Unlocking the full automation potential of S/4HANA

Unlock the full automation potential of S/4HANACompany mergers and acquisitions, rapid expansion during periods of strong growth and local system purchases often lead to a heterogeneous ERP landscape that is difficult for most finance departments to manage. Often, financial data cannot be integrated satisfactorily due to the different ERP versions and instances.

There are also companies that have multiple instances of an ERP system. The challenge here is that these instances are often configured differently, leading to inefficiencies, lack of transparency, poor controls and increased costs. In addition, the underlying systems change as the company grows and evolves.

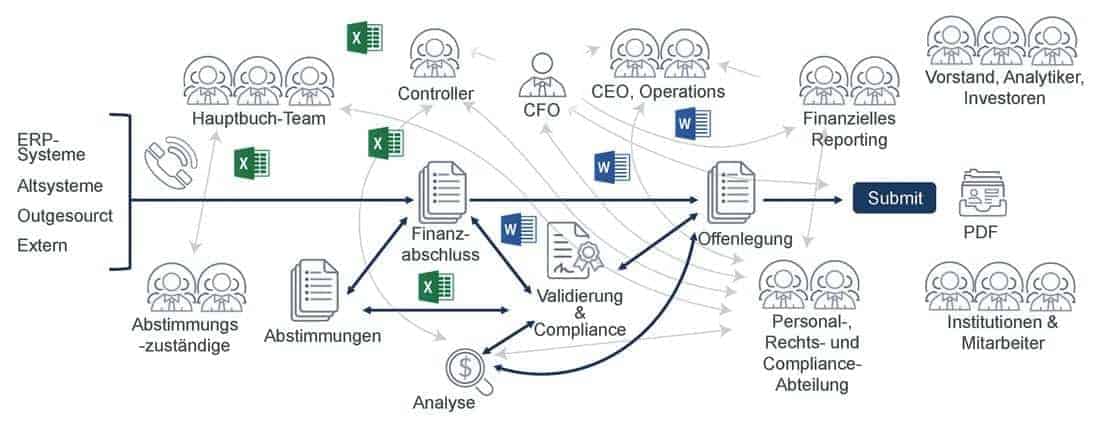

In both types of ERP landscapes, data is often pulled from the ERP systems and processed manually. This makes internal audits very chaotic and can be a nightmare for organizations subject to Sarbanes Oxley.

Inefficient coordination processes cause high costs

If closing activities are carried out outside of the ERP system, this is often done manually. This results in lengthy, disjointed and inefficient closing processes. The figures and documentation are often inaccurate and the values have to be corrected. In addition to the time required, this also incurs additional costs such as re-audit fees for external auditors, subsequent income statements and official fines.

Reliable financial statements and S/4HANA migration

However, there are also companies that only use a single instance of an ERP system or are aiming to do so. Several companies have started or will soon start the transition to a consolidated SAP® S/4HANA instance for their company. However, even with a single ERP instance, most of the processes that are important for the financial close run outside of the ERP system. Even a migration to S/4HANA does not solve this problem. "S/4HANA is often seen as a panacea for all challenges in the finance department. In many companies, finance managers are not aware that not all finance processes will be automated with the switch to S/4HANA," says Lars Owe Nyland, Managing Director Europe at Trintech. "A significant amount of work is still done manually. The use of spreadsheets, emails, printouts, disparate documents and other tools is associated with a high risk of error and loss of control over the process."

In addition, the complex S/4HANA transformation is a major challenge for the finance department, as reliable financial statements must also be prepared during this transition phase. Paradoxically, many companies postpone strengthening their financial controls and compliance framework during this phase, even though standardized and automated financial processes would reduce costs, time and effort for the migration.

More than the sum of its parts

The solution to these challenges lies in the automation and standardization of financial processes. John Van Decker, Vice President of Gartner Research, saw significant savings potential in this back in 2007. "When we look at the automation and standardization of key financial processes such as account reconciliation, compliance and the financial close, the whole is greater than the sum of its parts. All of these processes are interdependent and, when combined, lead to return-on-investment savings." His statement still holds true today.

A financial control solution for the record-to-report process with automation technology such as Risk Intelligent RPATM creates clarity and transparency. Not only does it provide a clearer overview of all tasks, it also shows details of individual activities. For example, it is possible to see how satisfactorily a task has been completed and improvements can be made directly in the system. Automation ensures that the entire process is reliably monitored, so that everyone involved is informed about their tasks and the tasks of others at all times.

Particularly for groups with subsidiaries, global operations and multiple legal entities, automation enables compliance initiatives and resources to be directed to the most appropriate control mechanisms. Content and scope management, scheduling, test & evaluation workflow, management user interfaces, audit trails and flexible ad-hoc reporting ensure that the relevant performance and compliance management controls are correctly identified, planned and executed.

Work better, faster and cheaper

According to well-known management wisdom, only two of the three criteria of speed, quality and cost can ever be met. The great advantage of automation technology for the financial close process is that all three criteria are met simultaneously. Market-leading companies manage their daily reconciliations with improved quality, a 95% reduction in errors, increased speed (99% of items are automatically reconciled before the start of the day) and reduced costs, according to the Hacket Group's 2017 Account-to-Report Performance Study.

The example of the pharmaceutical company Sanofi shows that implementing the Cadency by Trintech record-to-report (R2R) solution in advance of or at the same time as an S/4HANA migration can significantly reduce time and costs. Sanofi is implementing Cadency in 95 different countries in parallel with the migration to S/4HANA. This will increase the productivity of 2,300 users, improve compliance for more than 2,500 accounts and eliminate manual processes. As a result, not only end users but also senior management have a clear insight into all activities of the financial close process.