Critical factor of a merger: the modern finance department

Growth is the be-all and end-all in a market economy. To achieve this goal, some companies focus on expanding their core competencies, while others diversify their offerings. Those who cannot expand or modify their products or services from their own resources generally buy them in.

This strategy is precisely one of the reasons why there are more and more corporate takeovers and mergers. Even during the pandemic, takeover interest remained high, as experts from the legal, banking or private equity sectors report. Many experts share the view that mergers can be a decisive factor for success.

Rick Smith, managing director of insolvency and corporate recovery specialist Forbes Burton, for example, even believes that mergers can be a particularly effective strategy for surviving the Coro-na crisis: "The advantages are obvious. Jobs can be secured, the business continues, and it's a great way for CEOs to retire when they want to devote their time to other things."

However, a company takeover is not just the purchase of know-how or market shares. An existing structure, established processes and a grown IT environment are also taken over. And this is precisely where the problem lies, because both the structures and workflows have to be integrated. Particular attention is paid to the finance department. It is the linchpin, because this is where all corporate data converges.

But every company organizes its accounting somewhat differently - has different tools and processes in place for the month-end closing, the balance sheets or the ERP. So if you want to make a merger a success, the first thing you should do is consolidate the different accounting ecosystems; everything else is secondary in the long run. Why? Because managers always, but especially after a merger, need an accurate overview of the consolidated figures and results quickly in order to set the right course.

The crux of financial processes

Many mergers appear breathtaking in the news. As if it were a matter of course, company representatives report outstanding synergy effects, excellent market opportunities and growth rates. But getting there requires not a pinch of luck, but above all a solid takeover concept that ideally has its starting point in accounting.

Integration, automation and digitization are the tasks that no one can avoid, because reality shows that mergers often suffer firstly because the systems and processes in the finance departments to be merged are too different. Secondly, employees and their needs must not be lost from view. In this context, it is not infrequently the employees and their attitude toward the takeover that have a decisive influence on the success or failure of the venture.

Herculean task: Fusion and manual processes

But there is another hurdle: the manual processes. Even without the challenge of a merger, they are a problem that should not be underestimated. They are difficult not only because important knowledge is locked up in the heads of individual employees and manual processes are more prone to error. They also take up an incredible amount of time, are often frustrating and prevent agile action.

In compressed form, all these challenges can be found in finance departments whose structures are still based on traditional procedures: the use of spreadsheets, the manual reconciliation of data and their manual transfers to other systems. All of this is diametrically opposed to modern accounting, a digital and end-to-end closing process that opens up new possibilities for finance departments. Because what is it all about?

Large companies in particular, which have to process non-standardized local data and figures worldwide in an SSC (Shared Service Center), have problems with manual processes: they are slow, not transparent, uncertain, hardly flexible and prone to errors. Especially in the case of a merger, this can have fatal consequences. Without up-to-date, valid figures, it is almost impossible to navigate today's dynamic markets in a meaningful way. Ergo: it is better to introduce a modern accounting process today than tomorrow.

Successful integration and standardization in five steps

There are five basic success factors for a tightly planned and rapid integration of financial processes and systems in a merger or acquisition: First, a unified system with consistently valid processes. Second, the greatest possible automation of manual processes. Third, the creation of end-to-end transparency and availability of financial figures to provide management with a solid basis for decision-making.

Fourth, the continuous improvement of the standard process for the organizational and financial systems and business solutions. The fifth aspect concerns the employees. The additional time gained means that finance professionals can devote more attention to evaluations and forecasts, which makes them important partners for corporate management.

For these five steps, it is advantageous if the acquiring company has already implemented an intelligent automation platform, because then the processes and systems are already standardized and there is visibility and transparency. Another advantage is that accounting platforms then integrate seamlessly into ERP systems such as those from SAP or other ERP providers. They take on tasks that are not traditionally performed by ERP solutions. But what needs to be considered?

Solution for flexibility and control

It's no secret that many F-and-A solutions require support from technical consultants or IT. And that's exactly what prevents accounting from being agile and responsive. But there is another way: With solutions, for example from BlackLine, the processes and systems can be integrated by the teams directly into the platform of the new company. Best practices principles are applied, data is cleansed and inefficient work steps are reduced.

Purpose-built automation, such as automated learning, helps with tasks such as transaction reconciliation. Thresholds for variances and exceptions are done with just a few clicks. Best practice templates accelerate standardization, create transparency so that report fields or dashboards can be changed on-the-fly, without the need to consult a technical consultant.

Unified platform ensures productivity and consistency

Too many data silos, different user experiences and fragmented workflows reduce accounting performance. Modern and cloud-based accounting solutions ensure that all financial data and processes are centralized, unified and accessible from anywhere. This harmonious interaction makes financial statements, reconciliations, and journal entries easier and the financial close smarter.

A unified user interface provides dashboards that provide real-time insight into the financial close. It's then easy to respond to discrepancies, incomplete tasks, or overdue items. Cluttered, disconnected interfaces, multiple log-ins or spreadsheets are a thing of the past.

Networked platform

Data from various applications, including ERP, subledger, tax, treasury, expense, payroll, and external banking systems, converge in accounting. Therefore, direct ERP-agnostic integration is essential.

BlackLine, for example, is able to work seamlessly with over 100 different systems. It supports a variety of out-of-the-box connectors to SAP and third-party systems to integrate summary and detail data, for example, to post journal entries to the general ledger.

End-to-end automation reduces workload

Many financial close solutions do not automate enough. Important month-end closing tasks only take place at the end of the month, causing accounting to fall behind. This makes the highest possible level of automation all the more important, as it is the only way to ensure the necessary continuous real-time processing and relieve the burden of the numerous month-end closing tasks. However, a modern accounting solution, such as the one from BlackLine, not only helps the accountants, but also the controllers, who thus have a better overview of the finances.

Key Factor Modern Accounting

The companies to be acquired often have complex systems and processes with many risky, very old items. But on the basis of Modern Accounting, the required flexibility and overview are created. This helps the companies in principle, but especially when it comes to merging corporate structures.

When the gap between systems is bridged by a higher-level concept and the appropriate technology, called Modern Accounting, companies are able to take their workflows and processes to the next level. The goals are clear: Modern Accounting helps overcome F-and-A challenges, minimize risks, and optimize team capacity. It stands for the modernization of accounting and for another important step in the optimization process: Continuous Accounting.

Modern Accounting is based on four key principles:

- The harmonization of data,

Tasks and processes - The automation of

Accounting tasks - The balancing and account analysis

with risk reduction - Analyzing the data including reporting

Modern Accounting reduces manual, Excel-based activities and creates visibility and transparency. The finance team now focuses only on value-added work and can act as a business partner.

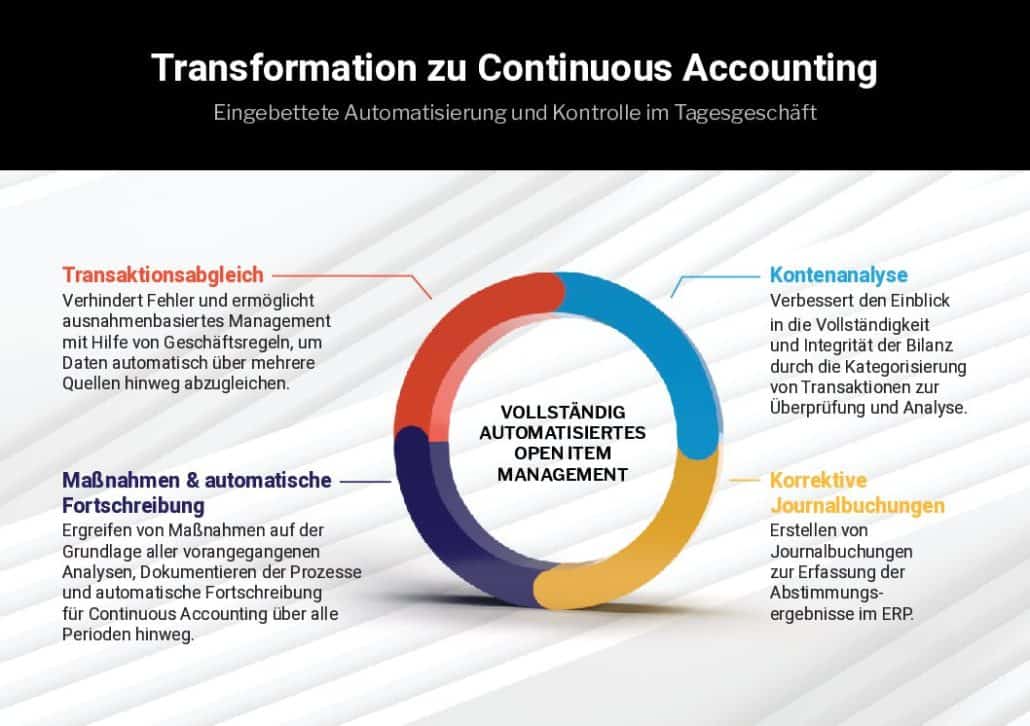

The supreme discipline of continuous accounting

Continuous Accounting is a direct consequence resulting from the Modern-Accounting-

approach emerges. It solves the problems of manual, risky and, above all, time-consuming accounting by relying on a continuous process. It is the goal of Continuous Accounting to no longer perform postings, account reconciliations, analyses and controls at the end of the month, quarter or year. Rather, postings are made throughout the accounting period and with daily updated data - continuously.

Transactions and accounts are recorded and reconciled immediately at the time they actually happen. This results in major advantages: Discrepancies are not discovered at the end of a reporting period and can be eliminated without time pressure. Consequently, specialists from the finance departments can perform solid analyses and make recommendations to management - in real time.

Continuous accounting is made possible with the help of powerful software solutions, for example for account reconciliation, variance analysis or transaction reconciliation. This makes it easier to close the books, distributes work more efficiently over the entire period, and increases both quality and transparency.

Conclusion: The time is ripe

Whether in the case of a company takeover, a merger or in the course of a general modernization of the finance department - good change management is urgently needed. It needs a person in charge who is not only familiar with the processes of a change in an organization, but who also has deep insights into what possibilities exist today with different systems.

The fundamental goal must be a transformation in which disparate systems and processes are centrally transferred into a single entity. In the context of a merger, the integration of financial systems is an even more critical success factor than it already is. Because one thing must not be forgotten: If the finance team of the acquired company feels that it can count on the best possible support and work with the leading solutions from now on, it will be all the more motivated to support the change.

Experts therefore advise initiating the planning of the changeover in the finance department even as early as the due dili-gence phase. Those who analyze and plan possible risks, opportunities and measures in advance have a clear advantage and can reap the rewards of a merger more quickly. So why wait with the introduction of Modern Accounting?