NetWeaver, Data Hub, Datasphere, BDC

Stay unbeatable with the SAP Business Suite, is what was plastered on an advertising banner on Handelsblatt.com a few days ago. SoH is back! A suite based on Hana is officially—probably—better than S/4 Hana. Does this new SAP Suite mean the end (EOL) of S/4 Hana? The SAP news from New York, USA, is difficult to categorize. There is once again an SAP Business Suite that has a dual basis—BTP and Hana. This brings the concept of SoH, or Suite on Hana, back into the focus of SAP's strategy, this time with a healthy dose of AI. SAP and the US IT provider Databricks want to improve corporate AI with a new cloud for business data.

SAP decided its future direction years ago. Initially, the Exchange infrastructure as part of SAP NetWeaver was intended to address the transport problem and facilitate data communication. This was followed by HEC (Hana Enterprise Cloud), HCP (Hana Cloud Platform), SCP (SAP Cloud Platform), SAC (SAP Analytic Cloud), BTP (Business Technology Platform), and most recently, BDC (Business Data Cloud). In addition to the platform concepts, there were also the stand-alone products Data Hub and Datasphere. SAP has had a proliferation of many products, concepts, solutions, visions, and strategies for many years. This fickleness and inconsistency is not ideal for planning decade-long ERP systems.

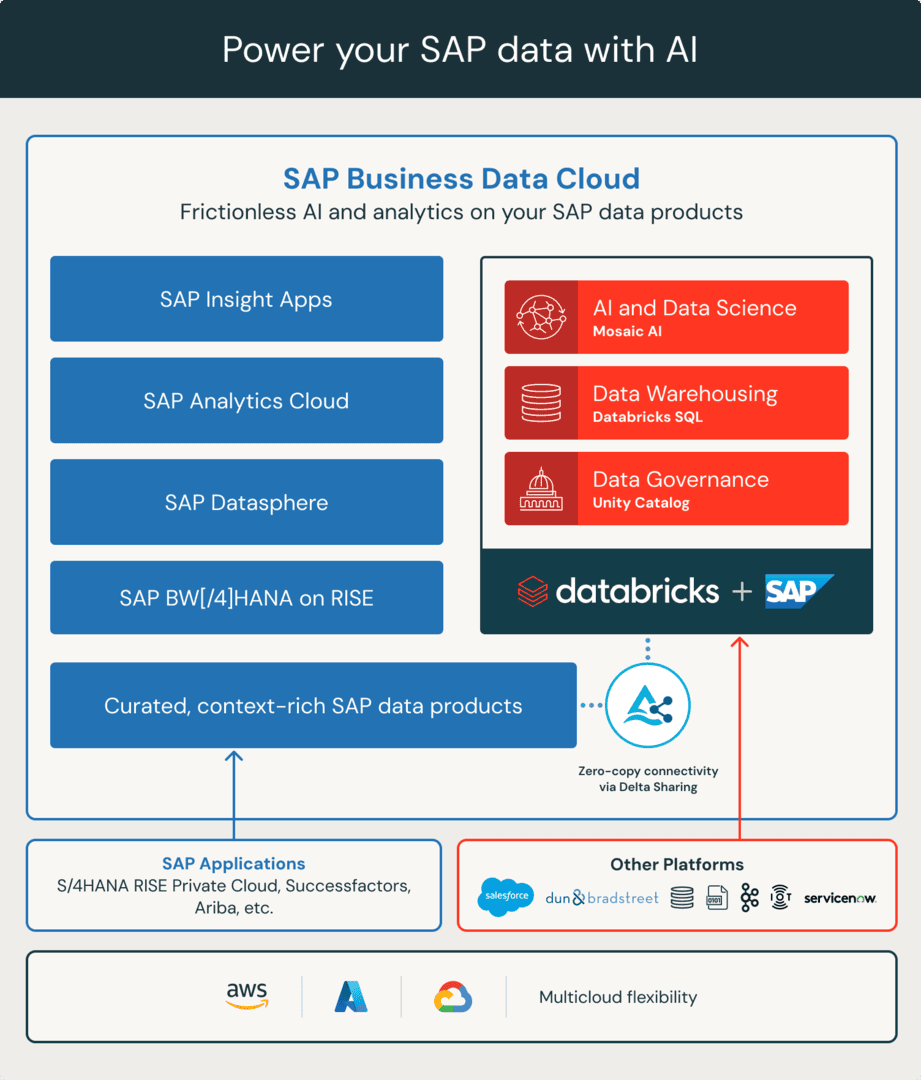

As part of the BDC announcement, SAP has announced its partnership with the US IT provider Databricks. With the BDC, the Databricks portfolio will be integrated into the SAP ecosystem via a simple interface (connectivity via delta sharing), which many SAP customers are already familiar with through hyperscaler offerings such as Azure Databricks. With the BDC, a specially adapted version of the Databricks portfolio is now available. DSAG Chief Technology Officer Sebastian Westphal explains that, “companies can benefit from the modern AI and warehousing functions of Databricks and should be able to seamlessly integrate individual data products into the SAP ecosystem with a low entry hurdle and usable via existing SAP contracts.”

Sebastian Westphal, Chief Technology Officer, DSAG

If the plan for the SAP data product is successful, the way we process raw data could be replaced by semantic data and business logic. A statement from the DSAG says it will be hard to implement complex data paths in the future. In some cases, generic data bricks, tools, or hyperscaler solutions may still be needed (see graphic below).

SAP's Business Data Cloud is a new tool that brings together all your company's data, as well as data from other sources, in one place. The goal of BDC is to create a reliable database that companies can use to make better decisions and make the results of AI more reliable. The solution is designed to manage data from critical business applications, with features for data engineering and business analytics. The plan is not without merit, however, its release date is at least five years too late. Hyperscalers or specialists like Databricks or Boomi have been offering similar solutions for years. SAP's partnership with Databricks highlights its own shortcomings. SAP didn't ignore innovations such as the Internet or AI, but it seems to have missed the mark with the much more important "Master Data Management."

SAP believes that the partnership between SAP and Databricks will usher in a new era in the corporate data management. Two market leaders plan to redefine the collaboration between applications and data platforms, see also "Algorithms and Data Structures", a standard textbok on computer science by the late ETH professor Niklaus Wirth. The SAP solution integrates techniques from Databricks for data engineering, machine learning, and AI workloads. "SAP Business Data Cloud allows business data to be used optimally for enterprise AI," promises SAP CEO Christian Klein. "The groundbreaking solution combines SAP's unparalleled expertise in business-critical, end-to-end processes and data with rich semantics with Databricks' outstanding expertise in data engineering. This helps companies to get even more out of their data."

However, syntax comes before semantics. SAP still needs to do more research before this can be used effectively. There are still compatibility issues between the different cloud offerings and ERP modules. "Every company wants to get more value from their data and AI investments," said Ali Ghodsi, co-founder and CEO of Databricks. "By partnering with SAP, we are helping companies bring all their data together to create, analyze, and develop specific AI applications on the Databricks Platform."

From the perspective of the German-speaking SAP user organization DSAG, integrated business processes were and are one of the major advantages of SAP. "The basis for this was a strong ERP solution with almost all the necessary functions from finance to production in a single system," says Thomas Henzler, DSAG Board Member for Sales, Production, and Logistics. This topic has been the subject of many discussions in the past.

Thomas Henzler, Chief Sales, Production, Logistics Officer, DSAG

Numerous SAP company acquisitions in the past, technical changes and SAP's strategic orientation towards the cloud have led to the ERP portfolio becoming increasingly fragmented. One example is customer relationship management (CRM), which is currently dominated by Salesforce. Another example is individual finance and HR solutions, where Workday has become a successful competitor. The complexity of SAP contract designs has increased massively and, as a result, so has cost management. There were also challenges in terms of integration," summarizes Henzler. Overall, customers needed to decide whether to pursue a best-of-breed approach (composable ERP) or a best-of-suite approach (vendor lock-in).

From the DSAG's point of view, a major disadvantage in the past was that customers could not always easily benefit by purchasing everything from SAP directly, from a single source. "This often meant that solutions from other manufacturers were also purchased in tenders. The customer repeatedly had to negotiate individual deals with SAP—e.g. for CX or procurement solutions. There was a lack of transparency as to what commercial advantage the customer truly gained from purchasing everything from SAP. In addition, purchases from the past were generally not taken into consideration for discounts in new deals," explains Thomas Henzler in a recent DSAG statement.

BDC is intended to promote the use of data products by customers. The aim is to create a data ecosystem for modeling AI-supported insights. SAP Joule agents use business data and SAP Knowledge Graph solutions for this purpose. From DSAG's perspective, the introduction of the BDC marks yet another change in SAP's data strategy, which essentially means a simple lift-and-shift approach that supports existing data-holding SAP solutions and makes previously BW-based data products available in the BDC in future. "For companies, this means a balancing act: protecting existing investments while maintaining access to the new Lakehouse architecture with additional services. Legacy systems should continue to be able to be operated, while SAP-managed services increasingly replace individual data storage," says Sebastian Westphal.