Goodbye Excel - hello SAP Analytics Cloud: integrated financial planning made easy

In times of economic uncertainty and increasing market complexity, this is also essential. This makes it all the more important that financial planning is reliable and offers the opportunity to calculate new scenarios. However, this is where Excel spreadsheets, which are still used in many companies, are increasingly reaching their limits. With the help of state-of-the-art software solutions such as the SAP Analytics Cloud, however, financial planning can be automated and integrated across the company.

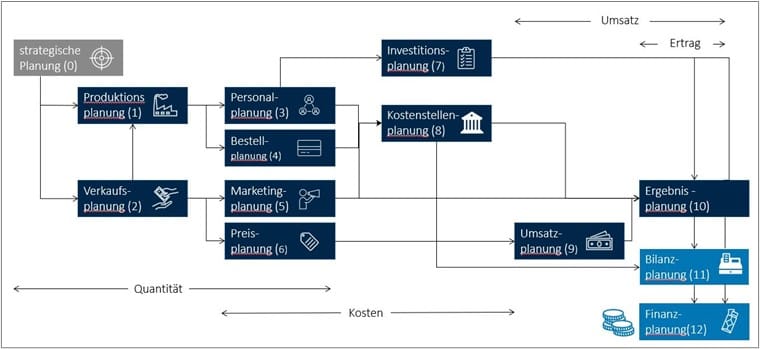

Financial planning includes sales and cost planning, investment planning, liquidity planning and capital requirements planning. The budgeted income statement and budgeted balance sheet can also be included in the sub-plans. Financial planning is therefore an important part of the business plan in order to show where the company is heading financially, where investments and budgets are to be allocated and which strategies are profitable. It is essential to ensure a clean data basis and to generate valid forecasts so that the resulting measures are well-founded.

Financial planning is therefore the central instrument in corporate management and a valuable tool for responding to unforeseen events, such as a pandemic or supply bottlenecks, with appropriate measures or for comparing different scenarios and activities. Excel-based planning quickly reaches its limits here: This is because filling out, forwarding, following up and checking Excel files is an administrative task that unnecessarily blocks resources in the controlling department - at least if it is not yet automated. The use of AI-based forecasts is also difficult to map in Excel.

Excel-based financial planning

The financial planning process often involves the controlling department sending Excel spreadsheets by email to the relevant managers in production, sales, HR, purchasing and other departments and requesting their manual data input. This involves numerous reconciliations and queries as well as long runtimes and revision times. Working in individual spreadsheets for the various sub-plans, linking data cells, forwarding and merging is both time-consuming and error-prone. Not only can technical problems lead to interruptions in data synchronization or fields being overwritten unnoticed.

In addition, every error must first be detected, laboriously reproduced if necessary and finally corrected manually. This often necessitates a new data entry loop, causing frustration for everyone involved. In addition, there is little help when filling in the data fields or calculating possible scenarios, such as investing in an additional production machine or the loss of staff due to retirement or parental leave. All of these challenges not only lead to a waste of resources, but can also result in excessive management response times and, in the worst-case scenario, incorrect business decisions.

Financial planning with the SAP Analytics Cloud

With integrated financial planning, the value flow is consistently mapped. This means that all sub-plans - whether production, personnel, cost center planning, balance sheet or liquidity planning - are represented in a software solution such as SAP Analytics Cloud. This has the advantage that if changes occur in one of the sub-plans, their effects on the other sub-plans are automatically adopted. For example, if a company plans to double its turnover, production must also increase. This may require new employees (personnel planning) or production facilities (investment planning), which in turn has an impact on the company's earnings.

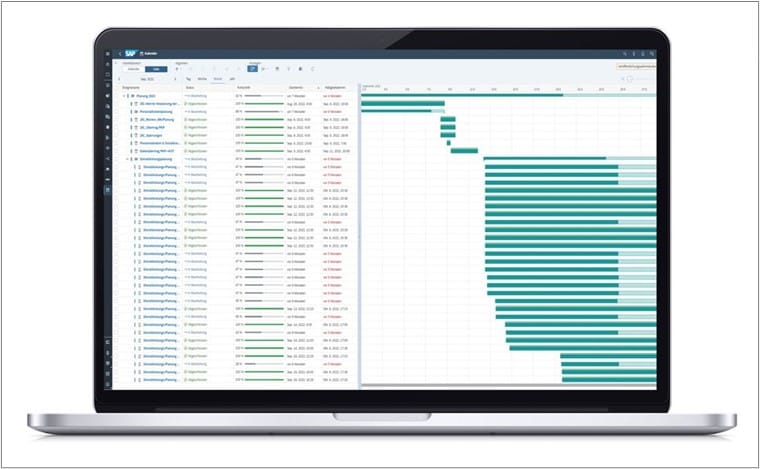

In addition to looking at the business side of integrated financial planning, the importance of coordination and timing can be seen on the process side. In functional terms, this usually means that there are specific input masks for the various data that provide assistance to those responsible. Entered data can be synchronized in real time in the overall overview or mapped in linked sub-plans so that a single correct and complete database is always available everywhere and at all times. The system automatically informs those responsible whether data needs to be entered or checked. Controlling, in turn, has an optimal overview of who has already entered data and who has not. An integrated roles and rights concept also ensures that only those people who are authorized to do so can view, enter and edit data. Furthermore, individual data points can be commented on so that explanations are stored directly in the database and can be called up if required.

Integrated and automated processes

Instead of distributed solutions and data silos, companies benefit from uniform and centralized data storage as well as automated retraction of data into financial planning. The various support functions for the input screens simplify the data entry process considerably. This reduces errors, saves time and nerves - and therefore also cuts costs. The controlling department has more resources for its actual tasks because the agile and effective planning environment automates and accelerates the financial planning process. Thanks to live integration, the data is automatically transferred to all linked sub-plans in real time.

AI-based for better decisions

With integrated financial planning, information is transparently available at all times for further planning, data collection or even for scenario calculations or AI-supported forecasts. Forecasts for the coming months to years can also be created automatically based on the last few years - taking into account seasonal effects, inflation and other aspects. For example, controlling can use a modern software solution such as SAP Analytics Cloud to simulate the impact an increase in inflation would have on the individual sub-plans. This forecast can serve as a "suggestion" and accelerates further planning. If the "suggestion" is accepted, adjustments are made in a targeted and automated manner where necessary or where effects arise. It is not necessary to restart planning from scratch.

Dashboards for maximum overview

In addition to the seamless integration of sub-plans and source systems - whether SAP or third-party systems - system-integrated communication significantly reduces the complexity of financial planning. This extends to reporting by Controlling, which can be highly customized - for example, to present different perspectives - and is also possible on an ad hoc basis. Unlike condensed PowerPoint presentations and coordination meetings with management or the board, clear dashboards allow for a faster, more reliable and more intuitive presentation of data and findings. The above-mentioned annotations of data points are a particular advantage, allowing the explanation for certain results to be called up as required. This makes it easier for the controlling department to prepare reports, as the context does not have to be presented separately. Instead, evaluations and visualizations with tables, graphs or maps can be displayed in a virtual boardroom with a dashboard. This allows decision-makers to see at a glance what is emerging from the data.

Integrated financial planning - stumbling blocks

To move towards integrated and automated financial planning, companies need professional change management. This is because every change has the potential to meet with resistance within the team. Employees who have always worked with Excel may be reluctant to part with it. However, this is essential if integrated financial planning is to develop its added value.

It is therefore important to get the affected departments on board at an early stage. Friendly customers or corporate influencers - i.e. well-meaning team members - can also help to test the solution in a dry run and convince other employees with their feedback and experience. An agile approach is also recommended instead of a fixed concept with a subsequent implementation phase. This is because the financial planning solution would most likely already be a year and a half old when it is launched. It is better to outline and implement the respective sub-topics step by step - from the as-is analysis to the control concept to the go-live. It can also make sense to wait and see, for example because the SAP Analytics Cloud software solution is updated every three months. Before having certain features programmed at considerable expense, it may be worth waiting for the next update, which may already include the solution.

Integrated financial planningg in 7 steps

- Bringing specialist departments, management and controlling together to identify perspectives and requirements.

- Set up a change management process that involves all stakeholders.

- Analyze the current status of existing processes, current requirements and technical possibilities.

- Define the management concept and key figures and outline the planning process to determine what is to be replaced and how.

- Model data bases and input processes so that the financial planning process can run smoothly for all parties involved.

- Perform a dry run and rectify any faults.

- Go-live with training of all affected employees and corresponding hypercare phase by the provider or IT service provider.

Conclusion: Sustainable financial planning

There is no question that financial planning is an important process in a company. However, many companies have still not gone down the path of digitalization and comprehensive automation in order to optimize financial planning in the company. "Never touch a running system" is a widespread credo. Today more than ever, it is important to check how quickly the initial costs of implementing integrated financial planning will pay for themselves. Especially if systems from the same manufacturer - such as the SAP Analytics Cloud - are already in use.

Generally speaking, integrated financial planning pays for itself quickly because it eliminates a lot of manual administration work. On the other hand, it is also essential for companies to generate accurate, rapid forecasts in order to position the company in a resilient manner. An experienced IT expert helps to weigh up the pros and cons and to carefully prepare and reliably implement the step towards integrated financial planning. After all, the more valid the financial plan, the better equipped the company is for the future.

The introduction of integrated financial planning at Bertelsmann

Bertelsmann's Corporate Center was looking for a solution to optimize the financial planning process both technically and procedurally. At the time, the planning process was characterized by historically grown system breaks, which caused manual evaluation processes and an increasing administrative effort in controlling. The aim was therefore to create a simplified, automated and standardized planning process by introducing the SAP Analytics Cloud. This was to include a technically integrative planning environment, offer Controlling more flexibility for ad-hoc analyses and ultimately enable more intensive business partnering with management.

Arvato Systems' solution included the development of specialized planning apps for data entry and a virtual boardroom with dashboards for the board of directors, some with an interactive approval process:

- The SAP Analytics Cloud offered seamless linking of all sub-plans and efficient data collection.

- The automation of workflows relieved the burden on controlling and increased transparency in the company, creating more room for valuable scenario analyses.

- The introduction of integrated financial planning has significantly accelerated the planning processes and roughly halved the planning period.

- A central, user-friendly platform for reporting and planning was created to ensure a uniform database.

The transformation illustrates how modern technology can increase efficiencies in the planning process and enable improved decision-making overall.