In order to be prepared for opportunities as well as risks, many companies are already taking precautions and adapting their budget for 2019 to the ever-advancing digitalization.

In the coming year, around 44 percent of companies in Germany, Austria and Switzerland are expected to increase their IT spending, with around one in seven (13.9 percent) even increasing it by more than ten percent. Only 2.5 percent will cut back in 2019, which is significantly less than in the previous year.

This means that the positive trend in IT spending of the past two years is continuing; this is shown by preliminary results of the annual IT Trends Study conducted by Capgemini in September and October.

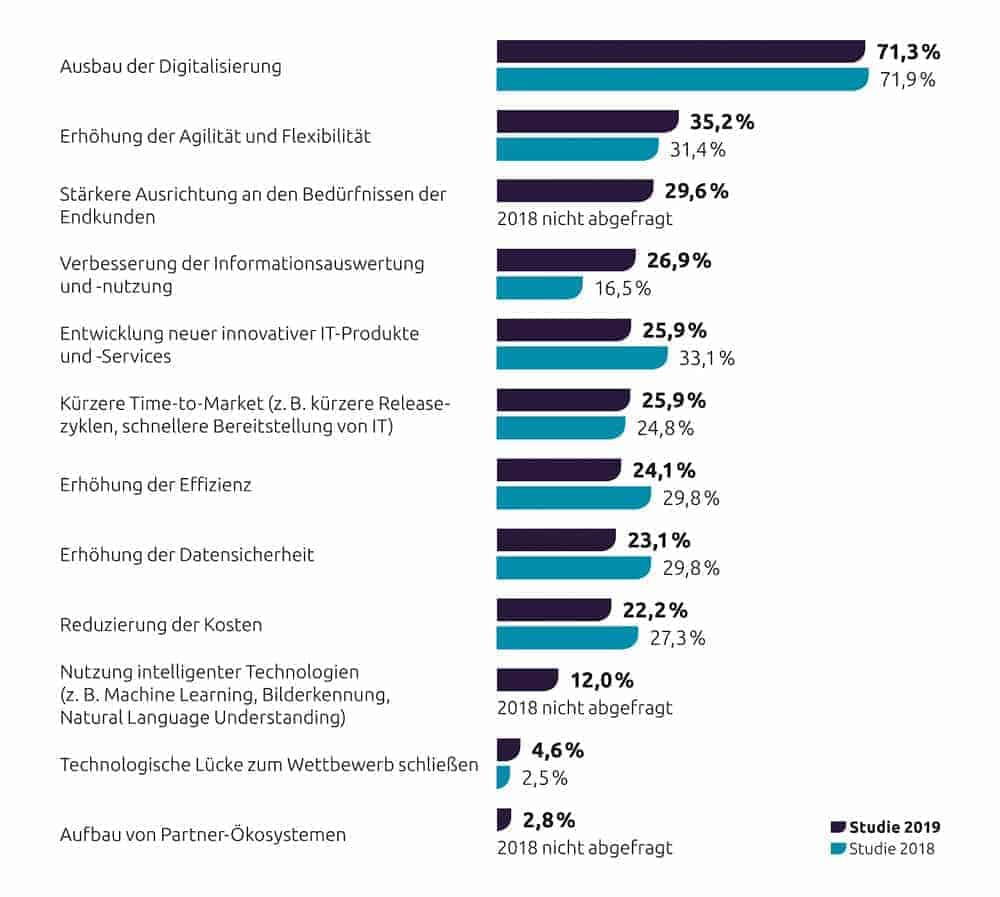

For more than 70 percent of companies, digitization is one of the three most important IT goals of the year. On average, a quarter of the IT budget goes toward its expansion. Groups with annual sales of one billion euros or more invest as much as 30 percent.

In addition, more than a third want to increase agility and flexibility. Almost 30 percent of companies are focusing on the needs of end customers, and around a quarter want to provide IT more quickly and shorten release cycles.

The evaluation and use of information should also improve in many organizations. Apparently, deficits in this area are increasingly coming to light and the pressure to act is growing.

"Data analysis is crucial for the success of digitization - and the basis for the use of intelligent technologies. Here, only mediocre data availability is currently one of the four biggest hurdles."

comments Uwe Dumslaff, Executive Vice President and Chief Technology Officer at Capgemini in Germany.

Particularly in the "Digital Customer Journey" market segment, meaningful information evaluation is of crucial importance for the digital transformation of a company.

"The key to successful transformation lies in understanding what is known as the customer journey."

says Heiko Henkes, Director Advisor at ISG Information Services Group.

"This is about understanding the customer relationship lifecycle so that companies can make personalized offers at the optimal time to differentiate themselves from the competition."

In this context, specialist departments in particular are pushing these developments and the use of new technologies in general.

Blockchain as a disruptor

But the blockchain market segment should also be a key focus, as this area has particularly strong inherent disruptive forces.

"Blockchain provides users with a sophisticated method to control and automate digital transactions of any kind"

explains Heiko Henkes.

"This is interesting for all application scenarios that require the establishment of decentralized accounting."

One example is the Internet of Things, where billions of IoT-enabled devices have the potential to communicate with each other. From a B2B perspective, many of these decentralized entities can be integrated into the value chain to execute transactions for a higher-level business purpose.

To do this, the devices must authenticate themselves securely and sufficiently document the course of their transactions. Blockchain is more suitable for these tasks than any other technology. Currently, blockchain service providers primarily use SaaS offerings from various public clouds as well as from the Linux Foundation, Hyperledger and R3 Corda.