![[shutterstock-699701578-Bakhtiar-Zein]](https://e3mag.com/wp-content/uploads/2022/03/shutterstock-699701578-Bakhtiar-Zein.jpg)

In a NetApp survey, three-quarters of customers surveyed plan to run enterprise infrastructure in hybrid cloud environments for the foreseeable future. Reasons for this include growing business demands for innovation and optimizing operations while reducing costs. The survey results also show that companies around the world want to recognize and take advantage of the benefits of a hybrid cloud environment. Twenty-six percent of respondents cited faster innovation as a reason for migration. A quarter are also convinced by increased responsiveness to customers and 22 percent want to benefit from improved collaboration.

Among the operational factors in favor of hybrid cloud is the improvement in flexibility and scalability (27 percent). Hybrid cloud concepts allow IT teams to access on-demand and innovative technologies offered by the public cloud, while continuing to use existing systems that run reliably on-premises. Cost optimization plays a role for 21 percent, and increased data availability for 13 percent. The most popular use case is data protection (including disaster recovery, back-up and archiving). Whereby 20 percent of respondents want to use the hybrid cloud more than thought for production applications.

"Speed is the new measure. IT leaders worldwide are driving digital transformation. To stay ahead of the competition and achieve immediate business results, they need agility and flexibility", says Ronen Schwartz, general manager and senior vice president of Cloud Volumes at Net-App. "Enterprises are turning to hybrid cloud models to effectively scale IT resources and support mission-critical applications and workloads."

Confirmation in practice

An indication that companies are increasingly focusing on hybrid and multi-cloud can be seen, for example, in the quarterly figures of Suse, a company specializing in open source and cloud. Q4 2021 exceeded expectations and the revised guidance released with Q3 results. Adjusted revenue was $154 million in the fourth quarter and $575.9 million for the full year, representing a 15 percent increase for the quarter and full year. According to Suse itself, this growth stems primarily from the increasing use of hybrid and multi-cloud architectures.

Companies are also increasingly using cloudnative technologies such as Kubernetes and container management technologies to simplify the deployment and control of applications in hybrid and multi-cloud infrastructures. Another point Suse cites is the growth in edge computing. This takes place outside the cloud and on-premises data centers and includes a wide range of applications used in cars, healthcare devices, factories, retail stores and more.

Takeovers pile up

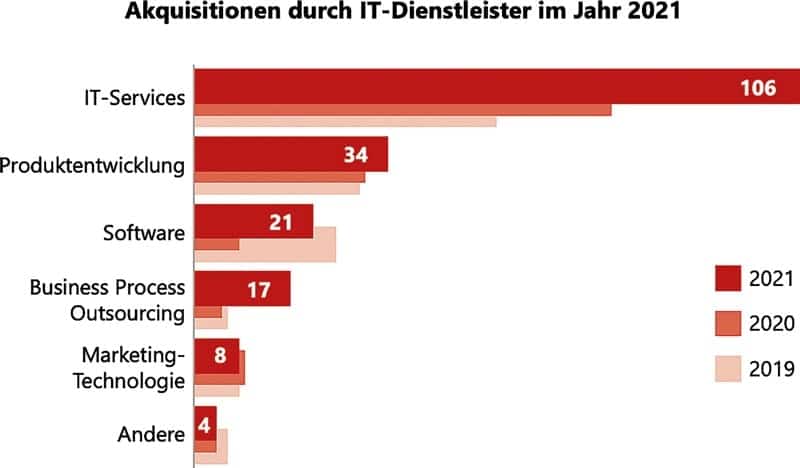

For those who cannot grow on the cloud market under their own steam, takeovers and mergers are a promising alternative. Here, too, there is a lot happening in the cloud sector. 2021 in particular was a record year for acquisitions in the IT services industry. Last year saw 47 percent more transactions than in 2020, a total of 190, and the value of these transactions rose by as much as 63 percent. Available capital saved during the pandemic, low interest rates and strong demand for digital transformation services were the key drivers leading to this record year.

The most active IT service providers in 2021 were Accenture, Deloitte, IBM, Atos, and Tech Mahindra, targeting other IT service providers in particular. In this market segment, the focus is primarily on cloud engineering, cybersecurity and data analytics - skills that are in particularly high demand from user companies due to the current digital transformation.

Not to be forgotten is the role of private equity companies in mergers and acquisitions in the technology and IT sectors. In 2021, such private

equity firms participated in seven transactions, each worth more than one billion US dollars. For example, KKR acquired Ensono, I Squared Capital acquired Kio Networks, Mexico's largest data center operator, and shortly before the end of the year Advent International acquired Encora, a digital engineering company.