Consolidation, insourcing and digitization drive M&A in the IT sector

Consolidation is already well advanced in the German IT market. Dominant market players such as Itelligence, All for One Steeb, MSG and Allgeier in the SAP service provider segment and Bechtle, Datagroup and Cancom in the system house segment have systematically acquired additional companies in recent years in order to further strengthen their market positions.

At the same time, many owners of medium-sized IT companies are looking for successors and investors. They often founded their companies in the 1980s and 1990s and, as best agers, are now slowly thinking about exit scenarios.

This process is driven by the increasing pressure on margins for traditional IT services and the steadily growing need for investment with ever shorter innovation cycles.

At the same time, access to the labor market and to financing opportunities is increasingly becoming a bottleneck and a brake on growth for digital SMEs. In recent years, a whole series of well-known names have disappeared from the IT market.

As a result, owners are increasingly looking to link up with a larger strategic partner or investor. In this way, you can dock your company to a larger one and use its infrastructure and distribution channels without directly losing your medium-sized flexibility.

The founder usually remains on board for a longer transitional phase and can then gradually bring his life's work into a safe harbor as part of a larger venture.

Such a comparatively smooth transition is usually also appreciated by investors because it avoids the risk of a hard cut when the founder leaves the company directly. One of the main goals of transactions in the IT sector is to keep the existing team on board with its digital expertise in order to maintain continuity in the business process.

Here, intensive integration management can help to retain employees and variable price models, a so-called earn-out, can motivate the founders still remaining in the company in the interests of the investors.

M&A as a turbo for digitization

In view of the consolidation in the market and the upcoming wave of successions, many owners of medium-sized IT companies are on the defensive and would be well advised to start the process of succession planning and finding investors in good time.

On the other hand, however, there are also a wide range of opportunities for IT companies arising from the wave of digital transformation that is now starting. For example, digitization is now on the agenda of all companies across all industries and is leading to a surge in demand for qualified IT services.

In addition to traditional IT services, contributions to the design of innovative business models are increasingly required. Despite all the euphoria about digitization, it is becoming increasingly difficult for many small and medium-sized IT companies to keep up and align their teams and business models with the new digital focus.

Digitalization is by no means a foregone conclusion for medium-sized IT companies. Nevertheless, it is clear that the growing demand for digital services is also having a direct impact on demand on the M&A market in the IT sector.

For medium-sized IT companies that have positioned themselves in good time for the upcoming digitization and are simultaneously looking for an investor, this means the best conditions with regard to a possible company sale.

Large technology companies such as Siemens and Bosch, as well as automotive manufacturers, are successively developing into IT and software service providers through massive acquisitions.

While IT was still considered an object for outsourcing in the recent past, now, with the increasing degree of digital value creation, IT is once again increasingly viewed as a core competence that needs to be brought back into the company.

M&A success in the IT market

And this trend will continue for the next few years. If we have long been talking about the "war for talent" in the personnel market in the IT sector, the battle for the acquisition of attractive digital companies has also long since begun here. For well-positioned IT companies, the M&A market has clearly turned into a seller's market.

Despite all the dynamism and demand on the IT market, M&A success is not necessarily automatically preprogrammed for both owners and investors. For owners, it is important to prepare the process of finding an investor properly.

This includes the right positioning of one's own company, the determination of the ideal target investor and the story with which one approaches the M&A market, as well as a convincing business plan that also expresses one's own story in resilient figures.

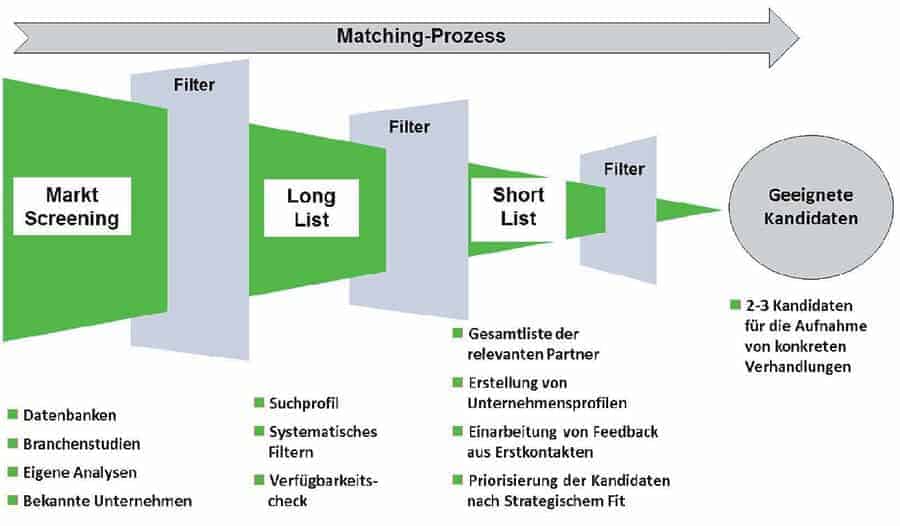

For investors themselves, the search for interesting target companies in the IT market is becoming increasingly competitive. Here, only a strategic approach can lead to the goal.

The purely opportunistic waiting for sales offers available on the market only rarely leads to success. If you receive an interesting company exposé on your desk, you can confidently assume that a whole series of other investors are on the case at the same time.

Compared to the classic M&A approach, there are numerous special features to be taken into account in the IT market that are important for a successful transaction. This starts with the fact that IT companies essentially market virtual goods in the form of software and services, which cannot be valued purely in terms of their intrinsic values.

For this reason, valuation methods based on the future values of the business plan (e.g. discounted cash flow (DCF) and capitalized earnings value methods) or on market-related comparative methods (e.g. multiples from comparable transactions or comparable listed companies) are of primary importance.

In this context, a calculated numerical enterprise value is initially regarded as a first point of reference that must be weighted to the specific characteristics of the IT market as part of a 360-degree view.

Such a 360-degree view includes as factors the business model, the business development, the organization and the team, the technical platform and the balance sheet structure.

The stability and growth capability of the company is important here. For example, the high proportion of recurring revenues and scalability in software-as-a-service (SaaS) business models are valued correspondingly highly by investors.

Due Diligence

Finally, the identified risks must also be taken into account for the evaluation. Examples include a focus on only a few customers (cluster risk), unclear IP relationships, e.g., in the context of the use of open source, a possible investment backlog in the technical platform and infrastructure, the risk of bogus self-employment when using freelancers, and special aspects in the balance sheet, such as pension commitments, provisions, and shareholder loans, or even incomplete company documentation and ongoing legal disputes or unclear ownership relationships.

Thus, the 360-degree view and the identified risk factors are further deepened in the course of the so-called due diligence and form the essential input for the final price negotiation. Although a large number of business, legal and technical issues need to be clarified in a transaction involving an IT company, the human factor is always the deciding factor in the end.

This starts with the initial contact with potential target companies. In view of the large number of inquiries from the market, there is often only a very small window of time to contact the owner and get him interested in the investor's concerns.

A convincing story from the investor that is focused on the target company quickly separates the wheat from the chaff here. And the first personal meeting also often plays a decisive role. If the investor's board of directors meets the IT founder in a hoody, the cultures clash not only visually.

Essential for the successful acquisition of digital companies is the development of a common vision and a convincing integration concept already in the early phase of the M&A transaction.

A convincing integration concept does not necessarily mean integrating the digital company as a department into one's own company as quickly as possible.

There is a risk that the tender seedling of the new agile and digital culture will soon be "flattened" by the existing organization. As a result, the "bought-in" IT experts then leave the buying company again with the effect that a lot of value is destroyed.

Intelligent integration concepts are therefore required. It often makes sense to continue to manage the new company with the existing brand as an independent entity and to gradually set up the cooperation with the own company.

In many cases, it also makes sense for the acquired company to continue offering third-party business on the market. On the one hand, this helps with employee retention because the employees then have further deployment options. At the same time, external innovation impulses can continue to be gained from the market.