Digitization push and falling IT spending

![[shutterstock: 1513572500, Pla2na]](https://e3mag.com/wp-content/uploads/2020/11/shutterstock_1513572500.jpg)

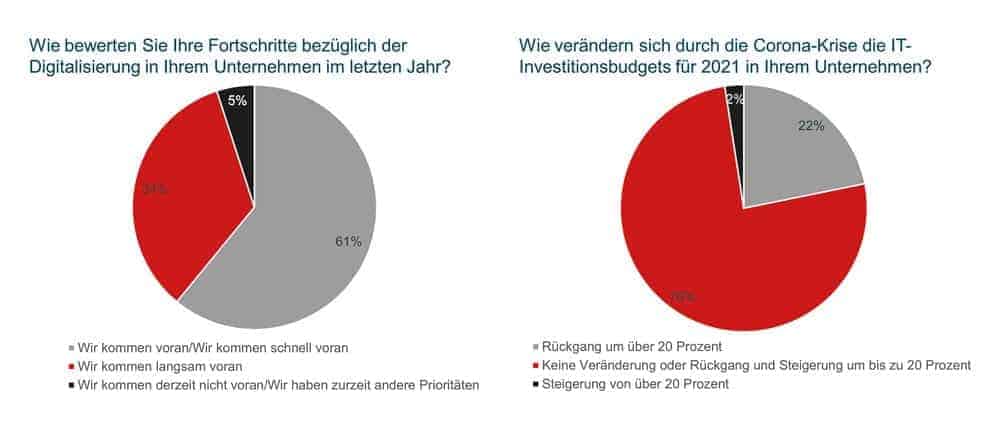

Digitization cannot be stopped, even if the requirements are increasing, as 81 percent of respondents concede. The greatest need for action is apparent in increasing the efficiency of existing processes and developing new digital business models and services. SAP enjoys a lead in terms of trust when it comes to digitizing core processes.

According to DSAG's Summer 2020 online survey, 74 percent of respondents are experiencing a sharp decline or decrease in revenue, and only 19 percent do not perceive any impact of the Covid 19 pandemic on revenue. At least seven percent can state that their sales are rising or rising sharply.

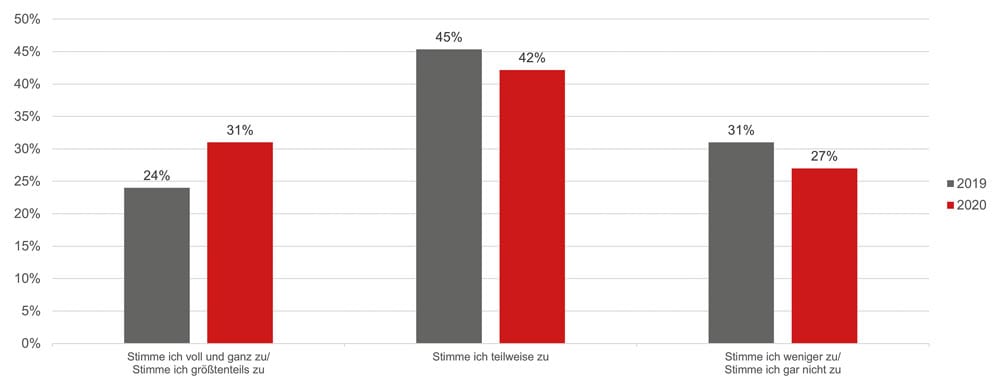

As a consequence of Corona on IT budgets, 22 percent expect a decline of more than 20 percent. However, it is also clear that the requirements for digitization in companies are increasing as a result of Corona. Eighty-one percent of respondents fully or largely agree with this.

Market researcher and analyst Forrester forecasts that technology spending in Germany, the UK and France will fall by between five and seven percent year-on-year in 2020 in an optimistic scenario. The reasons for this are the coronavirus crisis and the resulting recessions.

Asked about the greatest need for action as a result of the Corona crisis with regard to digitization in the SAP context, 72 percent of DSAG members answered with increasing the efficiency of existing processes. Last year, when the DSAG annual congress survey asked about the areas with the greatest impact due to digital transformation, increasing efficiency was still the top priority at 62 percent.

The development of new digital business models and services is still in second place at 36 percent this year. A more flexible relationship between customers and partners as part of a platform strategy is seen as important by only 24 percent.

"It is understandable that efficiency enhancement is still ahead as a classic field of action. I see this as a clear reaction to lower sales and smaller IT budgets"says former long-time DSAG CEO Marco Lenck.

However, DSAG has already pointed out in its statement on Corona that companies that want to be successful in the future should not only digitize their business processes in the long term, but also change their business models.

According to a flash survey conducted by German market researcher Lünendonk, the picture is more differentiated compared to Forrester: After months of uncertainty due to the Covid 19 pandemic, business-to-business (B2B) service companies are correcting their sales forecasts. In a snap survey conducted by market research firm Lünendonk and Hossenfelder, 57 percent of B2B service companies anticipate a negative sales trend.

In an initial flash survey in March, 89 percent still expected a decline. While 16 percent are currently planning for stagnating sales in 2020, 27 percent expect sales to grow despite Corona. The providers of temporary staffing and personnel services, industrial services and management consulting are most affected. Facility service and IT companies as well as auditors and tax consultants are more optimistic about the future.

The analysts at Forrester have gone into detail about the IT market: Germany will be less affected in 2020 compared to the UK and France, with a 5.2 percent decline in technology spending. The most likely scenario sees an eight percent decline in sales of computer equipment, six percent in technical consulting services and five percent in software.

"The Corona crisis has shown that it is incredibly important to be able to react quickly to new requirements. It seems that not everyone has realized this yet. In addition to SAP, we also see it as our duty to continue our educational work., comments Lenck.

Furthermore, the SAP User Association reported in mid-October that the S/4 projects of DSAG members are also benefiting from the increased digitization efforts. The digitization train is moving, companies have recognized how important the topic is, and are making progress. At the same time, however, they are moving in an area of tension between declining sales and massively shrinking IT budgets and, at the same time, higher requirements due to digitization.

With regard to the SAP product strategy, the perception among DSAG members has changed only slightly compared to last year. Thirty-one percent consider the SAP product strategy and roadmaps to be fully or largely reliable and trustworthy, seven percentage points more than in 2019. 42 percent agree with the statement in part, a decrease of three percentage points compared to the previous year.

SAP receives less or no approval on this point from 27 percent. This is a slight improvement on last year. It shows that something has changed and that the direction is right. But this has not yet been fully communicated to the market. SAP still has a considerable and sustained need for communication here.