![[shutterstock: 1493123198, kkssr]](https://e3mag.com/wp-content/uploads/2021/02/shutterstock1493123198.jpg)

The total budget for IT investments will increase in 2021 at 39 percent of DSAG companies in Germany, Austria and Switzerland, even in times of the corona crisis. The same applies to investments in SAP IT at 43 percent of companies. These are the findings of the Investment Report 2021 published by the German-speaking SAP User Group (DSAG). Slightly rising figures are also emerging for the switch to S/4 Hana. Only in the case of three-year planning are companies somewhat more cautious with their investment forecasts.

The immediate impact of the Corona crisis on companies was felt overwhelmingly last year. Many have had important experiences with the overall situation and its direct consequences. But they also learned quickly from it, which puts the outlook for 2021 in a positive light.

For example, the DSAG Investment Report revealed that the budget for general investments in IT will increase this year at 39 percent (2020: 46 percent) of the companies surveyed in Germany, Austria and Switzerland (DACH). At slightly less than a third of these, by between ten and 20 percent.

37 percent expect the rate to remain the same. 18 percent of respondents indicated falling values, with 44 percent of these also down by between ten and 20 percent. As far as SAP investments are concerned, 43 percent of respondents want to invest more, a slight decrease compared to the Investment Report 2020 with 49 percent.

Budgets for SAP will fall for 18 percent of respondents, compared with 19 percent in 2020. At 35 percent, investments will remain the same (2020: 32 percent). In manufacturing, the budget will increase at 47 percent (2020: 46 percent), and at 40 percent (2020: 47 percent) of companies in the service provider and retail sectors.

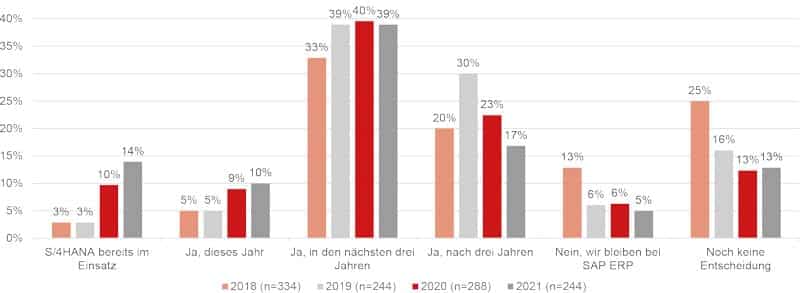

When it comes to switching to S/4, 13 percent of respondents had not yet made a decision last year, and this is also the case this year. At the same time, 14 percent are already using S/4 (2020: 10 percent) and another 10 percent (2020: 9 percent) are planning to make the switch this year. In the next three years, 39 percent (2020: 40 percent) also plan to rely on S/4.

Nevertheless, it is important to continue the dialog with SAP on S/4 and that the solution is consistently developed further. There is still potential to be exploited, e.g., with regard to the differentiation between on-premises and cloud or smooth integration.

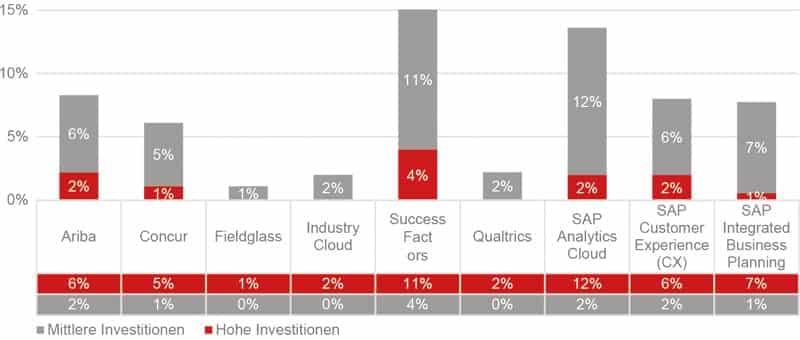

Despite SAP's cloud-first strategy, investments in corresponding solutions are still within manageable limits. According to the investment report, high and medium investments in the following SAP cloud solutions are planned for the first three places in the ranking for 2021: SAP Analytics Cloud at 14 percent (2020: 13 percent), SuccessFactors at 15 percent (2020: 14 percent) and SAP Customer Experience at 8 percent (2020: 11 percent). They are followed by Ariba and SAP Integrated Business Planning, each with 8 percent, and Concur with 6 percent. Industry Cloud (2 percent), Qualtrics (2 percent) and Fieldglass (1 percent) bring up the rear with a slight gap.