SAP All-time High

According to forecasts by analysts at Goldman Sachs, the target price for SAP shares is 240 euros. Starting from a low of 80 euros per share around two years ago, this would represent a tripling within a few months. The assessments of other financial analysts are not quite as euphoric, but also spectacular: JP Morgan sees SAP shares at 220 euros, UBS from Switzerland at 222 euros and the analyst firm Jefferies from New York, USA, even at 225 euros.

The reasons for this share success are manifold, but not unknown: The ERP world market leader's business development is only part of the answer. SAP is quite successful with certain aspects of its product strategy: Clean Core, Business Technology Platform, Rise and Hana. However, these components are complex and are only partially understood and scrutinized by financial analysts. So what moves and concerns existing SAP customers is usually something else. The financial analysts of the big banks live in their own bubble and evaluate according to different criteria than the SAP community.

Product strategy and roadmap

While SAP has been pursuing a mixed product strategy for many years and has provided its own partners and existing customers with plenty of light and shade, communication with the financial community was below average under former SAP CFO Luka Mucic. Most members of the SAP community attest to Luka Mucic's excellent work. He not only understood SAP finance, but also SAP products. He was at home in both worlds and financed both successful acquisitions and sales of investments. His balance sheet was always positive.

Goldman Sachs already sees the share price at EUR 240 (as of August 19, 2024).

However, the very positive work of former SAP CFO Luka Mucic was hardly reflected in the SAP share price, which made Professor Hasso Plattner nervous and dissatisfied. Because Luka Mucic was unable to convince financial analysts of SAP's obvious success and the share price moved sideways rather than upwards for a long time compared to SAP's competitors, Professor Plattner pulled the ripcord and Mucic had to go. His successor was Dominik Asam, who impressed with a flawless career in industry.

In the last SAP days of Luka Mucic in 2023, the SAP share price began to move upwards and Dominik Asam was able to take full advantage of this momentum. At the beginning of this year, he explained at the annual press conference: "2023 was a turning point for us. We kept our word and achieved double-digit growth in operating profit (non-IFRS) despite an unfavorable macroeconomic environment. In 2024, we will continue to focus on ensuring the path we have taken to improve earnings in order to achieve our updated 2025 targets and demonstrate sustainable growth and financial performance."

SAP CEO Christian Klein said at the annual press conference on January 23 this year: "SAP has delivered: We met or exceeded our 2023 outlook on all key metrics and with an outstanding order intake, our Current Cloud Backlog has increased by 27 percent to a record level. We are confident about 2024, as we are starting the next chapter in our success story from this position of strength: With the planned transformation program, we are increasingly shifting investments into strategic growth areas, primarily AI. This will enable us to continue to develop pioneering innovations in the future while improving the efficiency of our business processes."

Is the SAP share price a promise for the future? The current situation in the SAP community is not unknown: Europe thinks and acts differently than the rest of the world. Globally, new SAP customers are enjoying the functions of the S/4 Public Cloud. S/4 can be a boon for those who have no legacy issues and are starting out on a greenfield site. For long-standing existing SAP customers, the news that even more experienced employees are leaving the global ERP market leader than planned and that the public cloud is being optimized even more radically for efficiency and high contribution margins is already a disaster. In the long term, things look bleak for existing SAP customers.

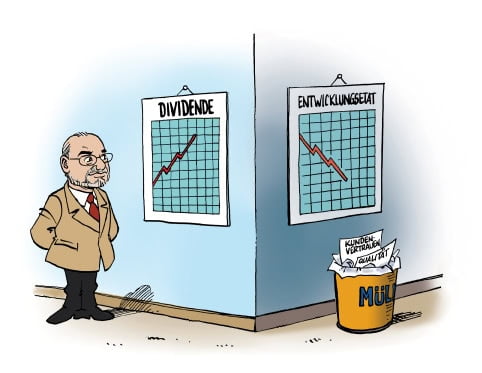

Standardization increases the contribution margin. Individualization costs resources. CEO Christian Klein and CFO Dominik Asam are trimming SAP to become a cash cow. SAP will earn a lot of money through mass redundancies and the public cloud. Because SAP is no longer aligning its entire business model with business management issues, but has instead embraced the technical paradigm of the public cloud, financial analysts and investors see a golden SAP future ahead: SAP's share price rose to an all-time high with the presentation of the financial figures for the second quarter of 2024.

Due to a comprehensive company reorganization, it was planned at the beginning of this year to lay off or retrain around 8,000 employees. SAP's plans have changed, now 10,000 people are to be affected, and the current plans show that the global ERP market leader wants to mutate even faster and more radically into a public cloud company. The business figures from the second quarter of 2024 confirm this trend and prove CEO Christian Klein and his CFO Dominik Asam right.

SAP can only win with a solid public cloud strategy, because a lot of staff with old on-prem and private cloud knowledge can be reduced and at the same time the well-known scaling and efficiency effect takes effect with a public cloud - the hyperscalers have been leading the way for years. However, it is not yet clear whether SAP will remain relevant for existing European customers with its radical public cloud strategy. A survey conducted by the German-speaking SAP user group (DSAG e. V.) at the beginning of this year shows that the relevance of SAP is perceived by DSAG members as remaining the same or falling slightly. Despite new topics such as AI and the cloud, SAP is not succeeding in becoming more attractive to traditional existing customers.

Growth momentum with the cloud

Christian Klein, CEO of SAP, said at the presentation of the second quarter results: "Our growth momentum in the cloud business remained strong in the second quarter and enterprise AI enabled many deals. We continue to execute our transformation with great discipline and are therefore raising our operating profit target for 2025. At the same time, we continue to invest in our goal of becoming the leading provider of enterprise AI. Based on our progress and strong order pipeline, we are confident of achieving accelerated revenue growth by 2027."

The expectations of existing SAP customers differ from the strategy of CEO Christian Klein. A long-standing SAP user expects standard business and organizational solutions from the ERP world market leader. SAP has always been relevant due to its programmed business processes, its holistic view of the organizational and operational structure of existing customers and its solid and efficient end-to-end processes. SAP always earned enough with standard business software. Naturally, Oracle's contribution margins were higher, but the difference was not due to a better strategy, but merely to a different business model. Software products such as Microsoft Office, Adobe Acrobat or Oracle can be sold differently than consulting-intensive ERP software. ERP in the form of the SAP software offering was not only time-consuming and complex for users, but also a challenge for the provider in terms of development and maintenance.

Due to the long-standing and high dependency of existing customers on SAP's goodwill, mistrust and a lack of communication have developed. It seems as if SAP is going its own way to optimize its share price and no longer considers the interests of customers and partners to be the goal. As a monopolistic ERP provider, SAP allows itself more freedom than many hyperscalers, which are in constant competition with each other. With the power of the monopoly, SAP has not always taken an easy path for existing customers over the past ten years. Many partners and customers believe that a correction is overdue, but financial analysts are rejoicing and the share price proves SAP CEO Christian Klein right.

"Our focus remains on meeting our outlook for this year," said SAP CFO Dominik Asam in July of this year. "Current cloud backlog growth in the second half of 2024, and especially in the fourth quarter, will be critical to laying the foundation for our 2025 cloud revenue target. At the same time, we are continuing to work on achieving our free cash flow target for 2025. This is despite restructuring payments in the mid-triple-digit million range, which will have an impact on next year."

With the S/4 Public Cloud, SAP wants to follow the successful path of hyperscalers: achieving maximum profit through maximum standardization. What may be possible in areas such as AI, mail, e-commerce, storage and databases is hardly conceivable for comprehensive ERP software. Nevertheless, SAP wants to become a public cloud company along the lines of the hyperscalers and is therefore cutting back on the functions of its own ERP legacy until it fits into a public cloud.

SAP's existing customers are very sceptical about the development towards a reduced, simplified and standardized public cloud. SAP hopes that this approach will result in high efficiency, a high contribution margin and fewer staff required. At the same time, the IT scene, including SAP, is investing in generative AI, which can compensate for any shortcomings of a public cloud. SAP CEO Christian Klein has stressed it often enough: business and organizational challenges, supply chain disruptions, digitalization and supply chain planning will continue to provide SAP with sufficient revenue for many years to come. Christian Klein is right. The world's best ERP software will be needed even more in challenging times.

SAP versus Hyperscaler

But why is SAP CEO Christian Klein concerned with the cloud? The hyperscalers or specialized and local hosters can probably do it better. Why is he dealing with AI? The hype is coming to an end, the effort and resources required are enormous. Suggestion: Leave cloud and AI to the specialists, ERP to SAP. A correction is overdue. SAP should find its way back to the ERP path. SAP has definitely lost its way. It started with the foray into the database sector. Hana is only a sufficiently satisfying success due to SAP's market dominance - a monopoly. Will cloud and AI suffer a similar fate at SAP?

SAP dominates the ERP market like no other company. Due to the complexity of the topic, SAP is also protected from any antitrust authority or monopoly commission. Naturally, SAP has a monopoly in the ERP market, which made it easy to establish an unfinished database as the new standard. Now SAP is forcing existing customers into the cloud and promising AI functionality. But generative AI could soon make any kind of manually programmed software obsolete. Many years ago, AI pioneer Jürgen Schmidhuber talked about the construction of neural networks for machine learning.

At the time, he believed that ML (machine learning) would soon be so successful that machines would construct their own neural networks. This effect is also conceivable for generative AI. A large-language model could design further and ever better models. One day, generative AI could offer the better ERP in the public cloud, which would thwart any further efforts by SAP. Giving up ERP knowledge in the form of standardization and employee layoffs may become a dead end in the era of generative AI. SAP should not try to become a cloud company, but continue to generate business knowledge. The short-term pursuit of more revenue and profit stands in the way of long-term knowledge and corporate success.

ERP software such as SAP ECC 6.0 is probably at the end of its life cycle. ERP software as the SAP community knows it is a discontinued model. However, S/4 and the Hana database are obviously not the right successors. Many existing SAP customers are switching to S/4 Hana due to a lack of alternatives and innovations. The established SAP competitor or the young start-up is still missing. Existing SAP customers are occasionally switching to special and niche solutions, but the SAP monopoly is safe for at least another five years. The S/4 conversion will be completed in around 2030, at which point the discussion about an S/4 Hana successor will begin, because no one in the SAP community will be interested in the S/4 continuity guarantee until 2040.

However, the next ERP generation must be more open, agile, public domain and transparent. Cloud computing can be a helpful operating model for many ERP areas. Generative AI will design new architecture models for the business structure and process organization from the outside. A public cloud system as a black box, as envisioned by SAP, cannot and will not exist. The public cloud as an ERP monopoly and thus SAP R/3 successor is nonsensical and merely an intermediate step. Sooner or later, every public cloud will become an ERP multi-cloud with different providers.

However, CEO Christian Klein is very satisfied with SAP's path. In April, he confirmed: "We have had a great start to 2024 and are confident of achieving our targets for the year. Going forward, we have strong growth drivers with our enterprise AI, the additional sale of further solutions from our cloud portfolio to existing customers and the acquisition of new customers in the midmarket. The record growth of our strong current cloud backlog is evidence of this continued momentum. In addition, our transformation program is on track and will help us achieve this growth and increase efficiency."

Even almost ten years after the presentation of the on-prem system S/4, market acceptance is still subdued. The S/4 metamorphosis from on-prem to cloud was not a stroke of genius by SAP. S/4 with the Hana database is not a cloud-native system. S/4 works adequately with hyperscalers and at SAP itself as a private and public version. SAP only has two options: to make a radical cut with a cloud-native ERP in the form of S/5 or to make S/4 more and more attractive with free add-ons. There are now many options that an existing SAP customer can have delivered free of charge if they are willing to move to the SAP cloud with S/4. LeanIX, Signavio and Enterprise Architects are just the tip of the iceberg here.

SAP CFO Dominik Asam is not always of the same opinion as the SAP community: "We successfully began implementing our transformation program in the first quarter. Together with the targeted investments in enterprise AI, we will pursue the opportunity to decouple cost development from revenue growth. We are also very pleased with the continued growth momentum of the cloud ERP suite, which reflects the long-term shift in the market towards integrated cloud solutions."

The remaining residual risk is not the numerous acquisitions and takeovers, but the lack of orchestration in the interests of the SAP community. If something new is to emerge from what already exists and the metamorphosis shapes further growth, then the risk for existing SAP customers will be minimized. SAP CEO Christian Klein is planning the opposite. He is taking a high risk with cloud and best-of-breed because he is chasing general and arbitrary IT trends. Existing SAP customers are used to planning for many years. Spontaneous IT shows, short-term roadmaps and short-lived trends are not the focus of SAP managers. In the past, Professor Hasso Plattner was responsible for shock moments and course corrections.

Alternatives and flying blind

SAP is marketing their current plan—where they are flying blind—as a successful path towards a glorious S/4 cloud future. Investors seem to believe this fairy tale is believed on the stock market, which is reflected in the impressive share price, but the SAP community knows better. It cannot go on like this. Customers are looking for alternatives and SAP is losing relevance, see the DSAG (German-speaking SAP User Group) investment survey from this year. SAP CEO Christian Klein is flying blind, supposedly enlightened by AI, which of course will not happen because AI is just another tool like cloud computing. What SAP's customers need are solutions—digital transformation processes—and not more IT tools. Even free add-ons are just a consolation and not a solution: if Signavio and LeanIX make their way to SAP customers free of charge, the discussion about the relevance of the products will begin again.

Even SAP will not be able to please everyone with everything. An IT general store like SAP will never be the answer to digital transformation. The SAP community needs direction, competence, and clear strategies from the world leader in ERP. Simultaneous real-time dancing (see SAP Hana) at every wedding is not an answer for SAP's customers.