Database monopoly

Diversity is expensive and complex. SAP had to experience this for the first time with the ERP version R/3. It is not known whether a figure exists for the possible combinations of hardware, operating systems and databases on which an R/3 can be customized.

What at first was seen as cosmopolitan and innovative developed over time into a juggernaut that could hardly be controlled.

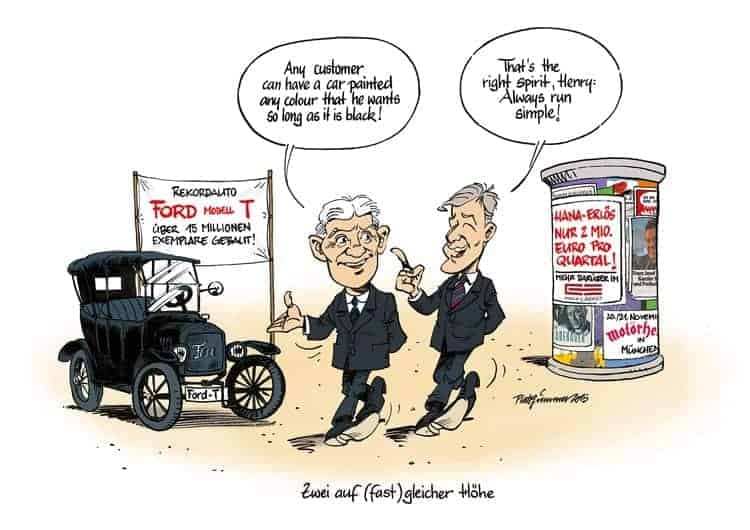

The quote from Henry Ford (1863 to 1947) is well known:

"Any customer can get their car painted any color they want, as long as the color they want is black."

For some years now, SAP has also been able to claim this, Bill McDermott:

"Any customer can get their ERP on any database they want, as long as the database they want is Hana."

What happened?

The ERP monopolist becomes a database oligarch. Due to its market power, SAP can dictate which hardware, which operating system and which database are to be used. This seems logical and justified on the one hand, but anti-market and anti-customer on the other.

SAP had to pull the ripcord! The variants of IT architectures for ERP/ECC 6.0 are almost unmanageable. What is an advantage for the user in negotiations with IT suppliers becomes an inferno for SAP service and support.

It is almost a Sisyphean task to find errors in a system with dozens of variables. In the end, SAP had to maintain all infrastructure variants consisting of hardware, operating system and database in order to provide adequate answers in the event of support.

campaign by SAP CEO Bill McDermott (r.), the comparison with car pioneer Henry Ford suggested itself. You don't get much more choice than that!

The "Hana consolidation" to certified hardware, two Linux operating system versions and Hana seems understandable from the ERP group's point of view.

Naturally, other tactical considerations also played an important role - for example, taking a little butter off Oracle's bread. How things will turn out with the singular database Hana will be judged after 2025 at the earliest.

However, SAP's database monopoly is also developing into a monopoly of opinion: SAP is increasingly coming to the conclusion that only SAP software can be right for existing customers.

With the new CRM initiative C/4, the aim is no more and no less than to monopolize the entire customer experience supply chain. Anyone who is still running SAP Hybris, Salesforce and Adobe, as well as ECC 6.0 or S/4 in the back office for their online store, will have to consider whether the additional license fees for "indirect" use are worth it to them or whether they should switch to C/4 and Hana.

By combining individual offerings into packages, SAP is reducing the choice available to its existing customers. Thus, it will soon be called by SAP CEO Bill McDermott:

"Any customer can get their CRM and supply chain from any software source, as long as the combination they want is C/4 Hana."