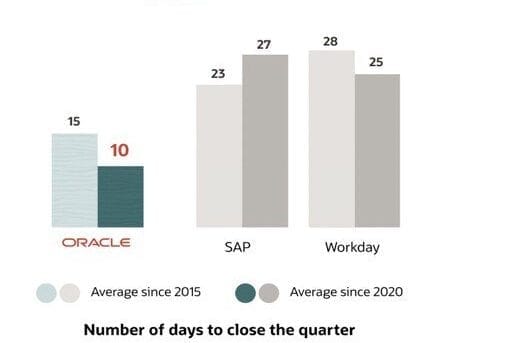

Why Oracle Closes Its Books Faster Than SAP and Workday

There’s a tendency among application vendors like SAP and Workday to assume that putting more data into financials applications is better. With data-driven innovation in mind, one could indeed think that more is better – the more data you have, the more you can analyze and the more intelligent your enterprise appears to be.

However, what is the optimal amount of data for finance? Where do you store data that you don’t absolutely require in your financial system? What types of analyses are useful? How much data do you need to benefit from data-driven innovation?

Let’s investigate

In finance, a general ledger consists of at least these data elements:

- Company, depicting a whole or logical part of a corporation, legal entity, or organization;

- Account, to record balances and organize financial information and reporting; and

- Center, a logical unit within your organization, like business unit, department or group.

Organizations typically use more than just these three segments in their financials. Other examples of segments that are commonly used are project and product. Most companies use about six segments. With Oracle Cloud ERP, the key can have 30 segments of 240 characters each. The total combined grouping of company, account and center and the other segments you’ve defined is called a ledger. You can have as many ledgers as you like.

Oracle’s ledgers can also be put into a federated structure. That means that you have a structure of ledgers that may share some key data elements (like cost centers or accounts), but they can also have other independent data elements in their key. Each ledger can have its own accounting method, cost method, cost granularity, and costing period.

With S/4 Hana, SAP introduced what is called the “universal journal.” SAP extended the number of segments that the universal journal can hold. S/4 Hana now has a total of 999 segments in S/4 financials, making up the ledger key. As a result, you can get customers, sales campaigns, and employee group as ledger keys in SAP’s financials. Running financials with this many segments is referred to as a thick GL, meaning that it has more data than you need from an accounting point of view. In contrast, a thin GL has enough data for financial reporting, while other data are stored elsewhere in the suite of applications.

In essence, Workday does the same as SAP: It has a thick ledger, with more ledger keys than you need from an accounting point of view. The data elements are called Worktags, and you can have approximately 100 different types of Worktags. These Worktags make up the ledger key. As with SAP, you can get customers, sales campaigns, and employee group as ledger keys in Workday financials.

In contrast with SAP and Workday, Oracle offers the option to run either a thin or thick ledger. In addition, maintenance is federated, so if you maintain the top ledger, the underneath ledgers can optionally inherit the updates from the top ledger. This way, you can have as many ledgers as you like, each with 30 segments, so an unlimited combination of key data elements in your financials. Oracle believes in being smarter and more structured with financials data. In contrast, SAP and Workday simply add more data in the hope that it makes the user smarter.

Getting smarter with the right data

To work smarter with all the data in your organization, close your quarterly periods faster, and speed up the decision-making process, consider these steps:

- Deploy machine learning (ML) techniques. The more data that is introduced to intelligent agents, the more accurate it becomes. But that doesn’t mean that you need to move more data into financials; ML can learn from data anywhere in your Oracle enterprise applications. It can even learn from data outside of Oracle applications. ML also learns from how people interact with data, so that ML can personalize the response. ML doesn’t just look at how people handle data in financials, but again, anywhere in your Oracle enterprise applications.

- Use real-time data from their source. You already have sales data in your customer experience applications, employee data in human capital management, supply chain data in supply chain management, and financial and planning data in ERP. Oracle also provides a semantic data model in Oracle Fusion Analytics Warehouse (FAW) to make end-users self-sufficient; they can interact with data in all those applications using commonly understood business terms in their respective source systems, without depending on IT.

- Drill back to the source, don’t copy it. Keep industry-specific detailed transactional data in the source system, like high-volume billing data in the telecommunications or insurance industries. Let Oracle Fusion Cloud Accounting Hub (part of Oracle Cloud Financials) harmonize the data and send the result to your financials. Drill back to the source when you need more details.