Transparency and reliability not yet achieved!

![[shutterstock.com: 596722127, HQuality]](https://e3mag.com/wp-content/uploads/2020/10/shutterstock_596722127.jpg)

But what is the level of acceptance of the SAP Digital Access licensing model and does the Digital Access Adoption Program (DAAP) provide sufficient incentive for a changeover? The majority of participants in the survey, which was conducted between June and August 2020, come from German-speaking countries (86 percent) and from the manufacturing, trade and services sectors (93 percent).

Most participants indicated that they have been SAP customers for more than ten years (86 percent). Participants represent a cross-section of different sizes, with: under 1,000 SAP users (42 percent); between 1,000 and 5,000 SAP users (33 percent); and over 5,000 SAP users (25 percent), including 12 percent with over 25,000 users.

Knowledge level increased

The majority of all respondents (86 percent) stated that they had already dealt with the issue of indirect use and were also familiar with the SAP Digital Access licensing model (82 percent). There was also an increase compared with the surveys conducted in 2015 and 2018 in the number of companies that believe that the use of SAP software in their company constitutes indirect use as defined by SAP. The table shows the responses over time.

Reasons for the increasing awareness of whether indirect use exists or not could be, on the one hand, the extensive public relations work of SAP and DSAG as well as the many publications and lectures on the subject area, in which the countless use cases and often unclear formulations in the contract and terms of use (PKL) are presented and discussed.

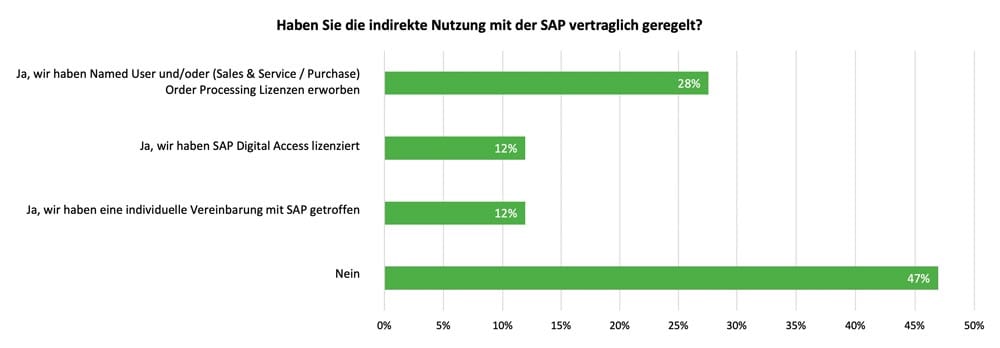

No regulation for indirect use

Despite the now widespread awareness of SAP's licensing requirements, around half of the existing SAP customers surveyed have not yet reached an agreement with SAP regarding indirect use. In existing agreements, however, the old form of licensing (named-user and order-processing licenses) or individual arrangements predominate. Few of the respondents (12 percent) have agreed on licensing based on SAP Digital Access.

Consequently, it can be stated that there is still a great deal of untapped revenue potential for SAP in the licensing of indirect use. It is therefore to be expected that both sales and auditing will be stepped up.

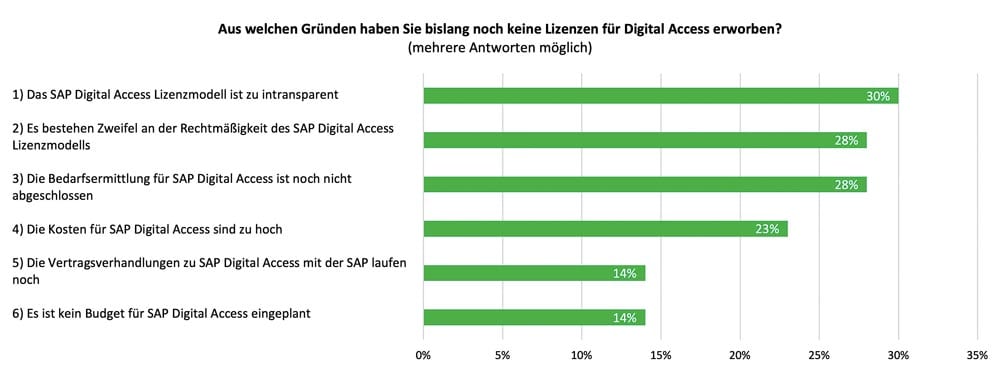

Lack of transparency and doubts about legality

The main reasons cited for the low acceptance of the digital access pricing model on the customer side are the lack of transparency in connection with the measurement and evaluation of document types and numbers and the legal uncertainty. Other mentions relate to the excessively high costs and lack of budget planning for precisely these. Likewise, the determination of requirements has not yet been completed in many places.

Consequently, it can be stated: While SAP managers' knowledge of whether or not indirect usage exists in their company has increased, they still find it difficult to determine the number of documents for Digital Access. There is still a lack of transparency as to what is counted and how exactly.

The results also show that, in addition to the demand for more transparency, the respondents miss a legal clarification of the issue. The question of whether SAP is even entitled to charge additional licenses for indirect use has still not been clarified today - five years after the first survey.

Incidentally, only 50 percent of respondents said they were even aware of the antitrust complaint filed by Voice's Federal Association of IT Users against the licensing of indirect use. Voice accuses the software group that SAP's licensing terms are illegal and that the monopolist is abusing its strong position in the market for ERP software vis-à-vis its customers to their detriment.

In addition, SAP's licensing demands are damaging the market for manufacturers of third-party applications. SAP's statement, which has since been received by the Cartel Office, is currently being examined. It is still unclear when a result can be expected.

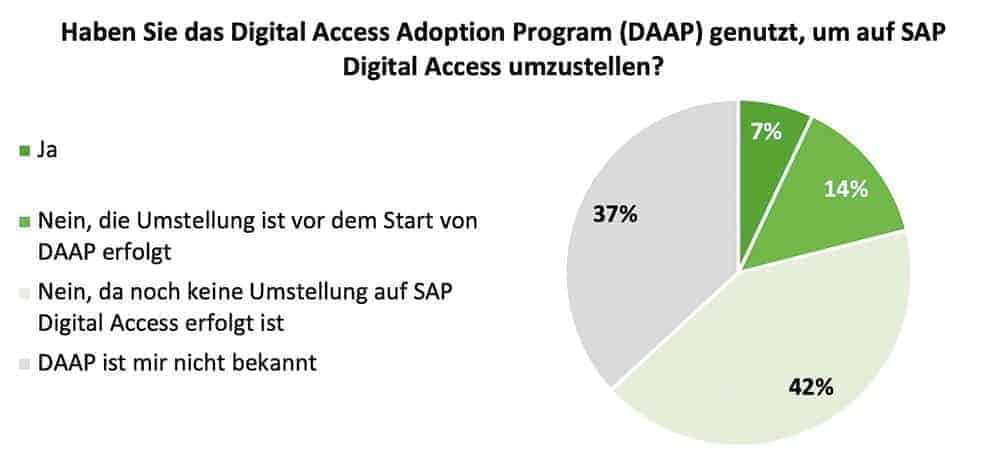

DAAP does not grip properly

The Digital Access Adoption Program was set up specifically to increase uptake among SAP customers. While most (63 percent) of respondents are aware of the DAAP, it does not appear to be an incentive to buy, with 67 percent stating that they are not sure whether the offering is commercially attractive.

After all, 57 percent of the participants who have already licensed Digital Access used the DAAP when acquiring the new licenses. It can therefore be seen that the current reservations regarding transparency and the uncertainty of users as to whether SAP's approach is even legal are weighted higher than pure cost considerations. The DAAP is not having a broad impact because it does not comprehensively address the core criticisms of SAP customers. The extension of the program until the end of 2021 is unlikely to change this.

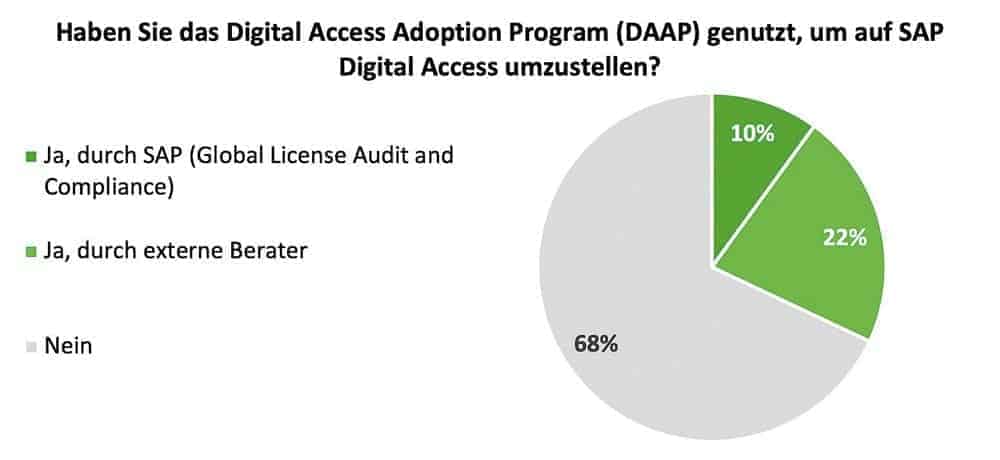

Nevertheless, SAP customers are getting to grips with the new Digital Access licensing model. Of all respondents, one-third said they have already conducted an evaluation of SAP Digital Access. Another third plan to evaluate, while another third also have no intentions of taking a closer look at Digital Access.

The vast majority of SAP's existing customers plan to carry out the Digital Access assessment without SAP's involvement and without external consultants. This suggests that it is still a sensitive topic that companies prefer to investigate internally and with their own expertise first.

Companies for which evaluation is not yet on the agenda presumably do not yet feel any pressure to act from outside or deliberately prefer a certain lack of transparency with regard to indirect use in order not to be forced to act. This approach becomes critical when a short-term licensing decision has to be made and the necessary database is lacking.

License acquisition despite missing data basis

Basically, only the SAP Passport Tool, which is also used in the context of system measurement, can provide such a data basis. In addition to the high implementation effort, there are doubts in the community as to whether the tool is even fully developed, whether the results of the tool are reliable, or whether other documents may have to be counted in the future than is currently the case.

When asked about the use of external license management tools (such as Aspera LicenseControl for SAP Software, Flexera FlexNet Manager for SAP Software, Snow Optimizer for SAP Software, or Voquz samQ), more than half of the respondents (53 percent) said they did not intend to use any of the solutions mentioned for estimation. Incidentally, this is a trend that has continued since 2015.

In all these cases, the only options are to rely on your gut feeling or to negotiate with SAP. Both options are risky because experience shows that they are labor-intensive, inaccurate, and thus often costly, at least in retrospect.

Of the respondents who stated that they had already acquired licenses for SAP Digital Access, 71 percent had done so as part of the existing ECC contract and 29 percent as part of the SAP S/4 migration via Product Conversion. However, there is not yet sufficient experience with measurement (audit). It is therefore not possible to draw any conclusions about how large the deviations between the number of document licenses acquired and the number required are in practice.

Target not (yet) reached

SAP's efforts to establish the new SAP Digital Access pricing model for indirect use licensing have not yet been successfully implemented. The call from SAP customers to make licensing more transparent is still loud, and doubts remain about the fundamental legitimacy of SAP's demand for additional charges for indirect use.

At the same time, those responsible for licensing are endeavoring to gain more certainty in the course of determining requirements and negotiating with SAP. The only thing that is certain at present, however, is that there can be no talk (yet) of "transparent and reliable access" with Digital Access, and so for the time being it will remain a "lifelong, but severely limited, trusting relationship".