EU Public Cloud Market Defies US Tariffs

According to IDC's Worldwide Software and Public Cloud Services Spending Guide, the public cloud in Europe remains on course for growth. Expenditure is expected to reach USD 229 billion in 2025, rising to USD 452 billion by 2029. This corresponds to a compound annual growth rate (CAGR) of 19% in the period from 2024 to 2029.

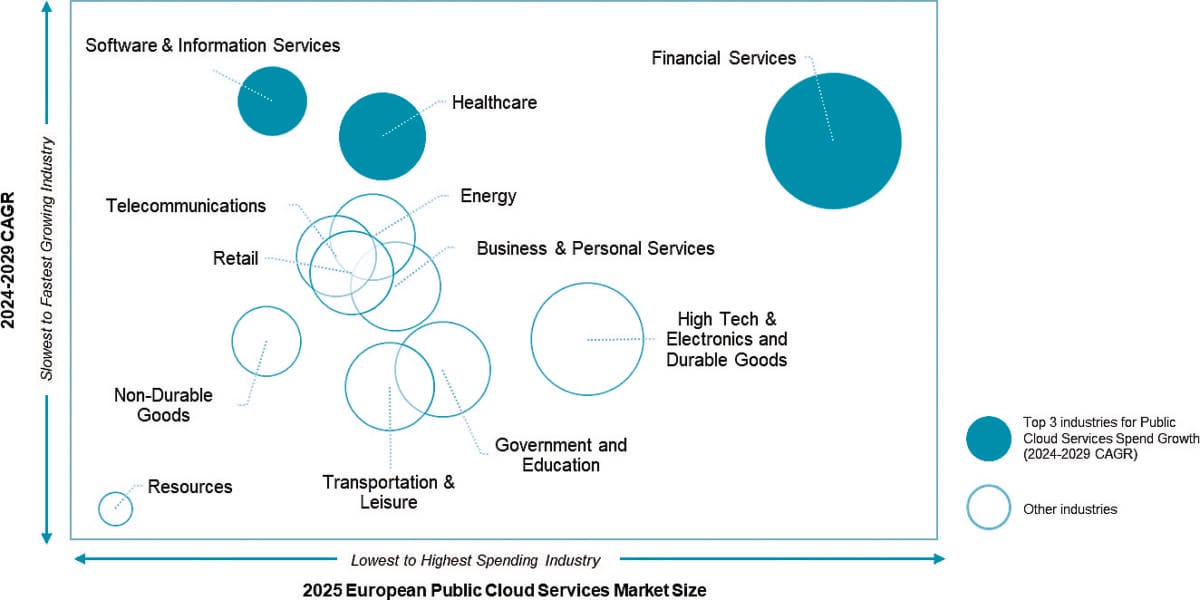

The main drivers are financial service providers, healthcare and software and information services that use the cloud as the basis for their digital transformation. While manufacturing, automotive and chemicals are acting more cautiously in light of US tariffs, the war in Ukraine and geopolitical tensions, IDC does not see any significant braking effect. Cloud remains central to supply chain transparency, agile inventory management and real-time forecasting.

Market size and forecast for spending on European public cloud services by key IDC industries, 2024 to 2029.

Stimulus from GenAI

AI and Generative AI in particular are boosting investment: Platform as a Service (PaaS) is set to grow by 32% annually until 2026. Companies are increasingly using the cloud to implement automation, scalability and efficiency. Cybersecurity and regulatory requirements are also driving demand, particularly in the banking, insurance and healthcare sectors. In 2026, IDC expects particularly strong growth in the health insurance, insurance and life sciences sectors.

The reasons for this are rising patient expectations, deficits in the state healthcare system - such as the British NHS, which is fueling private insurance companies - as well as EU funding and billions in investments in research and new therapies. Despite global uncertainties, the public cloud remains the driving force behind digitalization in Europe, according to IDC. It supports companies in managing risks, driving innovation and ensuring competitiveness. The close integration of cloud, AI and automation is laying the foundation for the next big push in Europe's digital economy.

Source: IDC