Digital industry sees first silver lining

![[shutterstock.com: 454070395, Juergen Faelchle]](https://e3mag.com/wp-content/uploads/2020/08/shutterstock_454070395.jpg)

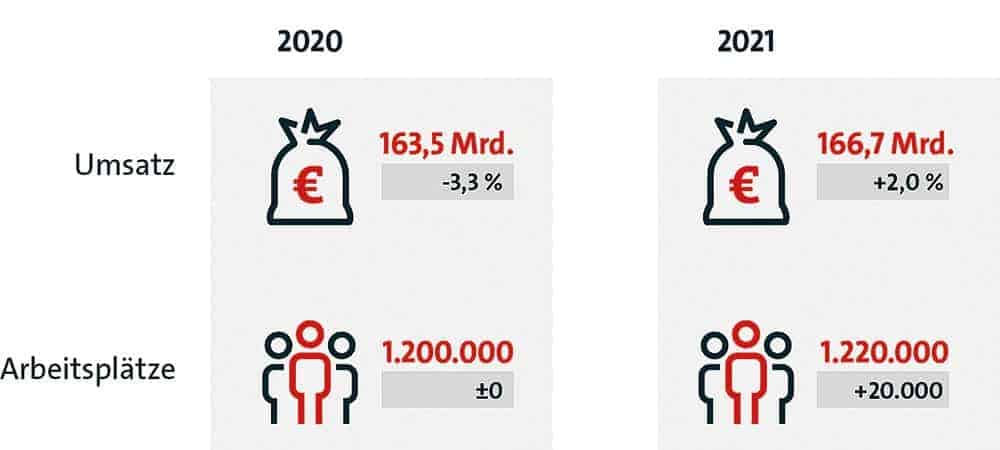

For 2020, the digital association Bitkom expects the industry's revenue to decline by 3.3 percent to 163.5 billion euros. This is expected to be largely made up for in the coming year. According to the forecast, the market will grow by two percent to 166.7 billion euros in 2021. The number of employees is expected to remain constant at 1.2 million in 2020 and increase by 20,000 additional jobs in the following year.

This is reported by Bitkom on the basis of current calculations, assuming that there is no renewed nationwide lockdown. "In the midst of the crisis with its many unknowns, forecasts primarily provide orientation values. One thing is certain: the digitization push will bring long-term growth to the ICT industry," says Bitkom President Achim Berg.

"Many of the customers I've talked to demand flexibility and rapid value creation. This has been reinforced by the Corona crisis."explains SAP CTO and Executive Board member Jürgen Müller.

"If both are to be achieved, technology becomes even more important. And SAP can help to better address these challenges. We have significantly enhanced all key components of our Business Technology Platform. This is how we aim to help our customers across all industries overcome the obstacles created by data overload, IT complexity and a volatile business environment."

After many years of strong growth, declining sales in information technology determined the minus in the overall market. According to Bitkom's 2020 forecast, sales in this largest submarket will fall by 5.6 percent to 88.2 billion euros. IT hardware will shrink the most, falling by 7.5 percent to 24.4 billion euros, largely due to the decline in business with semiconductors.

On the other hand, however, more laptops, headsets and other products for mobile working are being sold. The market for IT services including project business and IT consulting (38.7 billion euros, -5.4 percent) and software (25.2 billion euros, -4.0 percent) also declined.

"The special boom in some areas, such as video conferencing software, is not enough to compensate for declines elsewhere. Companies on short-time work usually need fewer IT resources than under full load"

says Berg.

"Software vendor customers are looking to safeguard liquidity and are reducing spending on licenses and maintenance contracts to the bare essentials. The declines in this area will not be offset by continued strong growth in the cloud business," says President Berg.

In June, ICT companies assessed their business situation as significantly better than in April and May, according to surveys by Bitkom and the ifo Institute. The index rose by 9.3 points to 11.6 points. On average, companies tended to assess the business situation positively.

Business expectations for the coming six months climbed by 12.3 points to the -8.0 mark. The Bitkom-ifo Digital Index, which is calculated from the situation and expectations, turned positive again in June for the first time since February and now stands at 1.5 points, 11.0 points higher than in the previous month.

"For companies in the digital industry, the business situation has improved for the second month in a row. Hopes are high that the economic low point of the Corona crisis has been overcome for the digital economy and that the general digitization push will boost demand for digital solutions"says Bitkom President Achim Berg.

In telecommunications, the trend of moderate growth will continue in the crisis year 2020. This year, an increase of 0.4 percent to 67.1 billion euros is expected. According to Bitkom calculations, telecommunications services will generate revenue of EUR 48.8 billion, an increase of 0.7 percent.

Business with terminal equipment decreases to EUR 11.2 billion (1.1 percent). Investments in infrastructure increase by 0.5 percent to EUR 7.1 billion.

"Telecommunications is the industry's anchor of stability. In the Corona crisis, demand for telecommunications services has increased. Declining roaming revenues in particular are having a negative impact, as international travel stops"says Berg.

"Yet network operators are investing billions in spectrum and in building out 5G and broadband networks."

In the medium term, the signs for the digital industry as a whole are pointing to growth again. Bitkom President Berg is appealing to those companies that have so far seen no reason to invest in digital transformation. According to a representative Bitkom study, only one in four companies across all industries (24 percent) plans to invest in digital business models this year.

"The weeks of lockdown should have been a wake-up call, even for brakemen and worriers." says Berg.