Dormant Potential

Two-thirds of American and German users in the corresponding SAP user groups ASUG and DSAG stated last year that they either did not know SAP Rise or were not familiar with it. According to the latest results of the DSAG Investment Report 2022, this situation has changed only marginally to date. On the plus side, SAP can so far count only seven percent of SAP users who have either already signed a contract or are likely to use the new offering. Everyone else is hesitant - overall, only a small minority is using S/4 from the cloud.

However, Rise still represents a "quantum leap" for SAP to get companies into the S/4 cloud - if it is understood correctly. That's why it's important for companies to explore their opportunities through Rise in advance - an initiative also known as Transformation as a Service. Take, for example, a Dax company in the healthcare sector that wants to move all of its 29 SAP systems to the cloud. After an interim step of initially switching to Business Suite 7 on Hana, the group is targeting the use of S/4 from the private cloud in the next step. Another customer from the automotive sector is moving its four SAP systems directly to the private cloud. Consolidation of the systems, more speed and an increasing cloud focus are frequently cited motivations of the companies.

Cloud Evolution

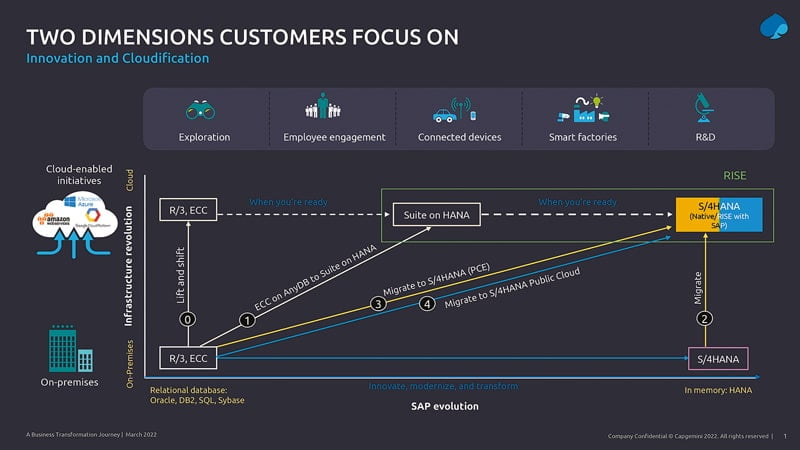

The migration paths available to companies within the framework of Rise are illustrated in the graphic, which shows SAP evolution on the x-axis and cloud evolution on the y-axis. Rise moves the traditional existing SAP customer running ECC 6.0 from the bottom left to the top right of the graph. In this case, both the infrastructure, Hana database and applications such as S/4, BTP, etc. would be mapped to the cloud. Most customers taking this step initially have two things in mind: they want to move their business to the public or private cloud and use the subscription model in an Infrastructure-as-a-Service approach, i.e., subscribe to software on a monthly basis and thus move away from licenses. Software costs are then recorded as operational costs. In contrast to Capex, the Opex recurring operating cost model offers companies the opportunity to flexibly structure expenses and immediately adapt them to requirements.

Rise brings the systems into the cloud, offers a stirrup into the cloud via Business Suite 7 on Hana, transforms Capex into Opex and gradually says goodbye to the tiresome licensing issue. So far, so understandable. But where do the problems of understanding in the SAP community come from? The challenges often lie in the details. SAP resources: Companies want to know what SAP does and does not do for them as part of IaaS. For example, there are about 1000 defined task packages, some of which are included in the Rise offering, some of which are included as an option, or some of which are not included. It is also unclear who will handle the interaction between Rise and non-SAP systems. Finally, CIOs lack an estimate of how many SAP resources will be needed in the future.

Range of functions: The standard Rise package includes SAP S/4, the "digital core," the Business Technology Platform (BTP) development platform, the Business Network (formerly Ariba) purchasing network, and process tools such as Signavio. Companies that don't need all the functionality can't slim down. In addition, the BTP in the Rise package is based only on basic functionalities, which are not always sufficient, and HR functionalities (HCM, SuccessFactors, etc.) are not included in Rise. It is necessary to look very closely and analyze whether the "total package" ultimately pays off.

Migration path: SAP Rise does not relieve companies of the task of considering what the migration strategy should ultimately look like. Decisions about greenfield, brownfield and rightfield, i.e., about the extent to which processes should be adapted, which data should continue to be used, to what extent the IT landscape should be streamlined, which systems should be used in the cloud and what the roll-out strategy should look like, must be made individually. The prerequisite is therefore still an overall picture for the migration. So sound preliminary work is needed first to be able to decide whether and at what point Rise can come into play.

The areas of use are individual. For example, the Private Cloud Edition (PCE) usually serves large companies as the target architecture of the future, while smaller companies as well as subsidiaries or sales offices of corporate groups use the public cloud because the standard functionalities are sufficient for them. In general, Rise is very well suited to covering the commodity via the standard and thus giving companies the chance to focus on project work that offers the company real added value and makes the difference to the competition.

Selective data transition

Carve-out, selective data transition and two-step to S/4 Cloud: Examples from industry show a possible conversion. An automotive manufacturer is currently spinning off a business unit. As part of this carve-out, the logistics, ERP and financial systems must be removed from the group IT and made available to the new autonomous business unit. Instead of taking over existing ECC systems one-to-one, the first step is to switch to S/4. As part of a selective data transition (SDT), the existing SAP customer only uses relevant data for the new company.

For a manufacturing company, the goal is to create a cloud-based

strategy to switch directly to S/4 and in the process reduce the number of ECC systems from three to two. The focus is on financial and logistical processes. Advantage here as well: Relevant customer-specific codes are adopted via an SDK and ECC licenses are replaced by new contractual agreements.

A Dax group from the healthcare sector is relying on a two-step path to S/4 and, in the first step, is using Hana databases and thus more speed in the processing of large volumes of data, before then planning a switch of its current 29 SAP systems to S/4 Private Cloud.

As can be seen from these examples, the switch to S/4 requires good preparation. The difference to the pre-Rise era: SAP is now pushing the switch to S/4 with Rise. Experience shows that SAP is currently making good offers to its existing customers to jump on Rise. When a customer recently had to "remeasure" its licenses, SAP put together an individual package that provided for entry into Rise and dispensed with a license update. The next DSAG survey on the topic will show whether SAP has come up with enough to finally get its customers excited about S/4 Hana in the cloud.