Indirect use in the SAP ecosystem

SAP is a success story and, ranking third, is the only globally operating German company among the world's ten largest software manufacturers.

SAP is a success story and, ranking third, is the only globally operating German company among the world's ten largest software manufacturers.

SAP's importance in the software industry tends to be portrayed as somewhat smaller than that of U.S. players. More than 15,000 official partner companies are listed by SAP, and the SAP Community Network (SCN) has more than two million members.

Author and analyst Vinnie Mirchandani estimates SAP's total annual global spend - consulting, hardware, internal overhead, software, training, etc. - at more than $309 billion.

For SAP, partners have been and continue to be a decisive factor in the company's own success. They support the sale and implementation of SAP software and thus significantly increase the attractiveness and competitiveness of the SAP solution offering.

They provide local consultants and develop special software components without which SAP solutions would be unusable or less attractive for customers.

In addition to consulting and services, many partners also offer their own complementary software solutions for SAP customers. A growing number of independent software vendors (ISVs) are also integrating their offerings for joint customers with SAP solutions.

What has changed in the SAP ecosystem?

While SAP was synonymous with "Enterprise Resource Planning (ERP)" in the past, the portfolio has been greatly expanded in recent years to become a universal solution offering for virtually all business areas, industries and company sizes.

The SAP solution scope is impressively demonstrated in the 225-page SAP price and conditions list (PKL) with over 1000 items in the associated Excel.

In addition to organic growth and in-house developments such as Hana, SAP relies heavily on acquisitions (M&A) of software companies. In the meantime, more than 50 companies have been bought and integrated - in the last five years alone for more than 20 billion US dollars.

Acquisitions such as Ariba, Business Objects, Concur, FieldGlass, Hybris and Sybase significantly expanded the SAP solution offering. However, this now also leads to overlaps and competition with existing partner solutions that, until the acquisition, completed the offering for SAP customers and made it more attractive.

In recent years, SAP has increasingly turned to customers who use SAP solutions in conjunction with partner solutions. Following license audits ("measurement of software usage"), SAP regularly demanded not inconsiderable additional payments of license fees on the grounds that the SAP software was used "indirectly" by the customer due to the partner application.

Numerous partners perceive the changed approach as an acute threat to their own economic success or even future survival in the SAP ecosystem.

In the ecosystem, there are some peculiarities in the interaction between partner and SAP solutions that, like the proverbial iceberg, "lurk in hiding beneath the surface of the water". To ensure that customers and software partners do not suffer the same fate as the infamous Titanic, it is necessary to identify and manage potential risks.

Sale of partner solutions

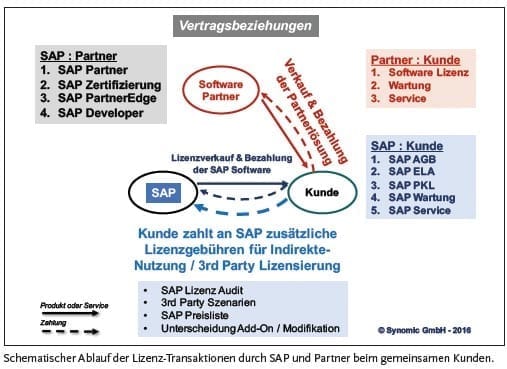

When SAP sells software licenses to customers, they pay license fees based on the contracts and current price and conditions list. Similarly, customers also pay partners a license fee for their software components. So far, so simple.

A special feature is when SAP asserts a more extensive license claim for access to interfaces and to the customer's data managed by the SAP software when using partner solutions.

This is referred to by SAP as "indirect SAP use", for which "3rd party license fees" are then incurred. SAP does not demand these from the partner, but directly from the customer. Partners are neither involved in this nor do they have any insight or influence on the license fees demanded by SAP.

SAP derives these additional license fees for "indirect SAP use" from the provisions of the contracts concluded with customers.

On the customer side, the following documents, among others, can form the basis of the contract: SAP General Terms and Conditions (GTC), End User License Agreement (ELA), SAP Price and Conditions List (PKL), maintenance contracts and service agreements.

On the partner side, these include: Certifications and partner contracts such as SAP PartnerEdge.

Furthermore, there is also a contractual relationship between the partner company and the customer with regard to its software solution.

What is the problem?

The sometimes drastic cost increases due to "indirect SAP use", not infrequently of 100 percent and more, are usually unpredictable and surprising for customers.

The use of partner solutions can thus become uneconomical, which hits partners hard when customers postpone their purchasing decisions due to the high additional licensing costs for SAP or cancel purchased solutions.

Customers and partners see the abolition of the attractively priced SAP Platform User Licenses (PUL), which were intended for the use of partner solutions, and the simultaneous licensing obligation for the "SAP NetWeaver Foundation for Third Party Applications Software", even if NetWeaver is not used, as the main drivers of this development.

This development is very critical for software manufacturers who do most of their business with the many SAP customers, as it means that they can no longer sell their own complementary software solutions.

Furthermore, SAP's actions massively restrict the interoperability of independently developed software, so that these actions could run counter to the legal guiding principle in Section 69e of the Copyright Act, which is intended to promote the "interplay" of components from different manufacturers to prevent data silos.

An interesting aspect of SAP's approach is that its own software solutions and those of selected partners offered via the SAP price list (OEM, Resell, EBS) do not fall under "indirect SAP use".

As a result, SAP and a few partners have a major competitive advantage over other third-party applications or partner solutions.

These developments not only unsettle customers and partners, but also pose risks to the success of the entire ecosystem because investments could be delayed or SAP alternatives given preference.

The risk to the SAP ecosystem also increases because partners generally invest not only in their own software solutions, but also in, among other things: Acquiring SAP development and test licenses, setting up and operating SAP infrastructure, recruiting and training employees, adapting to SAP interfaces, recurring SAP certifications, annual fees for various SAP partner programs, joint programs and marketing activities, etc.

What can the SAP ecosystem do?

It can certainly be assumed that most of those involved will continue to be interested in the success of the SAP ecosystem. For all those involved, it seems necessary to recognize the problem of "indirect SAP use" in good time - analogous to the iceberg example - and to "circumnavigate" it.

Representatives of SAP users (DSAG), the partner community (IA4SP) and SAP itself (possibly with the support of experienced software lawyers) may be able to help here in order to clarify important questions such as:

- How can the current uncertainty among customers and partners be resolved as quickly as possible?

- How can the necessary interoperability between SAP and partner solutions - which is also required by copyright law - be ensured in the long term?

- How can appropriate compensation for SAP look like and be effectively regulated?

- How can interoperability be prevented from being exploited to circumvent SAP's legitimate licensing requirements?

- How can partner investments in the SAP ecosystem be (better) protected?

- How can the SAP ecosystem as a whole be further developed together?