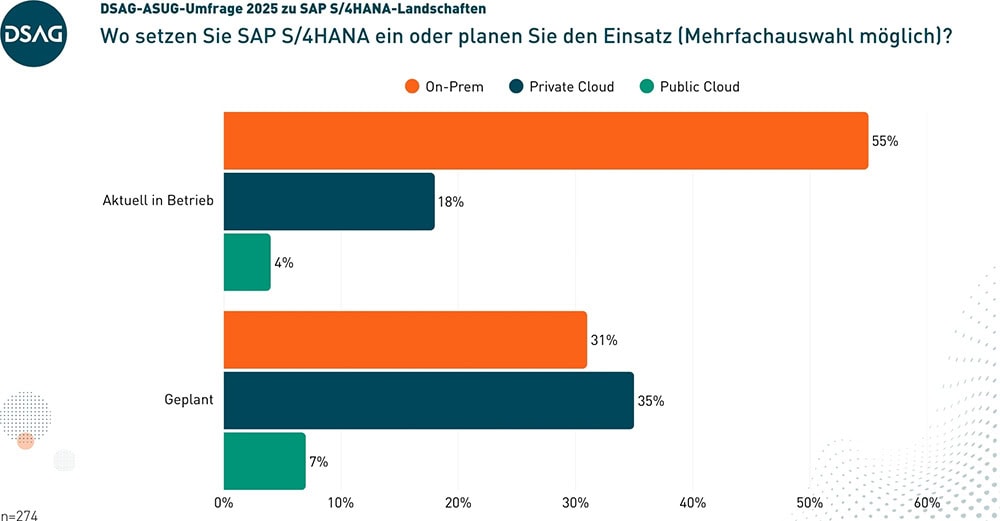

SAP's failure to invest in a CCoE (Customer Center of Expertise) structure and a cloud exit structure is now beginning to emerge as a serious mistake. It therefore seems logical that S/4 on-premises is used by 55 percent of DSAG members (ASUG: 28 percent, UKISUG: 23 percent, JSUG: 18 percent). On-premise also accounts for 31 percent of future plans for S/4 Hana deployment (ASUG: 15 percent, UKISUG: 10 percent, JSUG: 6 percent).

Actual S/4 usage appears to be stagnating

Only 18 percent of existing SAP customers surveyed currently use S/4 Hana as a private cloud edition (ASUG: 33 percent, UKISUG: 18 percent, JSUG: 44 percent). The current operational use of S/4 Public Cloud is comparatively low, with only 4 percent of DSAG members surveyed here using this option so far (ASUG: 10 percent, UKISUG: 10 percent, JSUG: 13 percent) – in the future, even fewer users will use SAP's general public cloud offering, see above.

The private cloud deployment of S/4 Hana is planned for 35 percent (ASUG: 50 percent, UKISUG: 35 percent, JSUG: 28 percent). Seven percent of DSAG members plan to use the S/4 public cloud (ASUG: 11 percent, UKISUG: 10 percent, JSUG: 16 percent). According to the user group DSAG, the reluctance of DACH companies to embrace the cloud is more cultural and structural than technical in nature.

The pronounced need for data protection in the DACH region and associated concerns about possible access, e.g., to data stored by US hyperscalers, play a role in these considerations. According to the survey, this translates into the following figures: 45 percent of DSAG members (ASUG: 52 percent, UKISUG: 47 percent, and JSUG: 31 percent) have security and data protection concerns when operating central SAP workloads and applications in the public cloud. Sixty-three percent in the DACH region (ASUG: 36 percent, UKISUG: 58 percent, JSUG 49 percent) fear a loss of system customizations and functions. Despite SAP BTP (Business Technology Platform), DSAG members consider the opportunity for modifications in the public cloud to be too limited.

Lack of ERP agility and S/4 flexibility

The DSAG survey showed that 43 percent of members would like more flexibility in their choice of deployment models, i.e., private cloud, public cloud, or on-premises (ASUG: 32 percent, UKISUG: 36 percent, JSUG 37 percent). This result reflects the demand of the DSAG user group for an open, standardized, and flexible deployment model for the public and private cloud.

„Customers need genuine freedom of choice and must be able to decide for themselves whether they want to operate their systems on-premises, in a private cloud, or in a public cloud. SAP must create the conditions for this with transparent and scalable licensing and cost models as well as clear migration paths,” says Jens Hungershausen, reiterating a key DSAG demand from the 2025 annual congress in Bremen.

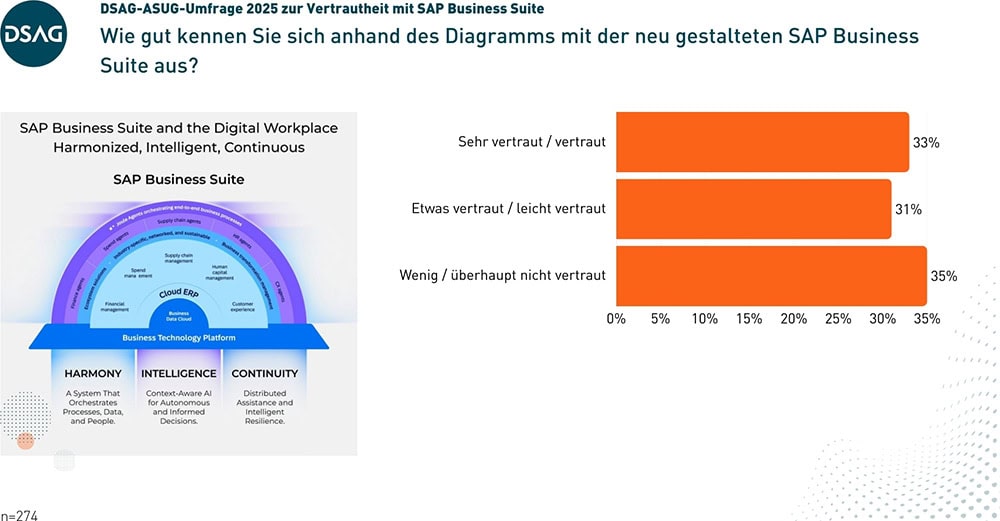

Information deficits and communication chaos at SAP

From the perspective of existing customers, communication efforts are needed regarding the licensing and pricing models for Business Suite. In recent months, SAP communication and marketing have been lacking. Observers of the SAP community largely agree that SAP is neglecting the old marketing rule of „do good and talk about it.“ SAP remains silent, and 70 percent of DSAG members complain about knowledge gaps in the area of suite roadmap and maintenance (ASUG: 39 percent, UKISUG: 61 percent, and JSUG: 68 percent). „Even though the new Business Suite has only been on the market for a relatively short time, this is a high figure for the DACH region. As DSAG, we need to work with SAP to do a much better job of educating people,“ says Jens Hungershausen, expressing his hope and expectation.

Specifically, half of DSAG members lack information about the long-term roadmap and support timelines (ASUG: 40 percent, UKISUG: 54 percent, JSUG: 35 percent). Only one-third of participants in the user survey are familiar with the newly designed Business Suite (ASUG: 22 percent, UKISUG: 27 percent, JSUG: 18 percent). Thirty-one percent of DSAG members consider themselves reasonably familiar with it (ASUG: 28 percent, UKISUG: 37 percent, JSUG: 29 percent). Only 35 percent of DSAG respondents are not very familiar or not familiar at all (ASUG: 51 percent, UKISUG: 36 percent, JSUG: 53 percent).

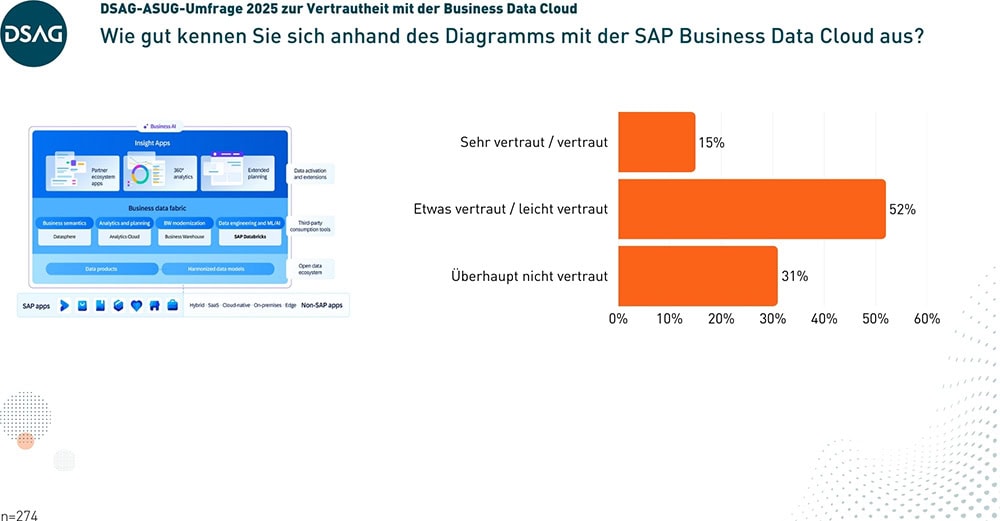

Knowledge gaps in SAP Business Data Cloud

Marketing and communication have also failed with regard to newer SAP products: when asked about their knowledge of the Business Data Cloud (BDC), only 15 percent said they were familiar with it (ASUG: 17 percent, UKISUG: 19 percent, JSUG: 11 percent). Only half of the survey participants in German-speaking countries are reasonably familiar with it (ASUG: 61 percent, UKISUG: 53 percent, JSUG: 66 percent). Thirty-one percent are not familiar with BDC at all (ASUG: 22 percent, UKISUG: 30 percent, JSUG: 22 percent). When it comes to gaps in knowledge about the Business Data Cloud, the top three areas are integration capabilities, licensing and pricing models, and differences from previous SAP data solutions. Many companies still lack sufficient guidance when it comes to the Business Data Cloud.

For SAP's marketing and communications departments, this means that the Business Data Cloud must be designed to be understandable, accessible, and open so that all SAP customers, both in the cloud and on-premises, can benefit from it. There must be no dependence on individual commercial constructs, and SAP needs to communicate more clearly and provide more information about the requirements and specific benefits of the solution. "Only then can the Business Data Cloud become a real added value for the entire SAP customer base," summarizes Hungershausen.

Cloud solutions in general (Microsoft, Workday, IBM, Oracle, Salesforce, etc.) continue to gain ground. The user survey also confirmed the coexistence of on-premise and cloud solutions that has been predicted for some time: The survey of SAP user groups in the DACH region, the US, the UK, and Japan shows that CEO Christian Klein's SAP cloud strategy has been driven into the ground and that SAP's marketing and communications departments have failed: hardly any SAP customers are aware of Business Data Cloud (BDC) and the new SAP Business Suite, as well as future support and operating models.

It gets worse: public cloud is not an accepted operating model, as the vast majority of SAP users prefer on-premises or hybrid models. The DSAG survey confirmed the coexistence of on-premises and cloud solutions that has been predicted for some time: many companies are relying on hybrid scenarios or planning them, and this will remain the case for the foreseeable future, according to DSAG CEO Jens Hungershausen.

2 comments

Werner Dähn

Mir stellen sich die folgenden Fragen:

1. Sollte der Erfolg einer Firma nicht an Neukunden Gewinnung gemessen werden? Wie viele neue Kunden hat SAP in den letzten Jahren gewonnen?

2. Ein Businessmodell, das nur darauf abzielt bestehende Kunden an sich zu binden, ist langfristig zum scheitern verurteilt, oder?

3. Wenn eine Migration so aufwendig und teuer wie eine Neuimplentierung ist, öffnet man der Konkurrenz Tür und Tor. Ist das geschickt?

4. Was ist der technische Unterschied eine S/4 Hana Instanz bei SAP laufen zu lassen (Rise), auf einem Rechner bei einem Hyperscaler oder auf einer Box bei mir im Rechenzentrum? Ist dann ein Cloud-only Ansatz nicht nur ein reines Investor-Marketing?

5. Sollte man nicht eher in zwei getrennten Dimensionen denken: Wo läuft die S/4 Instanz und welches Customizing verwendet ausschließlich stabile APIs (Clean Core)?

Peter M. Färbinger

Ja, natürlich …

Ad 1) Vollkommen richtig und hier kann SAP auch Positives vermelden: Für Neukunden ohne ERP-Altlasten kann S/4 Public Cloud eine gute Wahl sein – nicht preiswert, aber etwa für das Handelsgeschäft (ohne Produktion) vollkommen ausreichend.

Ad 2) Vendor-Lock-in ist einfach keine gute Lösung, weil sie sehr einseitig ist. Spätestens mit der Ablöse von S/4 Hana gehen dann die Kunden zu einem anderen Anbieter.

Ad 3) Richtig, und viele Releasewechsel sind bereits in der Projektphase so teuer wie ein ERP-Systemwechsel. Aber noch fesseln die Altlasten (Abap-Modifikationen) viele Anwender an SAP – mit Clean Core ergeben sich jedoch neue Optionen …

Ad 4) Nun, mit Rise verliert der SAP-Bestandskunde alle Rechte, weil er die On-prem-Lizenzen an SAP abgeben muss (Rise-Vertrag). Mit Lift and Shift zu einem Hyperscaler behält er zumindest die eigenen Lizenzen und kann im Fall des Falles wieder auf eine On-prem-Installation zurückgehen.

Ad 5) Sehr guter Punkt und perfekte Überlegung: Damit könnte der SAP-Bestandskunde eine klare Struktur in sein S/4-Betriebsmodell bringen.

Danke, erholsame Feiertage & liebe Grüße, Peter Färbinger