Integrated e-invoicing solutions - cloud-based and cross-country

There are huge sums at stake in the EU when it comes to the EU VAT Gap. In 2016 alone, the EU estimated the gap at over 147 billion euros. It tends to be the case that tax morale is not quite so rosy in the southern countries of Europe.

However, changes, some of them serious, are to be expected, which will probably reduce the aforementioned 147 billion euros. One driver here is EU Directive 2014/55 and its obligation to be implemented in the member states.

The main focus is on the regulation of electronic invoicing for public contracts (B2G or business-to-government). Accordingly, more than 300,000 public administrations in the EU countries are required to prepare themselves for e-invoicing in terms of both systems and processes. And this is mandatory.

For some time now, the various countries have been making concrete changes, albeit at different speeds and with inconsistent transition obligations. Italy, Hungary and Spain, for example, are now pioneers.

Greece and Romania are still lagging behind somewhat, but are on the verge of implementing the aforementioned EU standard. After all, the aim is to close tax loopholes and thus increase government revenues.

Here is a brief overview: Since January 1, 2019, it has been mandatory in Italy to issue all domestic invoices in a defined electronic format, to sign them and to exchange them via a government invoice portal. This refers to all invoices that involve an Italian invoicing party and/or invoice recipient.

This includes all invoices within Italy as well as all invoices from abroad to Italy or from Italy to abroad. The situation is similar in Hungary, where there will also be an invoice portal in the future.

Those who do not participate in B2T (business-to-tax) in Italy or Hungary - as in many other countries, by the way - even have to reckon with penalties.

In this context, it is important to know that so-called purely pictorial e-invoices are not electronic invoices within the meaning of EU-2014/55.

This means that incoming invoices in the popular PDF format pose a problem for direct electronic processing because they do not contain structured electronic invoice information. However, structured electronic invoice information is now a prerequisite for the best possible digitization.

B2G and B2T give wings to e-invoicing

This forces internationally operating companies to deal with e-invoicing in one way or another. Also because a large proportion of companies work for public-sector clients, and not only domestic companies, but also foreign ones.

This in turn means that electronically structured invoices must be issued to public-sector customers as standard. And for this reason alone, there is no getting around e-invoicing or it can be left to the left.

However, there are differences from country to country in terms of formats, transmission paths/modes or legal requirements (content, audits, retention and more) that need to be taken into account.

For example, when connecting state portals. The respective circumstances or national requirements can also change, sometimes from one day to the next.

For a company that is forced to exchange and process invoices electronically with public administrations anyway, it is obvious to push electronic invoicing with B2B business partners as well.

In particular, the electronic processing of incoming invoices. This puts the company right on the digitalization path.

In principle, e-invoicing is a proven lever or a kind of "point of digitization" for advancing digitization advantageously. One important reason for this is cost savings through automation. It also enables fully automated, cost-saving bookings, so-called "dark bookings".

According to studies, the average cost of traditional or manual processing of a paper/PDF incoming invoice is around eleven euros; for automatic electronic processing based on e-invoicing, between 80 and 90 cents.

Global e-invoicing needs expert knowledge

Over time, integrated e-invoicing has practically developed into a discipline in its own right. And it does so with solutions that ideally cover different processes, integrate various components or functions, and can be used independently of the ERP system in use.

From receiving invoices in various formats via different input channels, to preparing them for further processing such as conversion, enriching the data with master and order data from an ERP system, and creating and transferring a data record for a connected ERP system such as SAP, to customized invoice verification including clarification processes, approvals, and logging/archiving (for the purpose of traceability or also due to legal requirements). In addition, high-performance e-invoicing solutions have extensive functional workflow features.

Sophisticated integrated e-invoicing solutions cover the requirements of large global corporations as well as the needs of medium-sized companies that may only operate in a few countries and whose incoming invoice volumes tend to be moderate - especially as a cloud solution.

Whereby Seeburger e-invoicing cloud solutions with ready-made country-specific solution variants are predominantly used by many large companies.

Hybrid models that combine receipt, conversion, including signature checks, for example, as cloud services with subsequent processing, posting, and archiving in the customer's own operations can also be an effective solution variant.

For example, if a central SAP system is used globally and the processors (accountants, approvers, buyers and administrators) also want to process all other processes in SAP.

It is and will continue to be particularly relevant that national changes, innovations or certain developments/trends can also be used by companies internationally in a timely manner. By local companies or parts of companies as well as by branches or subsidiaries abroad.

Customers who can rely on solutions from an internationally active e-invoicing service provider are logically at an advantage. This is because the service provider is constantly on the pulse of the e-invoicing era, so to speak, and not only provides support with an up-to-date and high-performance solution, but is also able to accompany companies in an advisory capacity - even abroad.

Both in terms of business processes and technology, or in terms of market trends. For example, in the use of the Peppol network (Pan-European Public Procurement OnLine), which is becoming increasingly popular.

Peppol is on the rise

Among other things, the Peppol network serves as an electronic order and invoice exchange platform for public procurement and is also increasingly used for business-to-business (B2B) scenarios.

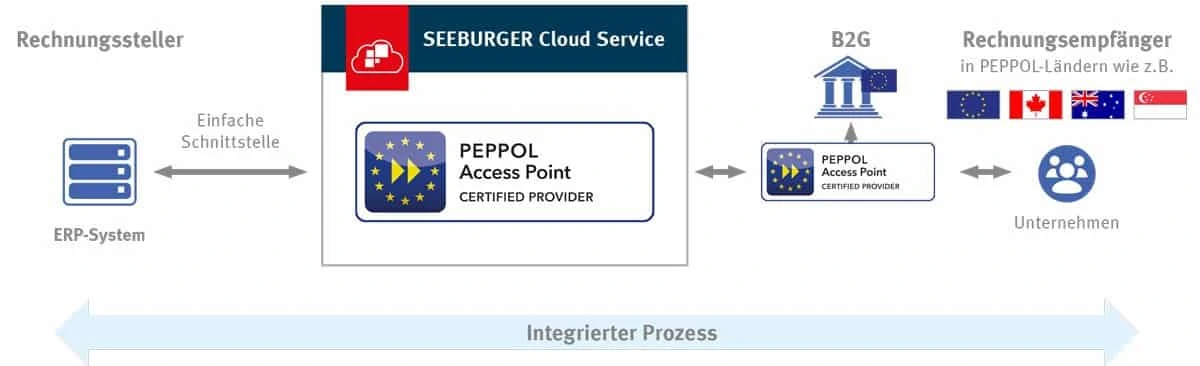

At the same time, the platform meets the requirements of the EU Directive 2014/55, as it is based on the Peppol-Bis format type and the eDelivery Network. The Peppol network for companies is used via Peppol access points, the so-called access points, through which structured invoices can be sent to the global invoice recipients.

Peppol is picking up speed worldwide and is used in 32 countries in Europe as well as in Canada, Singapore and the USA. Malaysia and Lithuania are also planning to join the Peppol network. Currently, Peppol consists of a consortium of project partners from twelve European countries.

In the countries, the so-called Peppol Authorities are responsible for defining the national specifics of e-invoicing. In Germany, the Coordination Office for IT Standards (KoSIT) assumes this task.

Among other things, KoSIT requires compliance with the XInvoice standard and the AS4 transport protocol. By the way, Seeburger is a certified Peppol access point provider and also offers this Peppol access as a cloud service.

Invoicing parties can use this Seeburger Peppol cloud service to quickly and easily send EU-compliant invoices to government agencies and other global invoice recipients.