Further e-invoicing push

The processes for processing image-based incoming invoices in paper format and as PDFs have been successfully automated and optimized by many companies over the past decades with invoice processing solutions.

Electronically structured formats for exchanging invoices between business partners have been around for just as long. Worldwide, however, the share of electronic structured invoices is relatively low compared to the share of image-based invoices.

This is partly because paper invoices still traditionally dominate in many countries. On the other hand, the most popular "electronic" format for invoices is PDF.

The fact is that a PDF invoice does not contain the structured electronic invoice information required for direct electronic processing and the best possible digitization.

So apparently, e-invoicing is an old hat that is rarely worn, despite many advantages. How can this phenomenon be justified when, according to a study by the consulting firm Billentis, 60 to 80 percent of costs can be saved per invoice on the supplier and customer side?

In our experience, many companies have held back on e-invoicing or put it on the back burner for the following reasons:

People like to think that the technology is too expensive or too complicated and that too many formats prevail. Furthermore, there are unclear legal requirements in various countries with regard to authenticity, integrity and archiving, as well as uncertainty about the validity of the input tax deduction.

But restraint is no longer an option. The obligation to implement EU standard 2014/55 in the EU member states by 2019 has significantly changed the framework conditions.

The aforementioned directive regulates electronic invoicing for public contracts. It obliges more than 300,000 public administrations in EU countries to be fit for e-invoicing in terms of systems and processes from November 2018/2019. It is important to note that purely pictorial e-invoices are not electronic invoices within the meaning of this directive.

The EU standard in question has a major leverage effect on e-invoicing as a whole. This is because typically 45 to 65 percent of all companies in a country are suppliers to the public sector. As a result, suppliers need to provide public-sector customers with invoices that are predominantly structured electronically. This indirectly increases the importance of e-invoicing in the B2B market.

It is obvious that suppliers forced to e-invoice with public administrations will want to send electronic invoices to all their customers virtually by default because of the cost benefits.

Whereby invoice recipients tend to benefit from even greater e-invoicing advantages, as their potential savings are almost twice as high. On the other hand, laws can also make decisions for the players - as the example of Italy shows. There, Italian business partners are simply required to use e-invoicing.

From January 1, 2019 at the latest, all domestic invoices in Italy must be issued in a defined electronic format, signed and exchanged via a government invoice portal. When other EU countries will follow Italy's example certainly remains exciting.

You don't have to be a prophet to predict that the trend throughout Europe will be towards electronic invoicing and that paper and PDF will be reduced to a minimum in the next few years.

E-invoicing implementation

If a company wants to further digitize its international purchase-to-pay processes with e-invoicing, there are numerous criteria to consider. There are different technical requirements, formats, transmission paths and legal invoice requirements for each country in terms of content, checks and storage.

E-invoicing solutions must - in addition to supporting the technical and legal requirements for invoices - integrate well into the existing, often heterogeneous system environment.

In addition, e-invoicing solutions should have a high degree of flexibility to adapt quickly and efficiently over time to changing invoice and customer environment requirements.

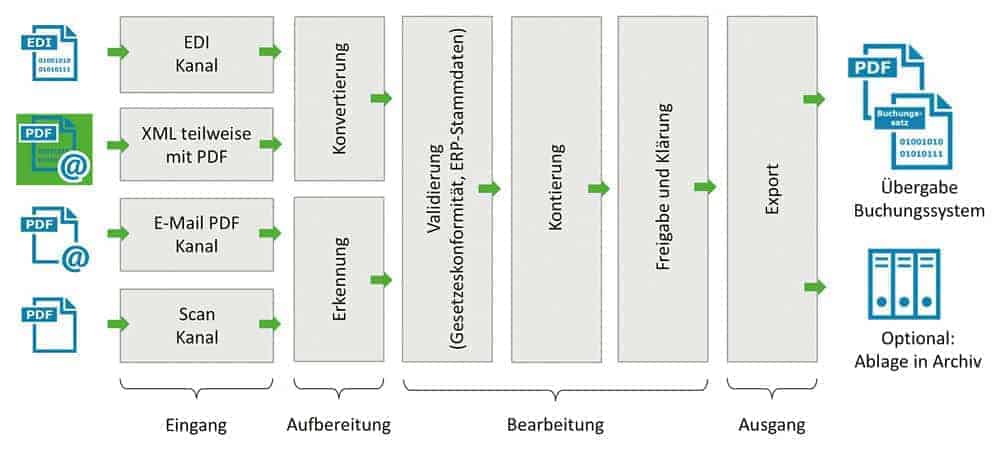

The process of e-invoicing is simplified as follows: In a first step, invoices are received automatically via various input channels.

A high proportion of electronic invoices can only be achieved across countries by offering a comprehensive range of transmission methods and input formats to replace traditional paper invoices and invoices in PDF format.

In the case of electronic formats, an increasing dynamic can be observed, which is partly caused by the national implementations of the EU2014/55 standard, but also by other factors.

After receipt, the invoice contents of all different formats are prepared for further processing. That is, they are transformed into an internal standard.

For this purpose, invoices that are already available in electronically structured form are converted. Scanned paper invoices or PDF invoices received by e-mail are identified and extracted using integrated OCR/recognition technology.

The extracted data is then enriched with master and order data from the ERP system. Each invoice is automatically checked - on a customer-specific basis, with regard to order reference, quantity and price variances, or country-specific rules, such as legal requirements for input tax deduction.

Ideally, invoices that comply with all rules are automatically transferred for posting. All other invoices are routed to an integrated clarification or approval process according to the customer's own guidelines.

The relevant persons for the release or clarification of quantity and price deviations are determined automatically for this purpose.

All the steps an invoice goes through in the verification process are logged. The invoice content required for posting is transferred to the customer's ERP system.

The invoice itself, attachments in the processing process, conversion and processing logs are archived in an audit-proof manner in accordance with applicable country requirements.

For archiving, some countries have particularly strict legal requirements regarding the use of time stamps, digital signatures and special procedural documentation.

On-premise vs. cloud usage

For most customers, cloud solutions are generally more suitable than in-house e-invoicing solutions. Country-specific e-invoicing solutions prefabricated in the cloud enable a quick start - regardless of the technological status and the geographical distribution of the international business partners.

Another advantage of a cloud solution is its independence from the booking system used, which is indispensable especially in the case of very heterogeneous system landscapes and enables process centralization and standardization that would hardly be achievable otherwise.

Legal requirements and retention periods for archiving are another aspect that can be well met with a cloud service, such as Seeburger's Invoice Portal Service.

Hybrid models

Hybrid models that combine receiving and conversion, including signature checks for example, as cloud services with subsequent processing, posting and archiving in-house at the customer's premises can also be an attractive solution.

For example, if a central SAP system is used globally and the processors (accountants, releasers, purchasers and administrators) also want to process all other processes in SAP.

Complete in-house operation is only worthwhile if only a few large business partners are to be connected directly via e-invoicing, each of whom sends a large number of invoices from only a few countries.

As soon as invoices are received from several state portals or certified providers or different signature standards have to be verified, it is generally more advisable to use a cloud service that can handle such tasks off the cuff - both now and in the future.

1 comment

Dina Haack

Vielen Dank für den informativen Beitrag!

Zu einem Punkt habe ich eine Frage: Sie sagen, dass viele Unternehmen zukünftig elektronische Rechnungen versenden müssen, weil sie an öffentliche Auftraggeber verkaufen. Mein letzter Stand war, dass dies nur für die Bundes-Ebene der Fall ist, das heißt Bundesbehörden nehmen ab einem bestimmten Datum nur noch elektronische Rechnungen an. Bei der öffentlichen Verwaltung auf Länder- und Kommunalebene ist dies aber weitgehend noch offen, ob es eine E-Rechnungs-Pflicht auch für die Lieferanten geben wird, oder ob nur die Annahme-Pflicht für die Verwaltung kommt.

Oder wissen Sie schon mehr über die Regelungen für die einzelnen Bundesländer? Falls Sie dazu mehr Informationen haben, würde ich mich freuen, wenn Sie diese teilen könnten.

Viele Grüße und vielen Dank im Voraus!

Dina Haack