Communication remains expandable

According to research and advisory firm Gartner, global IT spending will increase to $4.5 trillion in 2022, up 5.1 percent from 2021. The economic recovery, including high expectations for a burgeoning digital market, will continue to boost technology investments - despite potential disruptions from the omicron variant. Results of Capgemini's IT Trends Study, in which 195 IT and business managers from large companies and public authorities in the DACH region took part in September and October 2021, also confirm this view: almost three quarters of companies and public authorities will increase IT spending in the coming year. The forecasts for 2023 are similarly positive.

in new developments, but rather in the modernization of existing system landscapes.

Source: Capgemini.

The results of the Investment Report 2022 published by the German-speaking SAP User Group e. V. (DSAG) speak a similar language: The days of restraint are over when it comes to the propensity to invest in IT. At 59 percent of the companies surveyed in Germany, Austria and Switzerland (DACH), the overall IT budget is increasing, compared with just 39 percent a year ago. At 29 percent, it will remain the same (2021: 37 percent) and at five percent it will fall (2021: 18 percent). In terms of investments in SAP, the budget is increasing at 57 percent of the companies surveyed (2021: 43 percent), remaining unchanged at 32 percent (2021: 35 percent) and decreasing at seven percent (2021: 18 percent).

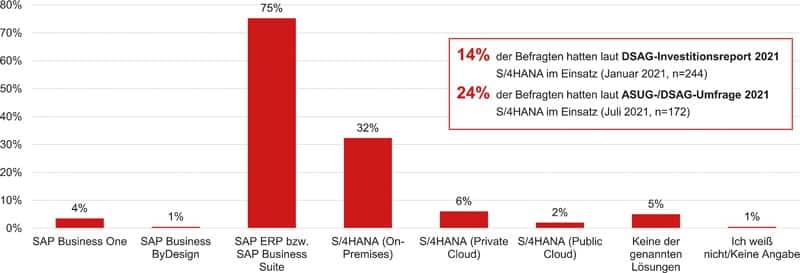

Asked which SAP ERP solutions the companies currently use, SAP Business Suite comes in at 75 percent, followed by 32 percent with S/4 Hana on-premises. In comparison, S/4 Cloud plays a rather subordinate role. Only six percent of respondents use S/4 as a private cloud solution and two percent as a public cloud solution. By comparison, in the DSAG Investment Report 2021, 14 percent of respondents said they were already using S/4. In a joint survey conducted by DSAG and the American SAP User Group (ASUG) in mid-2021, as many as 24 percent stated this. So here is an increase to be recorded. "2022 is the year the future returns for CIOs", says John-David Lovelock, Distinguished Research Vice President at Gartner. "They can now put the crisis-driven, short-term projects of the last two years behind them and focus on the long term."

Parallel operation the norm

It is interesting to note that just under half of the companies using S/4 on-premises also stated that they were using SAP Business Suite. This could indicate that, due to the complexity of the changeover, some companies will continue to operate their previous system in parallel for a while before completing the full transformation. When asked about the relevance of Business Suite for SAP investments in 2022, six percent of companies plan high investments (2021: three percent) and 18 percent plan medium investments (2021: 22 percent). For S/4, high investments are relevant for 26 percent (2021: 25 percent) and medium investments for 24 percent (2021: 31 percent). "The reluctance to move towards S/4 Hana is somewhat surprising. I would have expected transformation activities towards S/4 Hana to increase for this year. Rise with SAP is obviously not yet able to provide the necessary push here"Jens Hungershausen, DSAG Chairman of the Board, summarizes.

Making solutions cloud-enabled

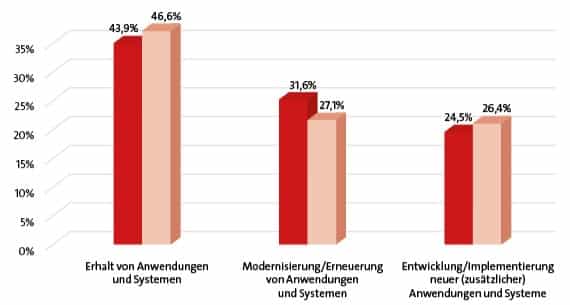

The aforementioned Capgemini study also confirms this picture: the additional investments will not flow primarily into new developments, but into modernizing existing system landscapes. Whereas in 2021 just under 47 percent of the IT budget was spent on maintaining the existing system landscape, this figure will fall to just under 44 percent in the coming year. This means that 20 percent more budget will still flow into existing system landscapes than into new developments: The budget here will fall from around 26 percent in the previous year to 24 percent. Companies and public authorities are planning to spend more money on modernization: The share of these investments in the total IT budget is rising from around 27 percent last year to just under 32 percent now.

"We assume that in many cases the modernizations will be projects in which applications are made cloud-enabled. Because in view of the high security and environmental standards, the wide range of services and the price-performance ratio, it is now worth modernizing older core applications and bringing them into the cloud."explains Thomas Heimann, Enterprise Architect Director at Capgemini and co-author of the IT Trends study.

A look at SAP cloud solutions and their relevance for investments in 2022 shows SuccessFactors clearly in the lead with high investments and medium investments of 21 percent (2021: 15 percent), followed by SAP Customer Experience (CX) and Ariba tied at nine percent each (2021: eight percent each). Concur and SAP Integrated Business Planning each account for six percent. Industry Cloud and Qualtrics have hardly any relevance for the 2022 respondents. "Somewhat surprisingly, given the importance of the Industry Cloud in SAP's strategy, according to our survey there are no plans to invest in this solution.

This is primarily a communication problem," explains Thomas Henzler, DSAG Board Member for Licenses, Service, and Support. "A lot has changed with Rise with SAP and S/4 Hana, and the big question now is: How transparent is the SAP portfolio to the customer?" In terms of the Business Technology Platform, high and medium investments are planned for analytics solutions by 20 percent of respondents, closely followed by database and data management solutions with 19 percent. Integration and enhancement/application development with eleven percent and intelligent technologies with four percent are in the other places.

Understanding of Rise expandable

Another important topic in the DSAG survey was Rise with SAP, the Business Transformation as a Service offering based on S/4 Cloud. Eleven percent say they have never heard of Rise (DSAG-ASUG survey 2021: ten percent). 60 percent have already heard of it (DSAG-ASUG survey 2021: 56 percent), but are not familiar with it. Twenty-one percent say they are somewhat familiar with Rise (DSAG-ASUG survey 2021: 27 percent). The results show that there has not yet been too much movement on this topic since last year.

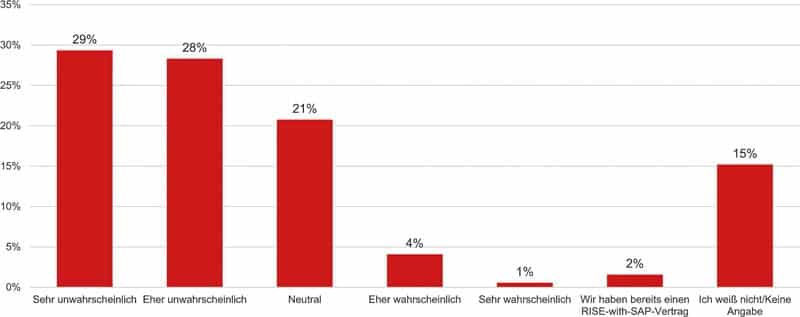

Consequences for SAP

Skepticism among DSAG members remains high. The values are correspondingly clear when asked about the use of Rise with SAP: 57 percent of the participants consider it very unlikely and rather unlikely to consider Rise. 21 percent are neutral on this point. "Besides the basic challenge - the pressure to move to S/4 Hana - with the surprise launch of Rise last year, we also have the problem that it is continuously being developed. So of course it's hard to constantly stay on the ball and expand your knowledge. The need for information is definitely there."says Thomas Henzler.

This could have far-reaching consequences for SAP. IT innovations are now almost as often financed by the business side as by the IT side. On the one hand, this shows that the core business of many companies is now based on IT. On the other hand, business decision-makers consider IT to be a competitive factor and initiate significantly more digital projects than in the past. For software manufacturers such as SAP, this means that business users must also understand the added value of the products in order to make sustainable investments.

Not only users optimistic

The general willingness of users to invest goes hand in hand with the increasing optimism of B2B service providers. Particularly topics such as digital transformation, a possible cloud switch or the upcoming migration to S/4 Hana require competent advice and expertise. Accordingly, the expected revenue gains for professional services providers are positive: The fact that management consultancies in particular are expecting significant double-digit revenue growth is one of the findings from the current Lünendonk flash survey of managers in various business-to-business segments. However, the consultants had a lot of catching up to do after 2020.

Strategy, organization and process consultants anticipate an average increase in sales of 12.4 percent. They are followed by IT service and consulting firms with an average sales growth forecast of 11.4 percent. Only the auditors and tax consultants surveyed are more cautious: they expect sales to increase by 4.6 percent in the current fiscal year.

"The signs are clearly pointing to growth"says Lünendonk Managing Director Jörg Hossenfelder. "Although the specific values for individual segments vary widely, 96 percent of respondents forecast a positive fiscal 2022 - despite the ongoing pandemic."

Treading water

The restraint of the past two years is giving way to an optimistic view of the future, which is expressed in an increasing willingness to invest, both in IT in general and in SAP in particular. The Business Suite is still well ahead of S/4 in terms of the solutions currently in use, although the latter is developing in a cautiously positive manner. In terms of willingness to invest, S/4 is now ahead of the Business Suite for around twice as many companies. Rise with SAP is more at a standstill in terms of acceptance among DSAG members.