Automated financial closure - Everything in safety

Globalization and digitalization are continuously increasing the demands placed on company financial statements. Processes need to be faster and more efficient, automated throughout and seamlessly integrated into existing SAP environments.

In addition, finance managers always need up-to-date, reliable, consistent and coherent financial data for far-reaching business decisions. All of this can be achieved with a smart close solution as part of the continuous accounting process.

The finance departments of companies - regardless of their size - are facing new challenges due to increasingly digitalized and internationalized processes: C-level finance managers must be able to access a consistent, seamless database at all times in order to make responsible and sustainable decisions.

The data must be mapped in a system that allows seamless integration into a holistic ERP environment - from SAP R/3 Enterprise to S/4 Simple Finance.

It is also important that financial processes are largely automated. This not only saves time, effort and costs, but also avoids errors.

In most companies today, financial statements are still prepared using manual processes. These have usually been firmly established for many years and are not critically scrutinized and broken up due to rigid structures and a lack of IT support.

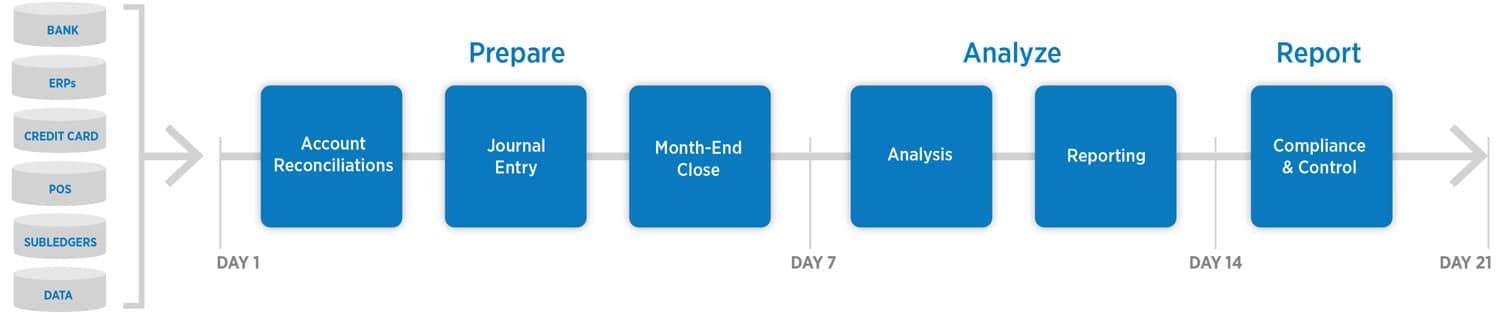

Cumbersome and inconsistent financial processes based on spreadsheets are still the reality in many companies. These are classic record-to-report processes that ensure financial closing at the end of the period.

This involves extracting, processing, analyzing and evaluating information from bank accounts, the general and subsidiary ledgers and other data from the SAP systems. The results then serve as the basis for creating reports.

Continuous Accounting

A decisive disadvantage of this procedure: It takes a very long time, usually several days, and entails a high, selective workload for the employees involved in the financial close at the end of the month.

On the other hand, the complexity and speed with which companies operate on the market today is increasing dramatically. More flexibility and agility are required at all levels.

Finance departments also have a duty to keep up: It is no longer enough to deliver financial forecasts, plans and reports at predefined, fixed times. Instead, management needs reliable real-time information in order to make well-founded business decisions on this basis.

To achieve this, the information on the financial statements must be available on a daily basis. Continuous accounting offers completely new possibilities for this: the methodology stands for a paradigm shift, a fundamental transformation of tasks in finance and accounting - away from periodically dominated processes towards a continuous financial close.

The decisive advantage of this is that the usually high workload at the end of the month, quarter, half-year or year is spread evenly over the entire period, which takes the pressure off employees and has a positive effect on their productivity.

Continuous reconciliations, analyses and controls are typical of the continuous accounting process. The relevant information and financial data is therefore not collected, checked, analyzed and evaluated at the end of the period, but in an ongoing process in real time.

Using financial data with EPM and BI

A major challenge here is that the data can only be used optimally if it can be detached from the SAP environment and transferred to Corporate Performance Management, Enterprise Performance Management (EPM) or the Business Intelligence Solution (BI). This is the only way to fully map and control the complexity of the financial statements down to the last detail.

However, some companies ignore this principle and continue to make do with spreadsheet programs. Companies fail to consider that an automated closing process saves considerable time and provides reliable data quality.

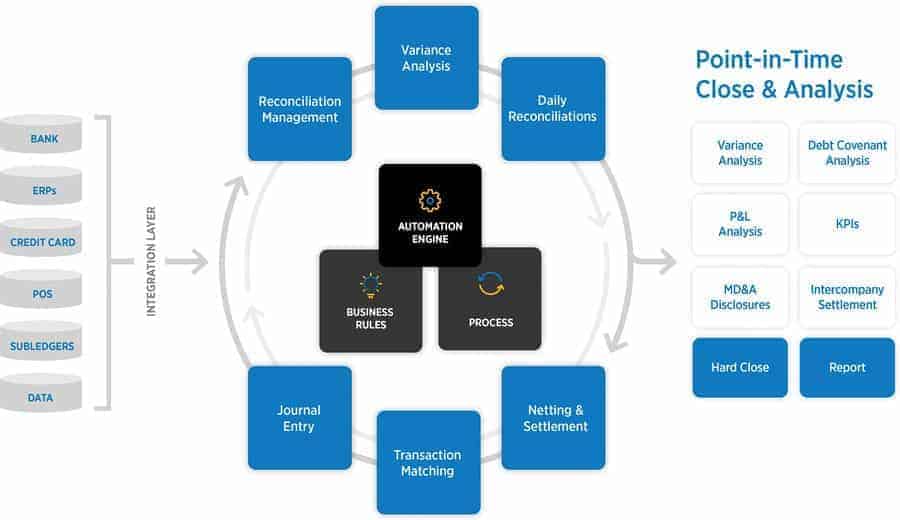

Another advantage is that the consistent automation of financial processes such as account reconciliation, declaration, confirmation and variance analysis as well as transaction reconciliation means that the rhythm of necessary actions in the financial area is already predetermined - without the need for manual intervention by an employee, which saves resources and therefore costs.

This allows both C-level managers and operational employees to continuously check and validate all processes in real time. This allows capacities to be planned precisely and well-founded business decisions to be made on the basis of up-to-date financial data.

Smart Close directly in SAP

So how can the idea of continuous accounting be put into practice? This requires software support that goes far beyond the traditional functionalities of the ERP system.

BlackLine provides a practical solution here with Smart Close: Seamlessly embedded in the existing SAP platform, the tool offers direct access to the entire SAP database - including historical data.

There is no need to download data, duplicate it in another system or manage interfaces. All tasks relating to the financial statements, such as the SAP controlling and cost modules, asset history sheet, chart of accounts, risk assessments and subledgers, can be completed with just a few clicks.

The software also enables maximum data integrity and security - one of the key requirements for the continuous accounting process.

The solution ideally complements the functions provided in SAP ECC 6.0 Finance and S/4 Simple Finance. Users can thus close a gap in the traditional financial close process between classic ERP functions, the S/4 Finance module and CPM/EPM solutions. This makes any manual effort and the use of confusing spreadsheets a thing of the past.

Automated financial closing

As required for continuous accounting, the Smart Close solution enables controlled and complete automation of the financial closing process, allowing the entire workflow to be standardized and optimized.

The software automatically checks the correctness of all closing transactions and triggers a notification in the event of discrepancies. In addition, a correction is made and the next step in the financial closing process is automatically initiated.

A transparent process overview visualizes the progress using red, yellow or green symbols. The BlackLine software always keeps all information up to date and, thanks to seamless integration into the SAP environment, always provides access to the latest live data.

For last-minute postings, the accounts with the changes are clearly highlighted for easy checking. In addition, the solution provides customizable insights into the financial closing processes - whether an overall view or a detailed breakdown of individual aspects.

And particularly important for holistic process chains: all processes - from financial closing to reporting - can be seamlessly linked to all other aspects of the accounting cycle within the SAP system.

Thanks to the perfect interaction with other financial control systems, finance managers benefit from end-to-end management of the closing process and clear, cross-system reporting.

Conclusion

Continuous accounting is the buzzword when it comes to automated financial closing - regardless of periodic peaks at the end of the month, quarter, half-year or year.

Employees benefit from a consistent workload throughout the entire accounting period, while CFOs benefit from real-time data for their decision-making processes.

Software tools such as Smart Close support the practical implementation of continuous accounting and its efficient use within an existing SAP environment.