Growth and innovation until 2020

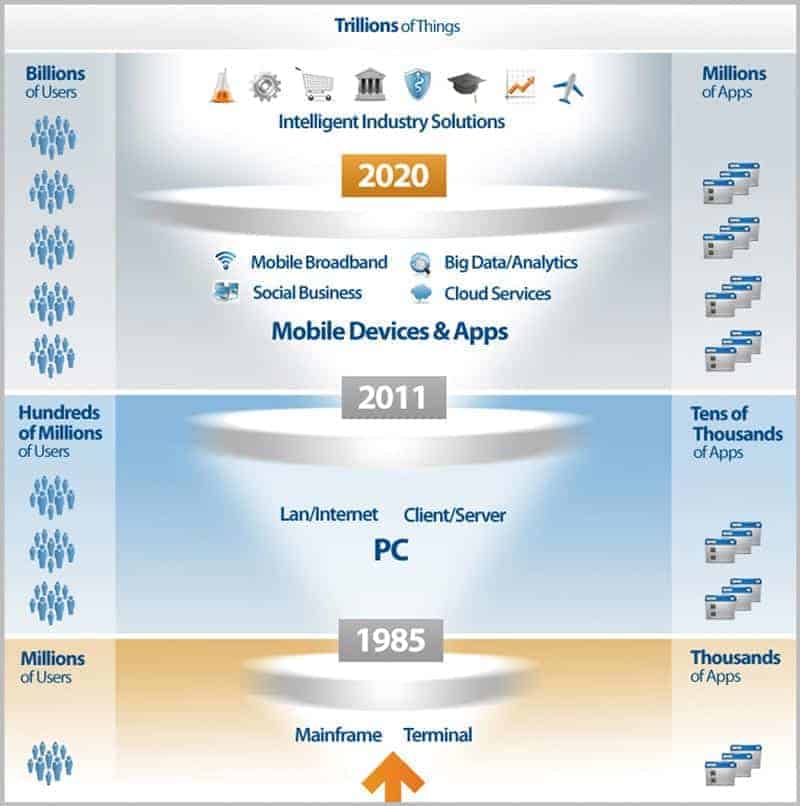

The 3rd platform builds on the mainframe as the 1st platform and the client/server technology that has been ubiquitous since 1985 as the 2nd platform, but without replacing them. We estimate that between 2013 and 2020, around 90 percent of IT market growth will be driven by 3rd platform technologies.

These technologies, which we like to call the Four Pillars (cloud, mobile, big data and social media), now account for only 22 percent of ICT spending.

We believe the four cornerstones will have a profound impact on the way software is procured and used over the next five years. Companies will benefit from the power of IT more quickly via different delivery models than is the case now.

In this context, responsibilities for IT spending and IT procurement within companies are shifting more and more toward new functions (mostly outside IT) with the aim of aligning IT even better with their own business needs.

This transformation, similar to the transformation to client/server technology, will create winners and losers among vendors.

IDC analyses have shown that vendors who invest in time in the above-described

technologies of the 3rd platform and the four cornerstones have seen stronger growth than those that have ignored this transformation so far.

In addition, the focus is increasingly on providing a roadmap for users to enable them to cope with the technology transformations. In this context, it is clear that CTOs and enterprise architects will be looking closely at vendors' software roadmaps to see how they will deal with the disruptive effects of cloud, social media, mobile and Big Data.

In this approach, vendors need a higher level of understanding of their customers' businesses, as well as new go-to-market approaches that engage with new buyers outside of IT departments.

Due to the new contact persons at the customer, the requirements for software sales are developing in the direction of a team selling approach. In addition, sales bonuses must become independent of the delivery model.

The performance of existing partners must then be reassessed, which can lead to difficult discussions. Companies need to take another careful look at who they want to work with in the future.

Ultimately, providers must now make the right investment decisions to be on the right, i.e. successful, side of the transformation to the 3rd platform. One challenge in this context is the management of margin expectations - both internally and externally.

As a result of these investment decisions, some software vendors will gain market share, others will lose it. For the European market, we expect that at least ten percent of the largest European ISVs will drop out of the top 100 of the "IDC European Software Tracker" as a result of this market disruption, to be replaced by other vendors.