![[shutterstock:476642494, Zapp2Photo]](https://e3mag.com/wp-content/uploads/2016/12/shutterstock_476642494.jpg)

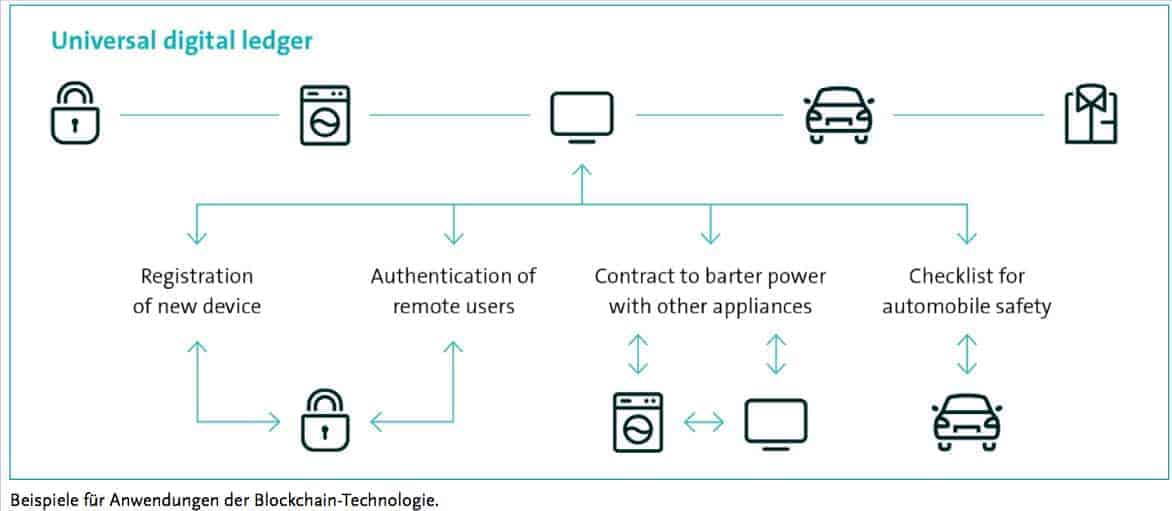

A digital Currency such as Bitcoins, which are independent of central and Commercial banks works. A detailed overview of the Supply chain of a product that is used in the Consumer arrives. One way to make contracts secure without a Notary to be deposited.

This is made possible by the blockchain, which has long since been discussed not only in the IT scene or in start-ups, but in all industries.

What are the current application possibilities and what legal questions are raised by the new Technology up?

There is still a great deal of confusion about this in some cases. The digital association Bitkom has therefore published a guide entitled "Blockchain #Banking" published.

Marco Liesenjohann, Banking, Financial Services & FinTechs Officer at Bitkom:

"The financial industry is a good example of the radical conceptual shift that blockchain-Technology is being heralded: Transactions will become possible directly between two parties - dispensing with many of the intermediary services that are still necessary today and based on a technological trust mechanism."

The approximately 60-page guide begins by providing a definition of blockchain-Technology and distinguishes it from other terms often used synonymously with it, such as Bitcoin or distributed ledger.

It also looks at the wide range of stakeholders in the financial industry who are interested in blockchain-Technologies have them, demand them, develop them, or are responsible for regulating them.

It also looks at the wide range of stakeholders in the financial industry who are interested in blockchain-Technologies have them, demand them, develop them, or are responsible for regulating them.

The individual chapters then go into detail on the topics of BitcoinRipple as an alternative approach and smart contracts using the Ethereum blockchain as an example.

Subsequently, concrete application scenarios for companies will be developed.

Another chapter is devoted to the broad range of legal issues raised by this group of disruptive Technologies are raised.

For example, it discusses how the Trade with virtual currencies from the perspective of banking supervisory law, which legal requirements providers of crowdlending or crowdfunding must fulfill, or what impact money laundering law has on blockchain solutions.

Finally, three Scenarios developed how a Financial Supervision at Euro area With widespread use of blockchain-Technologies could set up.