Evolution in SAP license management

SAP License Intelligence

In the vendor market, the fear of license risks is often advertised, while at the same time the high solution potential of license management tools is warmly touted to customers. This sounds too good to be true. However, the vendors or tools today do not explain to SAP customers how they can realistically assess and factually eliminate the identified risks. Furthermore, it remains unclear to companies how they can leverage the potential.

A solution to this problem would now be to go directly to the trusted licensing consultant who implements the potentials that the tool promised before.

The better way is an intelligent license analysis that provides the company with additional and necessary information on the current challenges in license management. Many SAP customers today are asking themselves which dependencies need to be taken into account in license management. What happens, for example, when they throw Cloud Subscription into the balance of their negotiation? What is the SAP sales or SAP partner's negotiating leverage? What are the minimum goals the company should achieve? At what point is a negotiation result good compared to other SAP customers and how secure is the company for the future?

SAP License Intelligence from Sandmeier Consulting provides all the necessary answers to these important questions. SAP License Intelligence not only delivers a tool for license management and provides the necessary content, but also incorporates the expertise of 15 years of license consulting. Here, negotiations are simulated for SAP customers, their own conditions are compared with the usual market benchmarks, and SAP audits are simulated and prepared.

We use three current challenges to illustrate the potential:

SAP Cloud

The most common questions our customers ask are: "What is a reasonable price for a cloud product? Does SAP's offering represent a good and market price or am I paying too much with this?" SAP knows full well that some of its pricing positions are not competitive, and it calculates the desired customer discounts up front. While OnPrem benchmarks could be easily derived over years for SAP customers, SAP cloud pricing is highly volatile and discounts adjust to current market conditions. For this reason, it is particularly important for companies to evaluate their own conditions and, in particular, the available offers.

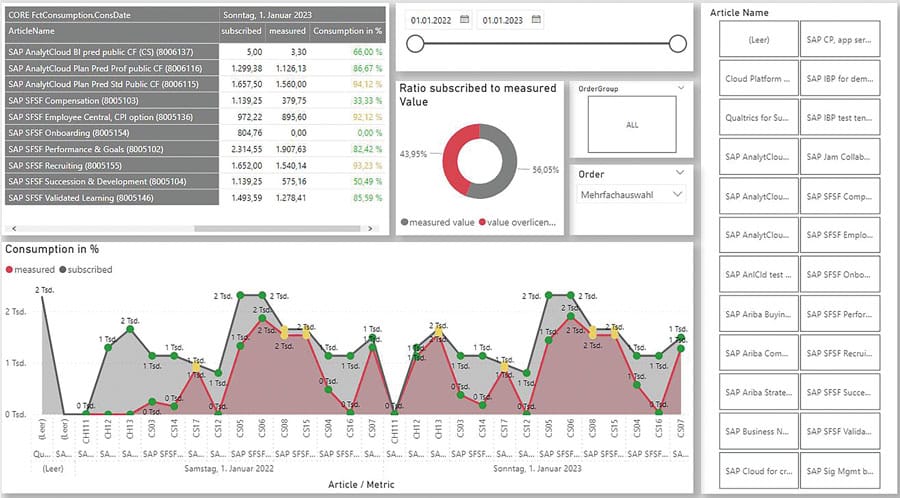

Once a cloud contract has been signed by the customer, the task now is to keep an eye on the consumption of the cloud solutions and to identify and exploit the opportunities offered by the contract, such as swap rights. SAP is of little help here in creating the necessary transparency, let alone identifying possible solutions. SAP License Intelligence provides clarity and gives customers an overview by mirroring license consumption against licensed volume and forecasting future over- and under-licensing. The swap potential can then be easily derived from this for each company.

Contract versus Product Conversion or RISE with SAP?

One of the biggest challenges for many SAP customers is still the negotiation of a contract or product conversion and the objectification of which scenario is the best for the company's licensing strategy in the future. Contract conversion, product conversion or RISE with SAP? The topic is complex, the negotiation difficult, and the scope of the decision extends beyond the next decades. Every customer who has ever discussed this topic with SAP knows SAP's preference on the cloud topic and knows that good prices are often only possible with the addition of a cloud contract. But the relationship between cloud volume level, discounting for conversion and add-on products in line with contract history is overly complicated. SAP License Intelligence reduces the complexity for companies to a minimum. Here, SAP customers have the opportunity to simulate different scenarios and objectively compare the results in monetary and qualitative terms. With this comparison, SAP customers can optimally derive the most sensible negotiation strategy with SAP.

Audit-proof measurement according to SAP authorizations

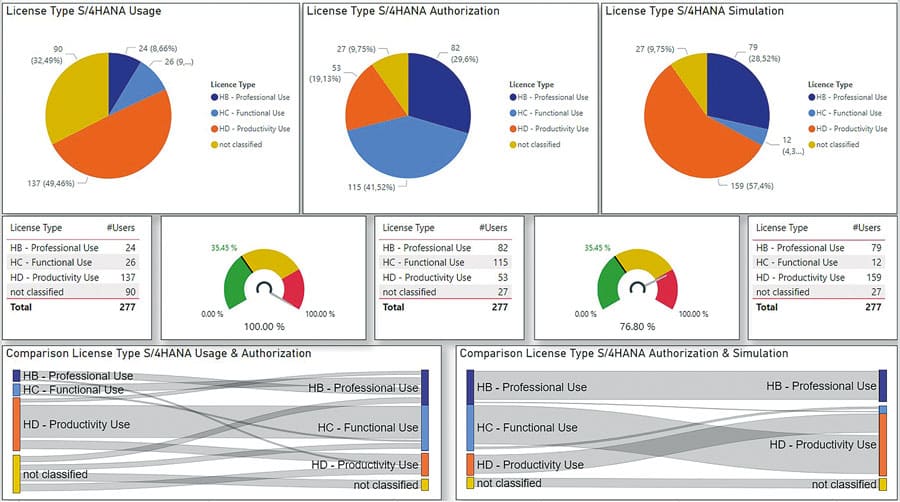

With the STAR Service, SAP has for the first time published a set of rules with which SAP can check the plausibility of license assignment according to authorizations as part of an audit. At the very least, SAP uses this set of rules to document a position on the allocation of license types based on authorization objects and activities. According to SAP's statement at the DSAG Congress 2022, this set of rules does not serve as a measurement tool, but exclusively as a tool in the context of SAP remote audits if a customer doubts the current license distribution. "Audit-proof" for customers in this case means being well prepared for such a remote audit and being able to justify deviations from the SAP rule set with certainty. For the use of some "engines", for example, it requires the assignment of standard ERP authorizations that do not result in "engine use" according to the SAP rules and regulations, but often also require "functional use". However, this approach contradicts the current SAP price list, so customers should resist this unnecessary double licensing. In this case, "fighting back" means being able to argue a deviating license assignment without any problems.

Prior to an SAP analysis as part of STAR Services, SAP customers should always obtain the necessary transparency and take advantage of the opportunity to optimize the role concept in a way that is compatible with licenses. SAP License Intelligence offers the option of simulating an SAP audit by authorization and comparing the difference in license management between actual usage and assigned authorizations. The most promising and feasible role changes are identified and their impact on the license value is simulated.

In all three examples, SAP License Intelligence helps SAP customers identify current problems and potential. In all three cases, companies are shown a realistic, economically viable solution and how to get there.